RBI maintains status quo on policy rates, inflation & growth projections; shifts stance to Neutral

#

9th Oct, 2024

- 8087 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

Comments from Mr. Srinivas Rao Ravuri, Chief Investment Officer, Bajaj Allianz Life

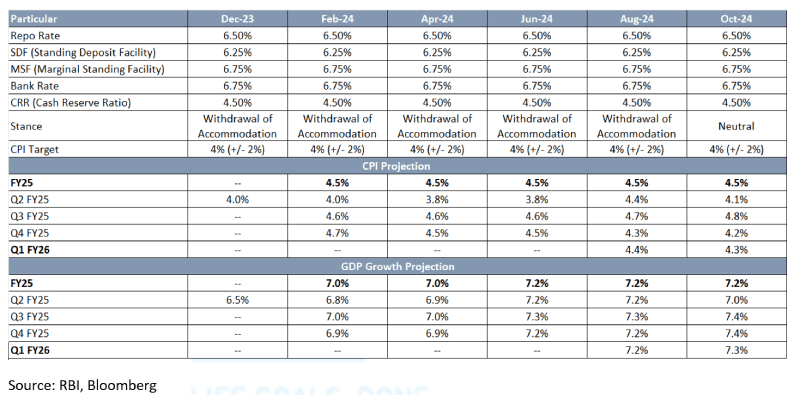

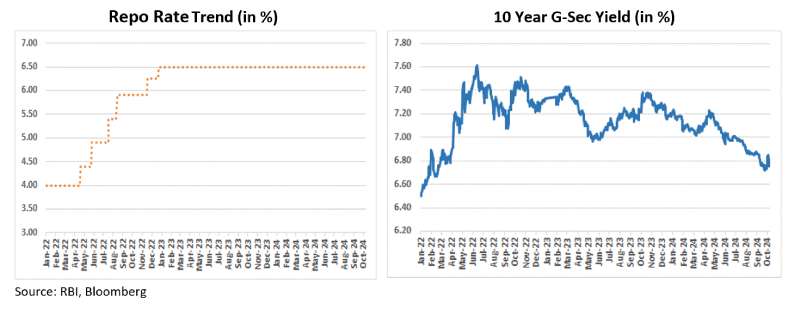

The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) has maintained policy rates for the 10th consecutive time, keeping the repo rate at 6.5%, the Standing Deposit Facility (SDF) at 6.25%, and the Marginal Standing Facility (MSF) at 6.75%. The MPC unanimously shifted its stance to ‘neutral,’ moving away from its previous stance of ‘withdrawal of accommodation.’ It indicates that RBI is comfortable with softening inflation and could follow up with policy rate cuts in the future to support economic growth. This is constructive for bond yields and interest rate sensitive sectors. Today, post policy announcement, the markets reacted positively with the 10-year Gsec yields reducing by 0.05% to ~6.75%.

The governor highlighted that the global economy has remained resilient since the last meeting of the MPC, although downside risks from increasingly intense geopolitical conflicts, geoeconomic fragmentation, financial market volatility and elevated public debt continue to play out.

On the inflation front

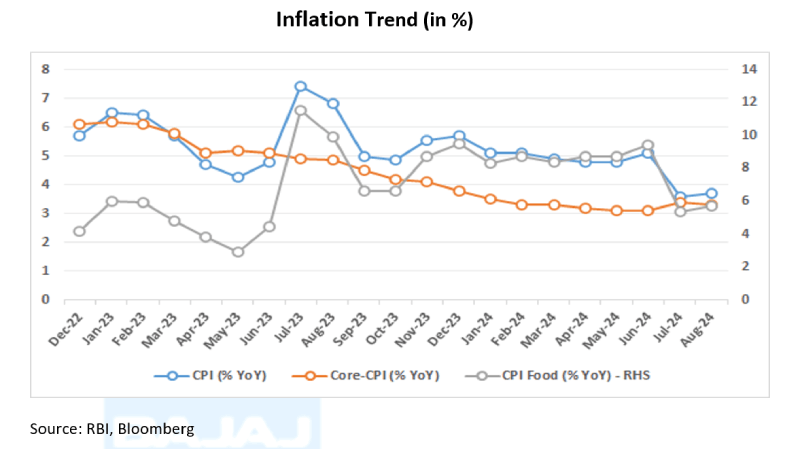

The MPC acknowledged that while inflation and growth indicators are currently balanced, headline inflation has been decreasing slowly and unevenly. The downward trend is expected to reverse in September due to unfavorable base effects, with inflation likely to remain elevated in the short term. However, food inflation could ease later in the year, thanks to robust kharif sowing, ample buffer stocks, and favorable conditions for rabi sowing. That said, adverse weather could still pose risks. Core inflation seems to have stabilized, and fuel prices continue to contract. The inflation forecast for FY25 remains at 4.5%, with marginal revisions to quarterly projections (for 2QFY25 was revised down by 30 bps, 3QFY25 was revised up by 10 bps, 4QFY25 was revised down by 10bps, and 1QFY26 was revised down by 10 bps).

On the Growth front,

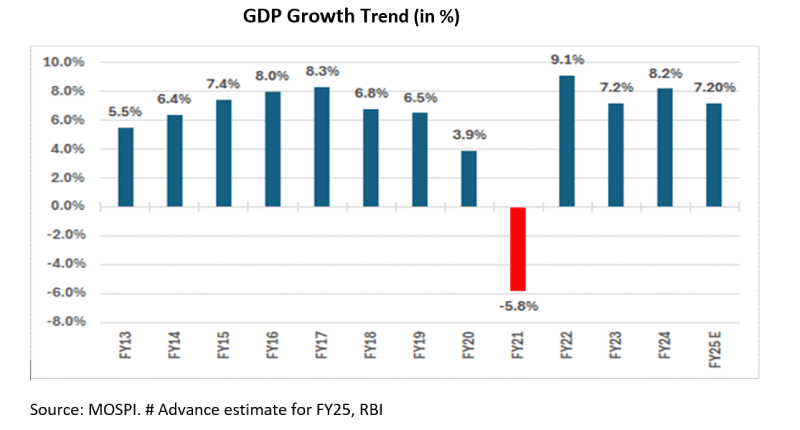

India’s economy grew by 6.7% in Q1 FY25, driven by a revival in private consumption and increased investment, which reached its highest share of GDP since 2012-13. While government spending contracted, gross value added (GVA) rose by 6.8%, outpacing GDP growth, due to strong industrial and service sector performance. Looking ahead, the fundamentals of India’s growth—consumption and investment—remain strong. Growth is expected to benefit from improved rural demand, buoyant services, and continued government investment. The GDP growth projection for FY25 stays at 7.2%, with slight adjustments in quarterly estimates (for 2QFY25 was revised down by 20 bps, 3QFY25 was revised up by 10 bps, 4QFY25 was revised up by 20bps, and 1QFY26 was revised up by 10 bps).

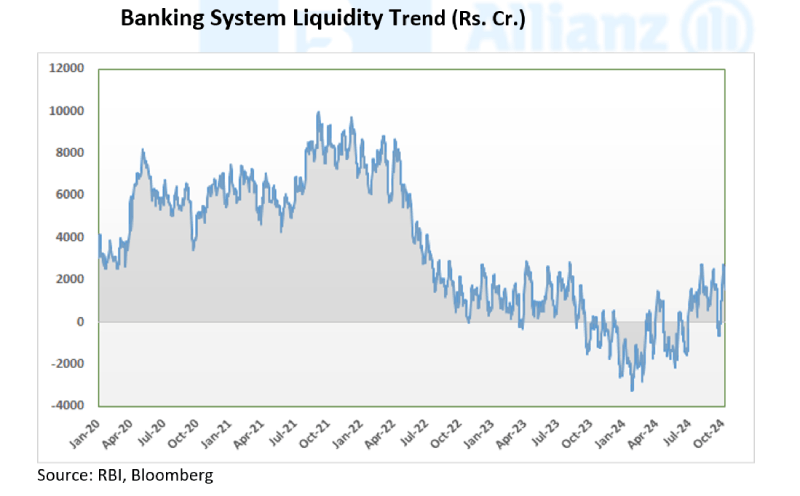

On the Liquidity front,

System liquidity remained in surplus through August to early October, supported by increased government spending and a decline in currency in circulation. However, liquidity briefly shifted to a deficit in late September due to tax outflows. The RBI responded proactively, conducting two-way liquidity operations to align inter-bank rates with the policy repo rate.

Outlook:

The MPC’s decision to maintain rates and shift its stance to neutral was largely expected by the market. This neutral position gives the RBI flexibility to adjust policy based on evolving economic conditions. With GDP growth remaining robust and inflation projected to stabilize at 4.5%, the RBI is likely to remain data dependent.

The market consensus on inflation projection for FY25 is largely below RBI’s projection of 4.5%. Today’s move of MPC to change the policy stance to “neutral” indicates that the MPC is now open to rate cuts in the future. We believe that the softening inflation may provide sufficient comfort to RBI to cut policy rates in the December 2024 MPC meeting. This will be a medium-term positive for Indian economy and rate sensitive sectors and augurs well for the fixed income markets.

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More