RBI maintains status quo on policy rates, prioritize inflation control with upward growth revision

#

8th Feb, 2024

- 11098 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

Comments from Mr. Sampath Reddy, Chief Investment Officer, Bajaj Allianz Life

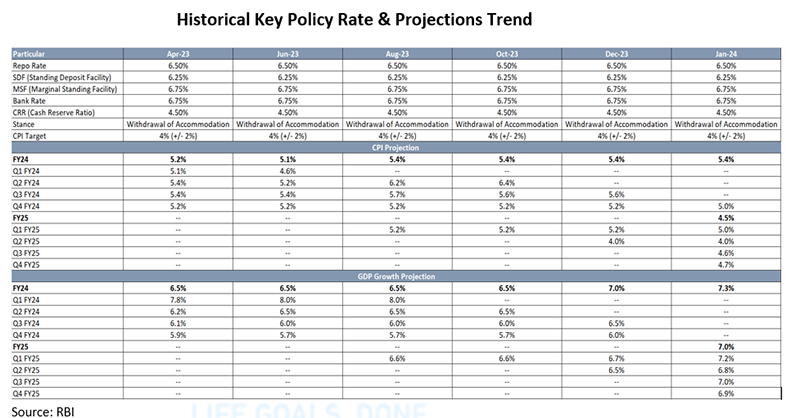

The RBI’s Monetary Policy Committee (MPC) for the 6th consecutive time kept the policy rates unchanged, by keeping repo rate steady at 6.5%, SDF at 6.25% and MSF and bank rate at 6.75%. The RBI also left its stance of “withdrawal of accommodation” unchanged with the vote of 5-1. The central bank highlighted that interest rate transmissions are still not complete, and inflation is yet to be brought down to targeted level on a durable basis. Hence, the RBI’s stance should be viewed in this context, and “mix of instruments” will be used by the Central Bank to manage the liquidity situation. The MPC last raised the repo rate by 25 bps to 6.50% in its Feb 2023 meeting.

On the inflation front, For FY24, the RBI has retained its projection at 5.4%, however it has lowered Q4FY24 estimate from 5.2% (Dec’23 policy) to 5%. For FY25, the Central Bank expects inflation to come in at 4.5%, with Q1 at 5% (5.2% as per Dec’23 policy), Q2 at 4% (unchanged from Dec’23), Q3 at 4.6% (4.7% earlier) and Q4 at 4.7%. The downward revisions have been made as the RBI remains confident that Rabi sowing has been satisfactory this season, and vegetable prices are also on a downward trajectory now. Further, these numbers are also based on the assumption of normal monsoon in FY25. Upside risks to these forecasts may emerge on account of volatility in international commodity price and in particular crude oil prices. Ongoing geopolitical tensions may disrupt supply chains, which could have adverse impact on global commodity prices.

On the inflation front, For FY24, the RBI has retained its projection at 5.4%, however it has lowered Q4FY24 estimate from 5.2% (Dec’23 policy) to 5%. For FY25, the Central Bank expects inflation to come in at 4.5%, with Q1 at 5% (5.2% as per Dec’23 policy), Q2 at 4% (unchanged from Dec’23), Q3 at 4.6% (4.7% earlier) and Q4 at 4.7%. The downward revisions have been made as the RBI remains confident that Rabi sowing has been satisfactory this season, and vegetable prices are also on a downward trajectory now. Further, these numbers are also based on the assumption of normal monsoon in FY25. Upside risks to these forecasts may emerge on account of volatility in international commodity price and in particular crude oil prices. Ongoing geopolitical tensions may disrupt supply chains, which could have adverse impact on global commodity prices.

On the Growth front, the central bank governor highlighted that on the back of robust domestic economic activity, India’s growth projected is to grow by 7.3% YoY in FY24 (following growth projections as per NSO’s advanced estimates), the RBI expects 7% growth in FY25. The continued strong growth in FY25 predicted on the back of: resilience shown in services activity, continued profitability of the manufacturing sector, possibility of increased consumption demand, steady Rabi sowing, and government retaining focus on capital expenditure. Downside risks may emerge from escalation of geopolitical tensions and volatility in international financial markets.

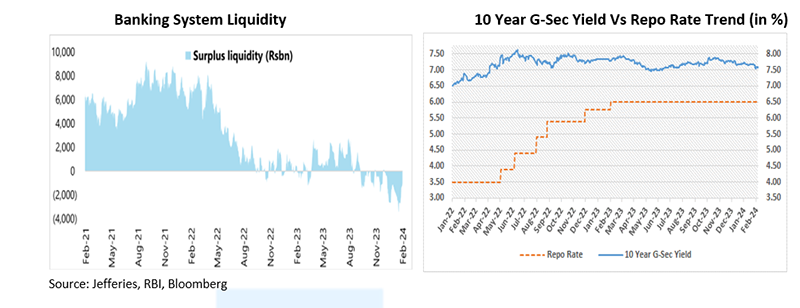

On the liquidity front, after remaining in surplus during April-August 2023, system level liquidity, turned into deficit from Sep’23 after a gap of four and half years. The liquidity deficit is being driven by multiple factors including lower government spending which is expected to pick up. After considering government cash balances, systemic liquidity remains in surplus. The RBI will deploy an appropriate mix of instruments to modulate frictional and durable liquidity.

Outlook:

The policy was largely along expected lines. The Monetary Policy Committee (MPC) acknowledged the resilience of domestic economic activity, supported by investment momentum, positive business sentiment, and rising consumer confidence. They recognized the disruptive impact of recurring food price shocks on the disinflation process driven by moderating core inflation (ex-food & energy). Geopolitical tensions, their implications on supply chains, volatility in global financial markets and commodity prices pose significant upside risks to inflation.

The cumulative effect of previous repo rate increases is still working its way through the system. The RBI’s commitment to aligning inflation with the 4% target (+/- 2%) remains intact. The governor again reiterated that the Central Bank is focused on bringing inflation back to 4% level on a durable basis and any change in stance should be looked at from the point of view of inflation and “incomplete transmission” of rates.

Going forward, we believe that the moderating inflation trends should give the RBI sufficient comfort to start cutting rates this year, if there are no adverse surprises on macro-economic front and the upcoming data is conducive. The 10-year bond yield remained flattish post the policy announcement as the policy was in line with the market expectations.

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More