RBI Window Open For Further Monetary Easing, Policy Rates Remain Unchanged

#

6th Aug, 2020

- 6395 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

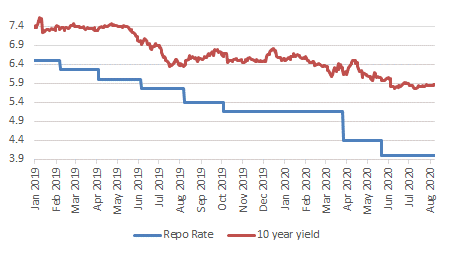

RBI Repo Rate Vs 10 year yield

As expected, the RBI Monetary Policy Committee (MPC) voted to keep the key policy rate (repo rate) unchanged at 4.0%, and the reverse repo rate unchanged at 3.35%. All MPC members unanimously voted for the decision, while continuing with the ‘accommodative’ stance.

Source: Bloomberg

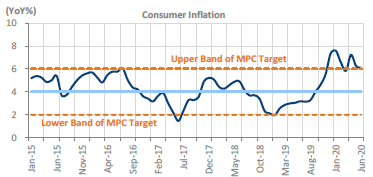

Headline consumer inflation has been above the RBI MPC’s 6% upper limit for the past few months (refer to below chart), primarily due to supply-chain related issue–amidst the lock-down. The RBI mentioned that there is some upside risk to inflation. It added that headline consumer inflation may remain elevated in Q2 FY21, but may moderate in H2 FY21, aided by large favourable base effects.

India Consumer Inflation Trend (% YoY)

Source: CEIC, IIFL Research

On the economic front, RBI did not provide an official number on GDP forecast, but said that GDP is expected to be in negative territory for H1 FY21, and for entire FY21, too. It mentioned that high-frequency economic indicators indicate modest resumption of economic activity, although some of them have levelled-off.

Some of the other key measures announced were as follows:

• Additional special liquidity facility of Rs 10,000 crore to NHB and NABARD.

• Provide a window under the Prudential Framework for resolution/re-structuring of corporate and retail loans without asset quality downgrade. A committee headed by KV Kamath will make recommendations to the RBI on financial parameters to be factored into resolution plans.

• Those MSMEs eligible of restructuring under existing guidelines, which are standard as of 1st March 2020, can be restructured by 31st March 2021.

• For advances against gold ornaments for non-agri purposes, the loan to value (LTV) ratio has been increased from 75% to 90% and will be available till 31st March 2021. This will be beneficial for gold loans as less collateral will be required.

Outlook:

As expected, the RBI maintained status quo on policy rates and policy stance, citing some upward inflationary pressure that has been seen lately. It added that space for monetary policy action should be used judiciously, and it is prudent to pause and remain watchful of incoming data, amidst the uncertain inflation outlook. However, the central bank indicated that it will be watchful of inflation, and if it subsides in H2 FY21 (as expected), then it provides space for further monetary easing–to support economic revival. Bonds yields rose a bit post the policy, with the benchmark 10 year 5.79% GOI 2030 bond closing the day at 5.86% yield versus 5.83% the previous day.

The RBI noted that the transmission of rate cuts to bank lending rates has improved further, with the weighted average lending rate (WALR) on fresh rupee loans declining by 91 bps during March-June 2020. Also, corporate bond spreads (over G-Secs) have reduced from earlier, and liquidity still remains in abundance.

The announcement of loan re-structuring scheme is also a bit of a respite for the financial sector, which has been under concerns of asset quality issues lately. In its latest Financial Stability Report, the RBI had forecasted that the consolidated Gross Non-Performing Assets (GNPA) of all banks in India could rise to 12.5% by March 2021, from 8.5% in March 2020; and in severe stress scenario could even rise to 14.7% by March 2021. However, the details of the loan restructuring scheme/plan need be looked at more closely based on recommendations of the KV Kamath committee—once released.

From an investment perspective, we continue to prefer the shorter to medium term part of the yield curve.

“The opinion expressed by the Author in this article/note is his personal opinion and readers are advised to seek independent financial advice before taking any investment decisions.”

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More