RBI gradually shifts towards policy tightening

#

8th Apr, 2022

- 2240 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

Comments from Mr. Sampath Reddy, Chief Investment Officer, Bajaj Allianz Life

RBI’s Monetary Policy Committee (MPC) unanimously voted to keep the benchmark policy rate (repo rate) unchanged at 4.0%. The marginal standing facility (MSF) rate and the Bank rate remain unchanged at 4.25%. The floor of the corridor will now be provided by the newly instituted Standing Deposit Facility (SDF), which will be placed 25 basis points below the repo rate, i.e., at 3.75%. Consequently, the RBI has restored the width of the Liquidity Adjustment Facility (LAF) corridor to 50 basis points, the position that prevailed before the pandemic.

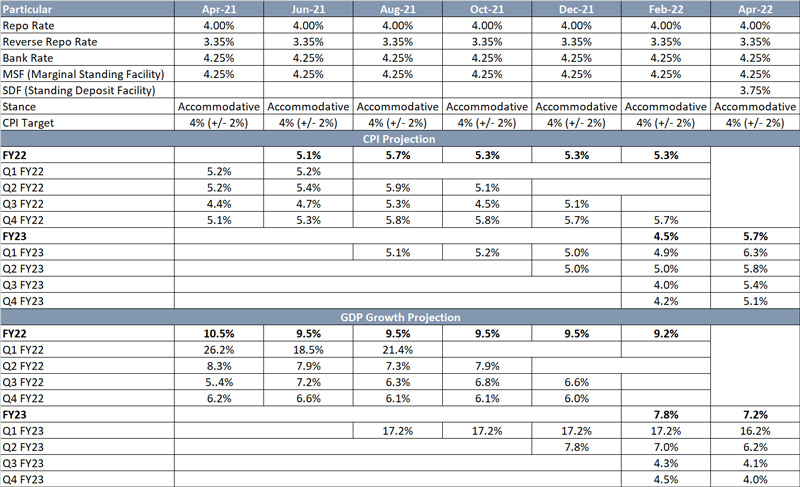

The MPC while reiterating its accommodative stance has also rephrased with focus on withdrawal of accommodation as it ensures inflation remains in target with continuous support to growth. Amidst the concerns over geopolitical conflict and surge in global commodity prices; inflation forecast has been revised upwards and growth projections are revised downwards across all quarters of FY23.

Source: RBI

On the domestic front, the MPC noted that economy has been showing signs of recovery as reflected by high frequency indicators along with buoyancy in merchandise exports. Expectations of higher Rabi output bodes well for rural demand as well as food prices. Private investment activity will be boosted further with Government schemes such as PLI. However, there has been significant shifts in macroeconomic environment since the last meeting (Feb’22). This is on the back of uncertainty in the ongoing geopolitical framework, along with tightening global financial conditions and surge in global crude and commodity prices that are likely to hurt growth outlook. Accordingly, RBI lowered its growth forecast downwards to 7.2% for FY23 (7.8% in Feb’22), Q1FY23 at 16.2% (from 17.2%), Q2FY23 at 6.2%, Q3 and Q4FY23 at 4.1% and 4% respectively.

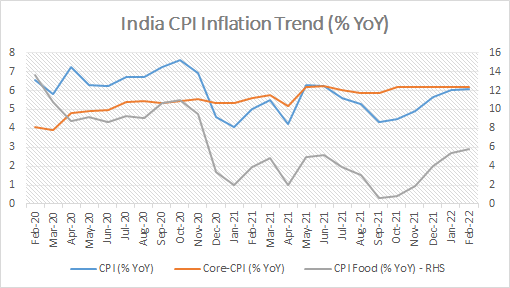

On the inflation front, the RBI governor said that it has revised the inflation projection upwards on the back of the evolving geopolitical tensions and its impact on overall global commodity prices. The Committee noted it remains watchful as it continues to monitor elevated global price pressure in food items including edible oils. These disruptions will add to input cost pressure too. Against the above backdrop along with assumption of normal monsoon and crude at US$100/bbl, the MPC has revised its forecast to 5.7% in FY23 (4.5% previously), for Q1FY23 to 6.3% (4.9% earlier), Q2FY23 at 5.8%, Q3FY23 and Q4FY23 at 5.4% and 5.1% respectively.

India CPI Inflation Trend (%YoY)

Source: Bloomberg

The RBI said that system liquidity continues to remain in large surplus with average absorption under the LAF window of Rs 7.5 lakh crore in March 2022. The central bank RBI has indicated that given the current macro-economic conditions and tightening by other major global central banks, RBI’s response will also be “pre-emptive and re-calibrated dynamically to the evolving outlook”. Currently, RBI manages liquidity in the system through Variable Reverse Repo Rate (VRRR) auctions and overnight reverse repo operations. These tools will continue to be used. Policy also confirmed that in order to avoid market shocks, RBI had been absorbing ~80% of the liquidity at rates close to Repo Rate (4%) through VRRR. Thus, normalization of LAF corridor to 3.75-4.25% (50bps; at pre-Covid-19 levels) has been along the expected lines.

To further manage liquidity, RBI has introduced a new tool, SDF (Standing Deposit Facility) or standing absorption facility. This will act as the floor of the LAF corridor and will be set at 25bps below the Repo Rate (3.75% at present). The key difference between Reverse Repo facility and SDF is that in case of SDF, RBI has no binding collateral constraint. Upper-end of the LAF corridor will be the Marginal Standing Facility (MSF), which will be 25bps above the Repo Rate (4.25% at present). With the introduction of SDF, the usability of Fixed Rate Reverse Repo (FRRR) will decline as the rate remains unchanged at 3.35%.

In addition, RBI has also announced that there will be a “calibrated withdrawal” of the current surplus liquidity overhang of Rs 8.5 lakh crore in the system. This will be done using a multi-year framework, with withdrawal starting from the current fiscal year FY23.

Some other key additional measures announced by the RBI were as follows:

• In Oct’20, RBI had increased the limits under Held to Maturity (HTM) category from 19.5% to 22% of NDTL in respect of statutory liquidity ratio (SLR) eligible securities acquired on or after September 1, 2020. This limit has been increased to 23% till March 31, 2023. From Q1FY24 onwards, the limit will begin to be reduced from 23% to 19.5% in a phased manner.

• In Oct’20, RBI had rationalized the risk weights for individual housing loans by linking them only with loan to value (LTV) ratios for all new housing loans sanctioned up to March 31, 2022. This facility has been extended to all housing loans sanctioned upto March 31, 2023.

• A discussion paper on Climate Risk and Sustainable Finance will be placed by the RBI. This is due to the need for Regulatory Entities (REs) to develop and implement a sound process for understanding and assessing the potential impact of climate-related financial risks in their business strategy and operations. This would require an appropriate governance structure and a strategic framework to effectively manage and address these risks.

• RBI has proposed to set up a committee to examine and review the state of customer service in the Regulatory Entities (REs) and adequacy of customer service regulations and suggest measure to improve the same.

• RBI has proposed that all banks and all ATMs support card-less withdrawal facility. To encourage card-less cash withdrawal facility across all banks and all ATM networks/operators, it is proposed to enable customer authorization through the use of Unified Payments Interface (UPI) while settlement of such transactions would happen through the ATM networks.

• Bharat Bill Payment System (BBPS) – RBI has proposed rationalization of Net-worth requirement for operating units (BBPOUs). The current requirement of net worth for a non-bank BBPOU to obtain authorization is Rs 100 crore and it is viewed as a constraint to greater participation. Therefore, RBI has reduced the net worth requirement for non-bank BBPOUs to Rs 25 crore.

• Cyber Resilience and Payment Security Controls of Payment System Operators (PSOs)-With greater adoption of digital payment modes, RBI had prescribed the necessary security controls for digital payment products and services offered by banks and credit card issuing NBFCs. Now, similar directions have been issued for Payment System Operators (PSOs).

Outlook:

The RBI policy has been shifted away from being dovish, and this has led to hardening of bond yields post the policy announcement. RBI’s concern on inflation has increased significantly especially with the FY2023 average inflation estimate revised upwards by 120 bps. The RBI in this policy has shifted its focus towards inflation from growth.

Although, there was no mention of Operation Twist or Open Market Operations in the RBI policy, we expect the RBI to use these tools from time to time to manage the yield curve in an efficient manner to help achieve the large market borrowing programme in a smooth manner.

However, we expect bond yields to continue to harden during the year, on the back of further rate hikes expected later during the year in India, normalization of monetary policy by major global central banks, elevated crude oil prices and supply side pressures due to the large market borrowing in FY23. From a debt markets perspective, we presently prefer the medium term of the yield curve.

The equity markets also cheered the hawkish monetary policy today. The corporate earnings revival in India will help market sentiments as domestic economy returns to normalcy. We believe the economic recovery will be continued as pandemic effect slowing down in the economy. However, persistent geopolitical tensions, elevated market valuations, higher commodity prices and upcoming quarterly results may cause some volatility in the market for short term and may lead to muted equity market returns over the coming year (when compared to the previous year).

Disclaimer: “The views expressed by the Author in this article/note is not to be construed as investment advice and readers are suggested to seek independent financial advice before making any investment decisions”

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More