RBI maintains status quo as expected; ups inflation target

#

6th Aug, 2021

- 3228 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

Comments from Mr. Sampath Reddy, Chief Investment Officer, Bajaj Allianz Life

RBI’s Monetary Policy Committee (MPC) unanimously voted to keep the key policy rate (repo rate) unchanged at 4.0%, and the reverse repo rate unchanged at 3.35%, as widely expected. The MPC voted 5-1 in favour of maintaining an accommodative stance–to revive and sustain growth on a durable basis and mitigate economic impact of Covid.

Source: Bloomberg

The RBI has taken various measures to maintain ample surplus liquidity since the onset of the pandemic to ensure easing of financial conditions in support of domestic demand. The governor mentioned that the central bank has been conducting 14-day variable reverse repo rate (VRRR) auctions as its main liquidity operation and we have seen higher appetite for the same. He also said that fears that the commencement of VRRR tantamount to tightening of liquidity have been allayed. With this, the absorption of liquidity under the VRRR will be gradually increased from Rs. 2.5 trln to Rs. 4 trln every fortnight upto September 24, 2021. However, governor Das reiterated that this should not be misconstrued as reversal of the accommodative policy stance or tightening of liquidity.

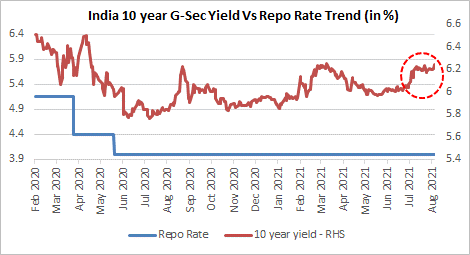

The governor mentioned that RBI’s G-Sec acquisition programme (GSAP) has been successful in anchoring yield expectations and got keen response from market participants. The RBI proposes to conduct 2 more GSAP auctions of Rs. 250 bln each in the month of August 2021. Further, the central bank will continue to conduct Operation Twist & Open Market Operations (OMOs).

On the inflation front, the RBI indicated that inflation prints in the months of May and June 2021 surprised on the upside, by coming in at above its 6% upper tolerance limit. However, the central bank’s assessment is that the inflationary pressures are transitory in nature and largely driven by supply side issues. Meanwhile, the RBI increased its headline inflation forecast for FY22 to 5.7% from 5.1% earlier.

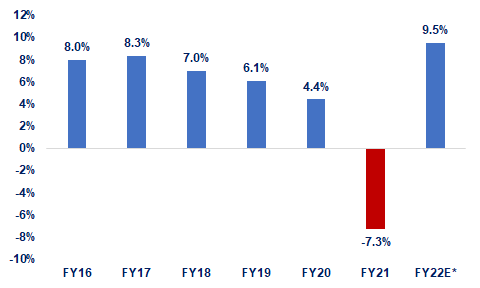

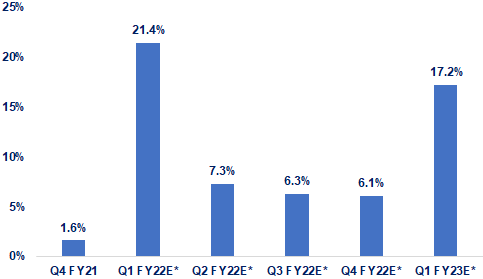

On the economic front, domestic economic activity has started recovering with the significant moderation in the second Covid wave and re-opening of the economy. The RBI said that various high frequency indicators suggest that consumption, investments and external demand are gaining traction. Therefore, it maintained its GDP growth forecast for FY22 at 9.5%.

India GDP – Trend and Projections (% YoY)

Source: MOSPI, RBI. *RBI growth forecast/expectation

Some other additional measures announced by the RBI were as follows:

• The on-tap TLTRO has been extended by a period of 3 months till end of December 2021.

• The relaxation in Marginal Standing Facility (MSF) has also been extended by 3 months till end of December 2021. The RBI mentioned that this provides increased access to funds to the tune of Rs. 1.62 trln.

Outlook:

The RBI’s priority is to still provide impetus to support the economic growth recovery, considering that credit growth remains quite low. The RBI governor mentioned that growth impulses need to be nurtured to ensure durable growth recovery along a sustainable path.

We expect that the RBI will continue to intervene to support bond yields and keep them in check, to ensure an orderly and efficient completion of the large market borrowing programme. Therefore, we believe that the central bank will continue to be accommodative for some time (at least through this calendar year), with an eye on the inflation trajectory. Therefore, policy normalization is still some time away.

However, bond yields moved up post today’s RBI policy review as the market started to price in growing inflation risk. The shorter end of the yield curve could see some hardening with the announcement today of a gradual increase in quantum of VRRR auctions to absorb additional liquidity. However, the central bank seems keen to maintain liquidity in comfortable surplus for some time, to aid economic growth. We presently prefer the shorter to medium term end of the yield curve.

The accommodative monetary policy should benefit the equity markets by keeping borrowing costs in check for some time, although they seem to have bottomed out. Corporate earnings, global liquidity & easy monetary policy continue to support the equity markets. Downside risks to economic activity could stem from rise in global commodity prices, financial market volatility and rise in Covid cases due to the Delta variant (although we need to see if and how a third Covid wave pans out in India). Investors should continue to invest systematically in equities and can use any market volatility / dips to increase their equity exposure gradually (as per their individual risk profile).

Disclaimer: “The views expressed by the Author in this article/note is not to be construed as investment advice and readers are suggested to seek independent financial advice before making any investment decisions”

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More