RBI Continues With Dovish Accommodative Stance, Policy Rates Remain Unchanged

#

5th Feb, 2021

- 2876 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

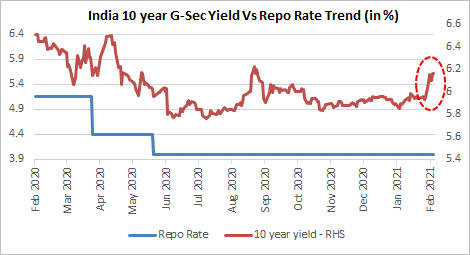

As expected, the RBI Monetary Policy Committee (MPC) unanimously voted to keep the key policy rate (repo rate) unchanged at 4.0%, and the reverse repo rate unchanged at 3.35%. The MPC also unanimously continued with their dovish undertone of maintaining an accommodative stance through next fiscal year—to support growth on a durable basis.

Source: Bloomberg

Headline consumer inflation moderated to 4.6% in December 2020 after being elevated at 7% (or above) for the past few months. The RBI has revised its inflation forecasts–to 5.2% for Q4 FY21 (vs 5.8% earlier), 5.2% to 5.0% for H1 FY22 (vs earlier lower estimate of 5.2% to 4.6%); and headline inflation is expected to moderate to 4.3% by Q3 FY22, with risks broadly balanced.

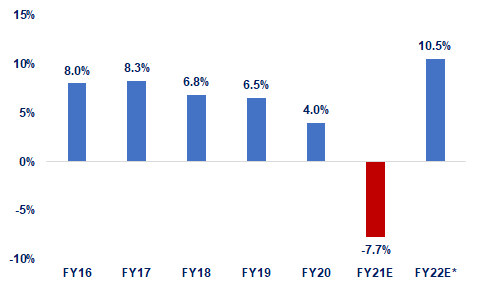

India Annual GDP Growth Trend & Forecast (% YoY)

Source: MOSPI, RBI. *RBI forecast

On the economic front, the RBI forecasts GDP growth for FY22 at a healthy 10.5% (see chart). However, this estimate is slightly lower than that of some other agencies (eg. IMF projects 11.5% growth in FY22). The earlier FY21 GDP forecast of -7.5% by the RBI is quite close to the government’s official forecast of -7.7%. The RBI mentioned that the fiscal stimulus by the government in the budget will likely accelerate public investment, although private investment may remain sluggish amidst still-low-capacity utilization.

Outlook:

Liquidity in the banking system continued to remain in healthy surplus. RBI has reiterated its commitment to ensure availability of ample liquidity to support the nascent economic recovery & manage the high government borrowing program. The central bank announced that it will roll back the earlier Cash Reserve Ratio or CRR cut (of 1% in March 2020) in two tranches—to 3.5% by March 2021 and to 4.0% by May 2021. However, the banking sector availing funds under MSF by dipping into additional 1% of SLR (which was earlier extended to March 2021 end) has further been extended by another 6 months to Sep 2021 end; and this should help to give access to Rs. 1.53 lakh crore of liquidity. Also, to manage the higher government borrowing, RBI announced the extension of enhanced HTM limit for banks upto Mar 31, 2023 in order to address the demand-supply mismatch & manage the large sovereign borrowing program.

The government in the recent budget gave precedence to growth—by allowing for high fiscal slippage while relaxing the fiscal deficit glide path by amending the FRBM act. The fiscal stimulus along with increased allocation to infrastructure & healthcare sectors, and various measures for the financial sector should support (and accelerate) the ongoing economic growth recovery. The higher government borrowing (due to the fiscal slippage) has led to hardening of bond yields, post the budget announcement, in anticipation of demand-supply mismatch. However, the central bank reiterated its commitment to complete the large gross market borrowing of Rs. 12 lakh crore budgeted for FY22 in an orderly and non-disruptive manner—which provides some comfort.

From a debt market perspective—the CRR roll-back, slight upward revision in CPI inflation forecast for H1 FY22 and lack of mention of OMOs in the policy (which the market was expecting) has caused some hardening of bond yields—especially at the longer end of the curve (post the RBI policy announcement). With the large market borrowing budgeted for FY22 we feel there is limited/no space for more rates cuts, and future monetary policy action will depend on the inflation trajectory. We continue to prefer the shorter to medium term end of the yield curve.

– Sampath Reddy, Chief Investment Officer

Disclaimer: “The views expressed by the Author in this article/note is not to be construed as investment advice and readers are suggested to seek independent financial advice before making any investment decisions”

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More