RBI maintains status-quo amid evolving inflation & growth dynamics

#

6th Aug, 2025

- 507 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

Comments from Mr. Srinivas Rao Ravuri, Chief Investment Officer, Bajaj Allianz Life

Monetary Policy Decision – While being watchful RBI retains status quo

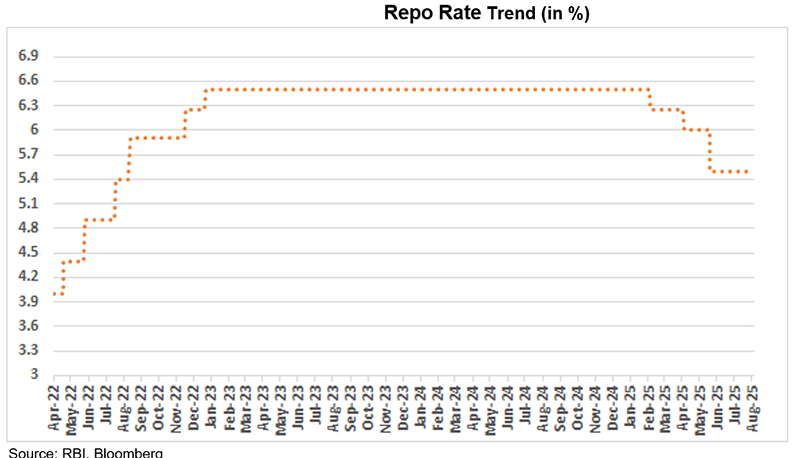

In its August 2025 monetary policy review, the Reserve Bank of India (RBI) decided to keep the policy repo rate unchanged at 5.5%, maintaining the Standing Deposit Facility (SDF) at 5.25% and the Marginal Standing Facility (MSF) and Bank Rate at 5.75%. The RBI’s Monetary Policy Committee (MPC) voted unanimously to retain the current rate and continue with a ‘neutral’ stance, indicating that future moves will depend on evolving data. The central bank emphasized the importance of allowing earlier rate cuts to transmit fully into the economy before taking further steps.

Growth Outlook: Broadly Positive, but Uneven

India’s economic growth remains in line with RBI’s projections, although some high-frequency indicators are signalling mixed trends. Rural demand remains strong, supported by healthy monsoon activity, which has improved kharif sowing and reservoir levels. Government capital expenditure, construction, and services activity remain robust. However, industrial growth, particularly in mining and electricity, has been subdued. Consequently, the RBI has retained its GDP growth forecast for FY26 at 6.5%, with quarterly estimates ranging from 6.3% to 6.7%. Risks to the outlook remain evenly balanced, with external uncertainties, especially around global trade and tariffs, continuing to pose a challenge.

Inflation: Historic Lows but Cautious Path Ahead

Headline CPI inflation fell to a 77-month low of 2.1% in June 2025, driven by sharp declines in vegetable and pulses prices further supported by healthy foodgrain buffers and a strong southwest monsoon. Core inflation, however, rose to 4.4% partly driven by increase in gold prices. Looking ahead, inflation is projected to remain below 4% through most of FY26 but could rise to 4.4% in Q4 due to base effects and demand revival driven by policy actions. The RBI projects average CPI inflation at 3.1% for FY26. The risks are evenly balanced with weather related shocks being potential threats.

Liquidity and Transmission: Conditions Improving Further

System liquidity remains comfortable, with the average daily surplus rising to Rs. 3.0 lakh crore since the last MPC, as compared to an average daily surplus of Rs.1.6 lakh crore during the previous two months. The staggered CRR cut announced earlier, set to begin from September 2025, will further ease liquidity. Transmission of June rate cuts is resulting in lower lending rates with the weighted average lending rates (WALR) on fresh loans already down 71 bps compared to February 2025 levels, correspondingly deposit rates are also moderating. The RBI affirmed its commitment of maintaining sufficient liquidity to support economic activity and effective policy transmission.

External Sector: Resilient with Strong Buffers

India’s external sector remains stable. The current account deficit (CAD) narrowed to 0.6% of GDP in FY25, supported by strong services exports and remittance flows. While merchandise trade deficit remains high, India’s services exports share in global trade continues to rise and stood at 4.3% in the year 2024. Gross FDI inflows stayed strong, though net FDI moderated due to higher outbound investments. FPI flows turned negative due to outflows from both equity & debt. However, external commercial borrowings and non-resident deposits saw healthy inflows. Forex reserves stood at $688.9 billion, covering more than 11 months of imports.

Financial System: Stable and Well-Capitalized

India’s financial system remains robust. Scheduled Commercial Banks (SCBs) and NBFCs reported strong capital adequacy and profitability. Bank credit grew by 12.1% in FY25—slower than the previous year but still higher than the 10-year average of 10.3%. The flow of non-bank credit made up for the slower bank lending, indicating healthy financing to the commercial sector. Credit quality and liquidity buffers continue to improve, reflecting a stable financial environment.

Additional Measures: Focus on Financial Inclusion and Access

To mark 10 years of the Jan Dhan scheme, the RBI announced customer service camps at the Panchayat level between July and September for account servicing and enrolment in financial products. It also proposed a standardised process for settling claims related to deceased bank customers’ accounts and lockers. Further, retail investors will now be able to invest in treasury bills through SIPs on the RBI Retail-Direct platform, promoting wider participation in government securities.

Outlook: Further Rate Cuts Likely to be Data-Dependent

The policy was in line with our expectations, and space for further rate cut depends on the evolving data. We believe there is still a good chance of further rate cut by the RBI, supported by low inflation, subdued domestic growth, and the increasing likelihood of a U.S. Federal Reserve rate cut in the coming months. Since a large part of the easing cycle was frontloaded in June, the RBI is likely to hold rates steady in the near term, waiting for more clarity—especially on the potential impact of new U.S. tariffs on India.

The RBI concluded that inflation and growth trends are broadly aligned with expectations. With the benefit of past rate cuts yet to play out fully, the central bank is in no rush to change course. The “neutral” stance offers flexibility to respond to changing dynamics while supporting the ongoing recovery. The further transmission of the full impact of the previous rates cuts will eventually result in lowering FD rates, home and other consumers loans, which will continue to stimulate demand in economy.

Given this backdrop, we expect the 10-year government bond yield to remain in a narrow range of 6.25% to 6.50%. In the current interest rate environment, we prefer investments in 5-year corporate bonds.

Annexure:

CRR – The share of a bank’s total deposits that must be kept with the RBI in cash.

Stance – It gives an indication to the future policy action.

SDF – The rate at which Banks lend to RBI without collateral.

MSF –The rate at which RBI lends (provides emergency liquidity) to Banks.

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More