RBI Announces Measures For Greater Monetary Transmission, Policy Rates Remain Unchanged

#

6th Feb, 2020

- 2242 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

By Sampath Reddy, Chief Investment Officer, Bajaj Allianz Life Insurance

As expected, the RBI Monetary Policy Committee (MPC) voted to keep the key policy rate (repo rate) unchanged at 5.15%. All MPC members unanimously voted for the decision, while continuing with the ‘accommodative’ stance.

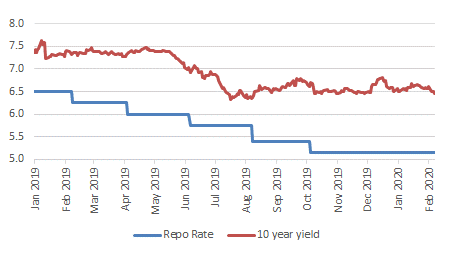

RBI Repo Rate Vs 10 year yield

Source: Bloomberg

The RBI has revised upwards CPI headline inflation projection to 6.5% for Q4 FY20, 5.0-5.4% for H1 FY21 (vs 3.8-4.0% earlier). But CPI inflation is projected to fall sharply to 3.2% in Q3 FY21. Risks are broadly balanced. RBI said that going forward inflation will be influenced by the following factors:

On the economic front, RBI projects GDP growth to recover from 5%YoY in FY20 to 6%YoY in FY21.

Some other measures were also announced as follows:

Outlook:

The various measures announced by RBI will help to further improve/aid liquidity conditions and monetary policy transmission, going forward. Transmission of rate cuts has been higher for the bond/money markets, than for the credit markets—with the RBI mentioning that the 1-year median marginal cost of funds-based lending rate (MCLR) has declined by 55 bps compared to 135 bps cut in the policy rate (repo rate). The measures should also help to revive credit growth, which has slowed down particularly due to stress in some sectors, and is therefore beneficial for the banking and NBFC sectors.

The RBI also seems to be comfortable with the additional market borrowing numbers announced in the Union Budget. It mentioned that the higher fiscal deficit for FY20 has not resulted in increase in market borrowings, and gross market borrowing is budgeted to increase by Rs. 70,000 crore in FY21.

Overall, the policy has been positive for the bond markets with bond yields easing (especially at the shorter end). The RBI recognized that there is monetary policy space for future action, but it will be data–dependent. The yield curve could steepen a bit, with short term yields easing more than long term yields. From an investment perspective, we continue to prefer the shorter to medium term part of the yield curve.

“The opinion expressed by the Author in this article/note is his personal opinion and readers are advised to seek independent financial advice before taking any investment decisions.”

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More