RBI delivers a dovish policy; maintains status quo

#

10th Feb, 2022

- 3048 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

Comments from Mr. Sampath Reddy, Chief Investment Officer, Bajaj Allianz Life

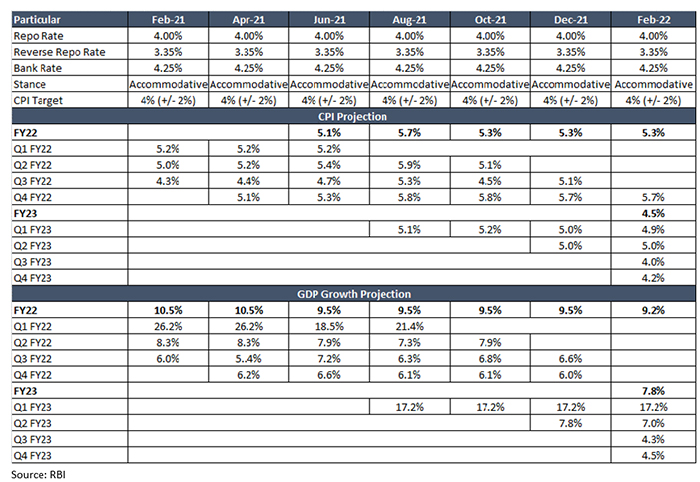

RBI’s Monetary Policy Committee (MPC) unanimously voted to keep the key policy rate (repo rate) unchanged at 4.0%, and the reverse repo rate unchanged at 3.35%. This was contrary to market expectations of a reverse repo rate hike to reduce/normalize the LAF corridor; thereby indicating a more dovish policy than market expectations. The MPC voted 5-1 in favour of maintaining an accommodative stance–to revive and sustain growth on a durable basis and mitigate economic impact of Covid, while ensuring that inflation is within the target going forward.

Source: RBI

On the domestic economy front, the RBI said that recovery in domestic economic activity is yet to be broad-based, as private consumption and contact-intensive services remain below pre-pandemic levels. However, it added that the impact of the ongoing third wave of Covid-19 pandemic is likely to be more limited than earlier waves; and the enhanced capital expenditure announced in the recent Union Budget is expected to augment growth. The central bank projected GDP growth for FY23 at 7.8%. The recent Economic Survey 2021-22 projects GDP growth for FY23 at 8-8.5%.

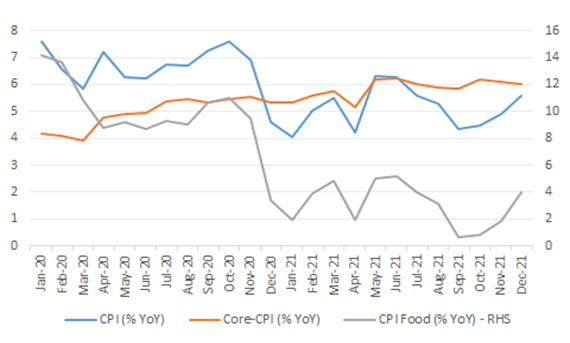

On the inflation front, the RBI governor said that CPI inflation trajectory has moved in close alignment with RBI projections. Core inflation remains elevated, although as risks from Omicron wane and supply chain pressures moderate, there could be some softening of core inflation. However, the governor added that hardening of crude oil prices, presents a major upside risk to the inflation outlook. The central bank maintained inflation forecast for FY22 at 5.3% and projected FY23 inflation at 4.5% (which is below market expectations).

India CPI Inflation Trend (%YoY)

Source: Bloomberg

The RBI said that system liquidity continues to remain in large surplus, although average absorption under the LAF window declined from Rs 8.6 lakh crore during October-November 2021 to Rs 7.6 lakh crore in January 2022. The central bank said it is logical to restore the revised liquidity management framework in order to make it more flexible and agile. It has not spoken on any liquidity withdrawal; but indicated that variable rate repos (VRRs) and variable rate reverse repos (VRRRs) of 14-day tenor will operate as the main liquidity management tool.

Some other key additional measures announced by the RBI were as follows:

• The RBI had earlier announced an on-tap liquidity facility of Rs 50,000 crore and Rs 15,000 crore for emergency healthcare services and contact intensive sectors respectively, wherein banks were provided incentives to lend into these areas. The two schemes stand extended from 31st March 2022 to 30th June 2022.

• Under the Voluntary Retention Scheme (to facilitate long-term investment by FPIs to invest in debt securities), the limit has been enhanced from Rs. 1.5 lakh crore to Rs. 2.5 lakh crore effective from April 2022 beginning.

• Under digital payments, the cap for e-RUPI prepaid digital voucher has been enhanced from Rs 10,000 to Rs 100,000.

Outlook:

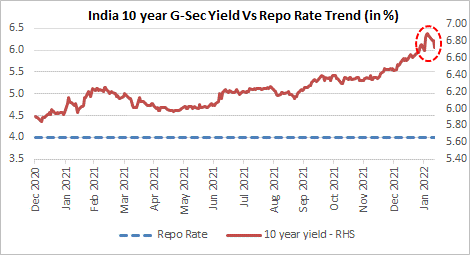

The RBI policy has been more dovish than market expectations, and this has led to softening of bond yields post the policy announcement. The market was expecting some further liquidity normalization and an increase in the reverse repo rate to reduce/normalize the LAF corridor, but that didn’t transpire in this policy. Also, the inflation forecast for FY23 was below market expectations, indicating that the RBI is still comfortable with the inflation trajectory in India. Globally, the inflation scenario is different with headline consumer inflation in the US touching a 40-year high of around 7%, thereby causing global central banks to be more aggressive in their monetary policy stance in recent times. The central bank in India wants to follow a calibrated approach of maintaining price stability and ensuring a strong and sustained economic recovery.

Post the Union Budget, we saw a spike in bond yields due to the higher than expected market borrowing and fiscal deficit numbers. The net market borrowing for FY23 is quite elevated at Rs. 11.2 lakh crore vs Rs 7.75 lakh crore in FY22RE. The RBI policy should therefore provide some comfort to bond yields in the near term. Although, there was no mention of Operation Twist or Open Market Operations in the RBI policy, we except the RBI to use these tools from time to time to manage the yield curve in an efficient manner to help achieve the large market borrowing programme in a smooth manner.

Source: Bloomberg

However, we expect bond yields to continue to harden during the year, on the back of rate hikes expected later during the year in India, normalization of monetary policy by major global central banks, elevated crude oil prices and supply side pressures due to the large market borrowing in FY23. From a debt markets perspective, we presently prefer the medium term of the yield curve.

The equity markets also cheered the dovish monetary policy today. The corporate earnings revival in India will help market sentiments as domestic economy returns to normalcy. But elevated market valuations and risk of faster than expected monetary policy normalization by global central banks may lead to muted equity market returns over the coming year (when compared to the previous year).

Disclaimer: “The views expressed by the Author in this article/note is not to be construed as investment advice and readers are suggested to seek independent financial advice before making any investment decisions”

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More