RBI Continues with Liquidity Normalization, Keeps The CPI Inflation Forecast Unchanged

#

8th Dec, 2021

- 2298 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

Comments from Mr. Sampath Reddy, Chief Investment Officer, Bajaj Allianz Life

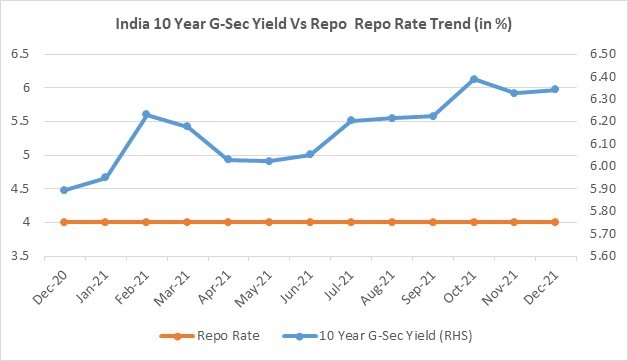

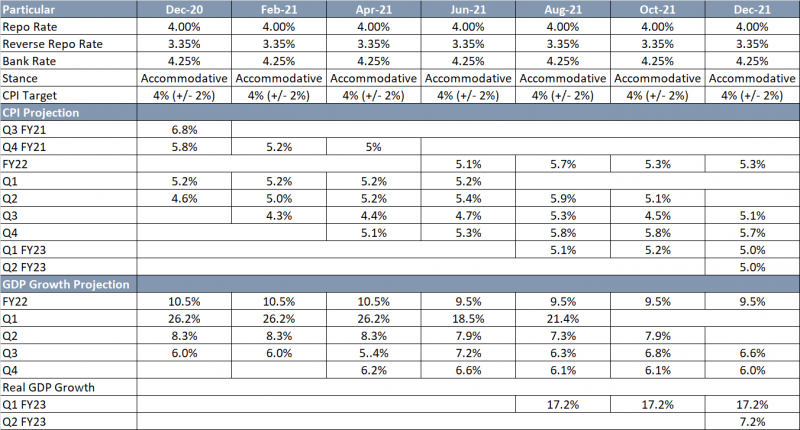

RBI’s Monetary Policy Committee (MPC) unanimously voted to keep the key policy rate (repo rate) unchanged at 4.0%, and the reverse repo rate unchanged at 3.35%, in line with the expectations. The MPC voted 5-1 in favour of maintaining an accommodative stance–to revive and sustain growth on a durable basis and mitigate economic impact of Covid, while ensuring that inflation is within the target going forward.

Source: Bloomberg

Source: RBI

The Omicron variant has added to the uncertainty which could impact the growth – inflation dynamics in the near term. Given slack in the economy, especially of private consumption which is still below pre-pandemic levels, the MPC noted that continued policy support is warranted for a durable and broad based recovery. RBI retained its GDP growth forecast at 9.5%. 3QFY22 GDP growth is seen at 6.6%; 4QFY22 at 6% ; 1QFY23 at 17.2 and 2QFY23 at 7.8%.

Banking System Liquidity (Rs. In Trln)

Source: RBI, Jefferies

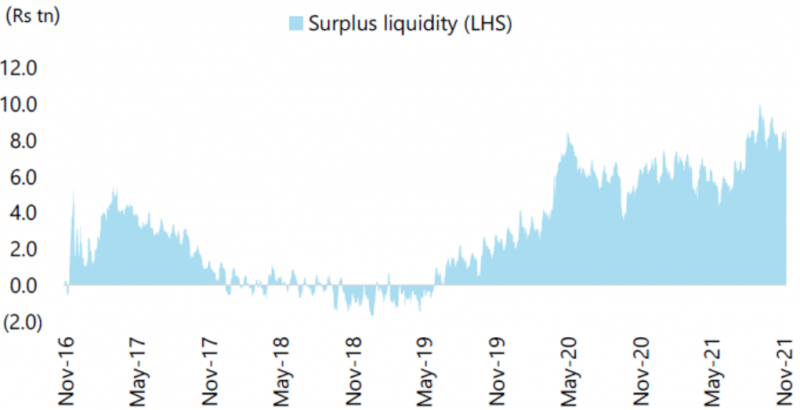

Meanwhile RBI continues with liquidity normalization. RBI has been rebalancing liquidity from overnight to longer term window through variable rate reverse repo auctions (VRRRs). The 14 day VRRR will now be expanded to Rs. 6.5tn by 17th December and Rs. 7.5tn by 31st December from Rs.6tn currently. The objective is to re-establish the 14 day VRR as the main liquidity management tool. From January 2022, VRRRs (primarily 14 day) will be the main route for liquidity absorption. At the same time RBI remains committed to operation twist and OMOs as may be warranted to keep yields anchored.

The governor noted that monetary policy is reaching an inflection point globally, but conveyed the message that policy will be domestically oriented while being cognisant of global spillovers. In withdrawal of crisis time policies, the MSF facility will be reduced to 2% of NDTL from 3% of NDTL while banks will be allowed to pre-pay funds availed under TLTRO 1.0 and TLTRO 2.0. Assuming that the Omicron variant does not pose a major threat to global and domestic recovery, we expect reverse repo hike in February and a repo rate hike in 1QFY23. We continue to expect 10 year yields to remain range bound while short term rates may edge up with ongoing liquidity normalization.

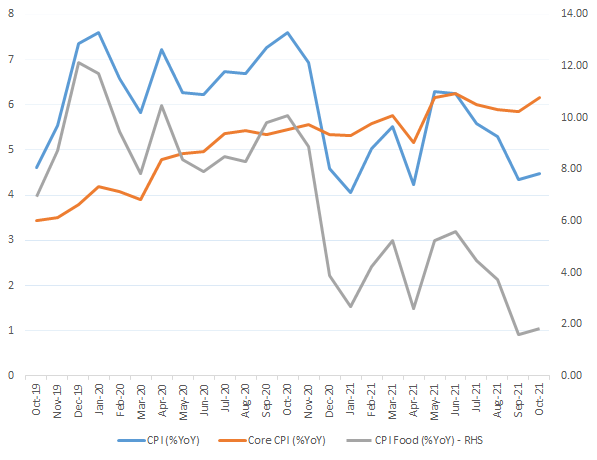

On the inflation front, the RBI said that the headline CPI inflation ticked up in October to 4.5% from 4.3% in September, after falling sharply between June and September. This uptick mainly reflected a spike in vegetable prices due to unseasonal rains in some parts of the country. Hardening international energy prices have kept domestic LPG and kerosene prices elevated for nearly three quarters, edging up fuel inflation to 14.3% in October. The impact of the recent spike in vegetables prices on food inflation prints is expected to dissipate as the usual softening of prices in the winter sets in. The partial roll back of Central excise and State Value Added Taxes (VAT) on petrol and diesel in November have eased retail selling prices and will have second round effects over a period of time. Crude oil has seen some correction but remains volatile. Core inflation will need to be closely monitored and held in check. We expect that inflation is likely to be in line with projections despite near term pressures. CPI inflation forecasts for FY22 have been kept unchanged at 5.3% while 3QFY22 is projected at 5.1%, 4QFY22 at 5.7% and 1QFY23 at 5.0%.

India CPI Inflation Trend (%YoY)

Source: Bloomberg

On the economic front, domestic economic activity has gained traction with the moderation in the second Covid wave. The RBI said that elevated commodity prices & input costs and potential global financial market volatility are key downside risks to domestic growth prospects. The central bank maintained its GDP growth forecast for FY22 at 9.5%. On the domestic front, data released by the National Statistical Office (NSO) on 30th November 2021 showed that real GDP expanded by 8.4% year-on-year (y-o-y) in 2QFY22, following a growth of 20.1% during 1QFY22. With the recovery gaining momentum, all constituents of aggregate demand entered the expansion zone, with exports and imports markedly exceeding their pre-COVID-19 levels.

Some other key additional measures announced by the RBI were as follows:

• Infusion of Capital in Overseas Branches and Subsidiaries of Banks and Retention/Repatriation/Transfer of Profits.

• Discussion Paper on Review of Prudential Norms for Investment Portfolio of Banks.

• External Commercial Borrowing (ECB)/Trade Credit (TC) – Transition from LIBOR to Alternative Reference Rate (ARR).

• Discussion Paper on Charges in Payment Systems.

• UPI for Feature Phone Users.

• Simplification of Process Flow for Small Value Transactions over UPI.

• Increase in UPI Transaction Limit for Specified Categories.

Outlook:

The discontinuance of G-SAP operations and gradual increase in VRRR auctions indicates that the RBI wants to normalize the surplus liquidity in the system in a calibrated manner, as the economy continues to recover.

The recovery of aggregate demand hinges on private investment, which is still lagging. The MPC regarded the accentuation of headwinds emanating from global developments as the main risk to the domestic outlook, which is now somewhat clouded by the Omicron variant of COVID-19. However, the recovery in domestic economic activity is turning increasingly broad-based, with the expanding vaccination coverage, slump in fresh COVID-19 cases and rapid normalization of mobility. Rural demand is expected to remain resilient. The spurt in contact-intensive activities and pent-up demand will continue to bolster urban demand. The government’s infrastructure push, the widening of the performance linked incentive scheme, structural reforms, recovering capacity utilization and benign liquidity and financial conditions provide conducive conditions for private investment demand.

The accommodative monetary policy stance should benefit the equity markets by keeping borrowing costs in check for some time, although they seem to have bottomed out. Corporate earnings have surprised on the upside amidst the pandemic and we expect a strong corporate earnings trajectory in FY22 & FY23 as well, which should help to support the current elevated market valuations. Therefore, we believe that any market correction may not be too deep and should be used as a buy on dips opportunity by the investor (as their individual risk profile). Meanwhile, investors should continue to invest systematically in equities.

Disclaimer: “The views expressed by the Author in this article/note is not to be construed as investment advice and readers are suggested to seek independent financial advice before making any investment decisions”

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More