Hawkish commentary by RBI leads to spike in bond yields

#

6th Oct, 2023

- 6117 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

Comments from Mr. Sampath Reddy, Chief Investment Officer, Bajaj Allianz Life

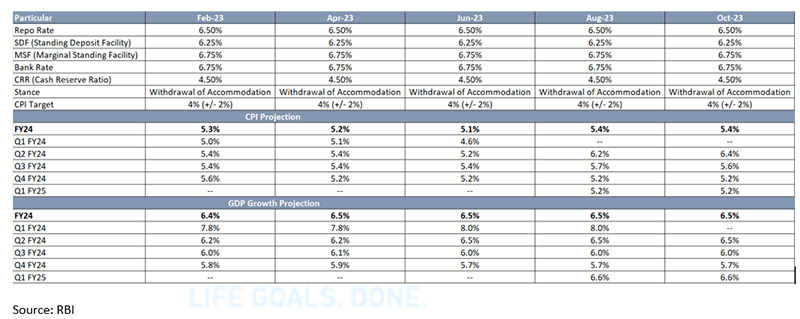

The RBI’s Monetary Policy Committee (MPC) has unanimously decided to maintain the policy repo rate at 6.5%. The marginal standing facility (MSF) rate and the Standing Deposit Facility (SDF) rate stand unchanged at 6.75% & 6.25% respectively. Additionally, in a majority of 5:1 vote, the MPC has decided to remain focused on “withdrawal of accommodation” stance, to ensure that inflation remains within the target going forward, while supporting growth. The RBI governor said that the cumulative rate hike of 250 basis points undertaken by the MPC is still working through the economy. The transmission of the 250 basis points (bps) increase in the policy repo rate to bank lending and deposit rates is still incomplete and hence the MPC decided to remain focused on “withdrawal of accommodation”. Nonetheless, domestic economic activity exhibits resilience on the back of strong domestic demand.

On the inflation, the central bank retained its inflation forecast for FY24 at 5.4% however, revised upwards its Q2 forecast to 6.4% (from 6.2% earlier) and revised down its Q3 FY24 forecast to 5.6% (from 5.7% earlier). In the near-term correction in vegetable prices and the recent reduction in LPG prices are likely to ease the inflation readings. However, there are emerging upside risks from the fall in Kharif sowing (for pulses, oilseeds), low reservoir levels, and volatile global food and energy prices.

On the Growth front, the central bank mentioned that the steady expansion is seen in urban consumption while rural demand is showing signs of revival. The MPC, along with the quarterly forecasts, retained its full year GDP growth forecast at 6.5% for FY24. Headwinds from geopolitical tensions, volatility in global financial markets, moderation in exports amid global growth slowdown and uneven monsoon pose downside risks to growth.

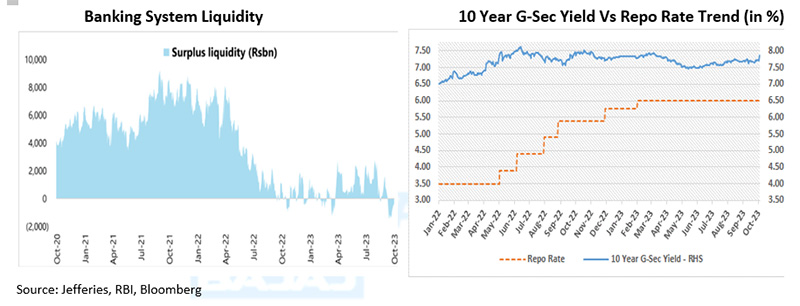

On the liquidity front, the RBI highlighted that to ensure the liquidity conditions evolve in sync with the monetary policy stance, earlier introduced as a temporary measure “incremental cash reserve ratio (I-CRR)” of 10% observed about Rs. 1.1 lakh crore from the banking system. In its governor’s statement footnotes, the RBI governor has enlisted factors caused liquidity overhang in the banking system are following,

(i)The return of ₹2000 banknotes to the banking system;

(ii)RBI’s surplus transfer to the government;

(iii) Pick up in government spending; and

(iv)Capital inflows.

The RBI governor also highlighted that while remaining nimble, they may have to consider OMO-sales (Open Market Operation sales) to manage liquidity if necessary, consistent with the stance of monetary policy. The timing and quantum of such operations will depend on the evolving liquidity conditions.

Outlook:

While the policy maintained status quo on rates and stance (in line with the market expectations), the emphasis was on liquidity management with explicit mention of OMO sales, we believe that the policy tone was more hawkish than the Aug’23 policy with additional emphasis on managing liquidity.

Given recent inflationary pressures driven by food & vegetable prices in India, the extended tightening measures by global central banks, and the RBI’s commitment to lower domestic inflation to 4%, the outlook for interest rates appears cautious in the near term. The possibility of OMO-sales to manage liquidity may pose short-term pressure on interest rates. We believe that the RBI’s future actions will depend on evolving data, and we continue to expect a long pause.

The 10-year bond yield jumped up post the policy announcement by 15 bps to 7.36%. This was in reaction to the signal that the central bank is open to conducting OMO sales going forward.

Disclaimer: “The views expressed by the Author in this article/note is not to be construed as investment advice and readers are suggested to seek independent financial advice before making any investment decisions”

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More