Covid-19 2nd Wave Causing Some Market Volatility – Concerns of Rising Bond Yields

#

26th Mar, 2021

- 6521 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

The Indian and global markets have witnessed some volatility lately. As of 26th March 2021, the benchmark Nifty 50 index has fallen ~6% from its 2021 peak, and for the broader markets–the Nifty Mid-cap & Small-cap indices have also fallen by ~7-8% from their peak. Despite the strong economic recovery and better-than-expected corporate earnings, the market volatility in India could be partly attributed to the rise in bond yields and signs of a possible second Covid-19 wave in India.

Global and domestic bond yields see some spike this year, but easy monetary policy to continue

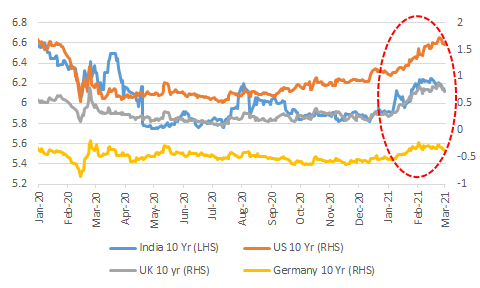

We have seen a significant rise in global and domestic bond yields, which can be attributed to the rise in prices of commodities (raising inflationary concerns) and a strong revival in economic growth. The benchmark 10-year US treasury yield has risen from 0.9% at the end of the CY2020 and breached the 1.7% mark in March 2021, before seeing some marginal softening. The India 10-year G-Sec yield has also risen from 5.85% at the end of CY2020 and breached the 6.25% mark in March 2021, before seeing some softening. Similarly, bond yields of other developed countries have also moved up. With the rise of bond yields the cost of capital (or borrowing) for companies is expected to go up from the record lows of last year. Also, rising bond yields and concerns of some tapering (of monetary stimulus) by major central banks later in 2021 could lead to some flight of risk capital from emerging markets (as has been seen historically too). This has hampered sentiment in the short term and has contributed to the volatility in markets.

10-year Bond Yields of Various Countries

Source: Bloomberg

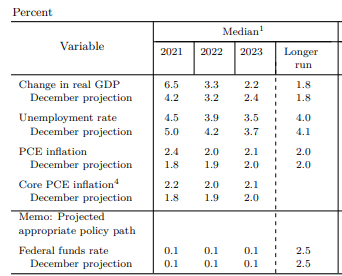

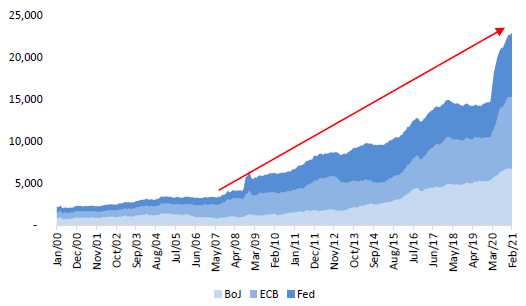

However, major global central banks have left rates unchanged and continue to be very accommodative in their tone and future guidance. In its March 2021 meeting, the US Federal Reserve delivered a dovish policy–left rates unchanged and the median forecast indicated that they will leave them unchanged through 2023. It maintained its ongoing monthly bond purchase or QE (quantitative easing) programme at $120 billion per month, and signaled that inflation going above the 2% target may be transitionary and not meet the standard for increasing rates. The US Fed also significantly upgraded its 2021 GDP growth forecast for the US to 6.5% from earlier projection of 4.2% growth in December 2020 meeting (Refer to table below for US Fed March 2021 meeting forecasts). The European Central Bank (ECB) also delivered a dovish policy in March and said that it would step up its bond purchases or quantitative easing. The ECB president warned that the economic outlook in Eurozone remains marred by uncertainty due to the Covid pandemic and that the central bank was against premature policy tightening. Therefore, it appears that economic growth recovery remains a priority for major global central banks and they will continue with their accommodative/easy monetary policy stance for some time. Since the Covid-19 pandemic emerged in early 2020, central banks have gone in for a war-like footing monetary stimulus, which has resulted in a massive & quick expansion in their balance sheets–never seen before (see chart below). This monetary stimulus combined with a massive fiscal stimulus by various developed countries has resulted in a global liquidity surge, which has helped in the strong recovery in global markets and economy.

US Fed Meeting Projections – March 2021

Source: US Federal Reserve

Balance Sheet of Major Central Banks (US$ in billion)

Source: Bloomberg, Phillip Capital

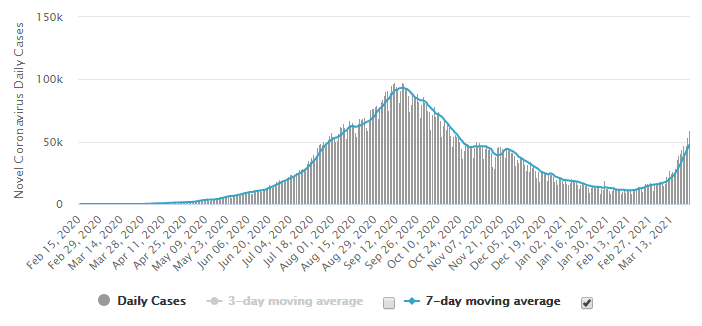

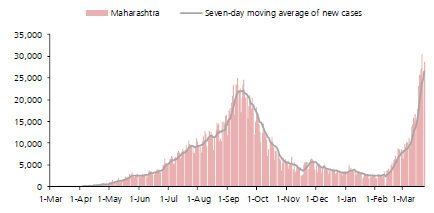

Signs of a possible second Covid wave in India raises some concerns; Maharashtra worst-hit

We have seen Covid-19 cases rising this year, which has raised concerns of a possible second wave in India. However, bulk of the new daily cases (~60%) is from Maharashtra over the past few weeks and recently Maharashtra even hit the highest new cases added in a single day, since the pandemic began last year (surpassing even the peak seen in September 2020). Besides Maharashtra, we have also seen cases rising in another states like Punjab, Gujarat, Kerala and Karnataka recently, although not to the same magnitude as that of Maharashtra. The case positivity rate in Maharashtra has spiked sharply, although the mortality/fatality rate remains in control at ~2% so far. The spike in case load in Maharashtra has led to restrictions in movement, and partial lock-down in some of the districts.

India – New Daily Covid Cases Trend

Source: Worldometers.info

Maharashtra – New Daily Covid Cases Trend

Source: Covid19india.org, Kotak Institutional Equities

At all India level, the mortality rate remains controlled at below 1.5%, although the active cases have reached levels seen in early December 2020. However, if cases continue to escalate in India there are concerns that there could be a lock-down or restrictions, which may hamper the pace of the economic recovery. This may lead to some market volatility in the short term.

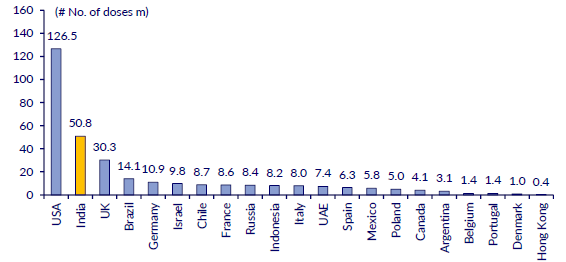

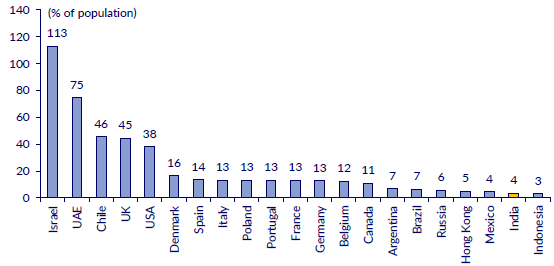

On the positive side, Covid vaccination drive in India has been progressing well. Data shows that in absolute terms, India has administered the second highest doses of Covid vaccination, behind the US. However, with its higher population, India lags other countries relatively based on the percentage of the population that has been vaccinated so far (refer to charts below). With the government gearing up to expand the vaccination drive to a larger part of the population, it looks that India will be in a better position to deal with a second Covid wave. Albeit, it will still take quite some time for a large part of the population to get vaccinated in India, so it remains to be seen how the government is able to manage these intermittent outbreaks.

Country-wise: Total No. of Covid Doses Administered (in Mln)

Source: CLSA, Our World in Data

Country-wise: Percentage of Population Vaccinated

Source: CLSA, Our World in Data

Indian economy has seen strong recovery, and corporate earnings have also been better than expected

With the Indian economy opening-up, we have seen a strong recovery in various economic indicators (from their lows during last year’s lock-down) –be it auto sales, PMI data, GST collections, steel & cement production, electricity generation, freight, cargo movement etc. India’s Q3 FY21 GDP growth recovered to positive territory at +0.4%YoY, compared to -7.3% in Q2 FY21 and a sharp decline of -24.4% in Q1 FY21 (amidst the lock-down). The government estimates an 8%YoY contraction in GDP growth in FY21, while the RBI projects a 10.5%YoY growth in FY22.

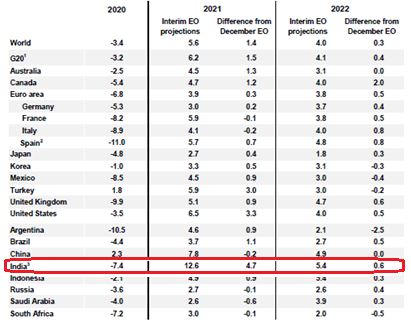

Other international agencies are expecting a stronger economic recovery in FY22. Economic think-tank OECD in its March 2021 Economic Outlook update, forecasts that India’s GDP will contract 7.4% in FY21, and will see strong recovery of 12.6% in FY22 (an upgrade of 4.7% from December 2020 forecast). This would make India the fastest growing major economy during the year, although part of it due to the lower base effect (of previous year). OECD also expects global GDP growth to recover to +5.6% in CY2021 (upgrade of 1.4% from Dec 2020 forecast) from a contraction of 3.4% in CY2020. This is being helped by stronger than expected growth in certain developed economies, especially the US. The US government recently passed a massive $1.9 trillion stimulus in addition to last year’s Covid stimulus package.

OECD GDP Growth Forecast (YoY in %) – March 2021 update

Source: OECD Economic Outlook (EO), March 2021. 3^For India 2020 = FY21 & 2021 = FY22

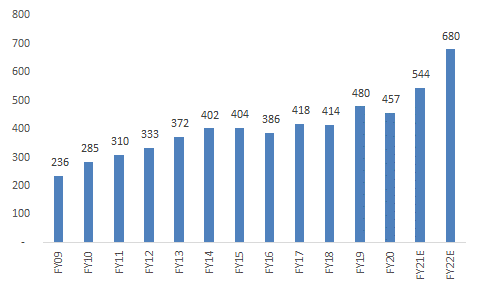

Corporate earnings in India have also been better than expected over the past two quarters (Q2 & Q3 FY21) and have seen a healthy recovery from the sharp decline in Q1 FY21 (amidst the Covid pandemic lock-down). The recovery has been helped by cost control by companies, translating into better margins and profitability. For FY21 we now expect Nifty EPS growth at ~19% (compared to earlier estimate of lower single-digit growth), and Nifty EPS growth to recover further to ~25% in FY22. If the corporate earnings recovery pans out as expected, it should be beneficial for equity markets, and help to moderate the elevated valuation multiple to some extent.

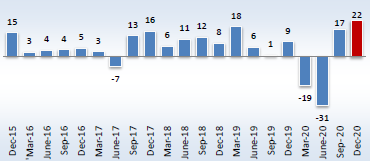

Nifty Index Quarterly PAT Growth Trend (% YoY)

Source: Motilal Oswal

Nifty Index EPS Trend

Source: Bajaj Allianz Life Insurance Estimates

Market Outlook:

In the short term, we may continue to see some market volatility if bond yields harden further or Covid cases continue to escalate. However, we feel that the worst may be behind us now and investors can use any market volatility / dips to increase their equity exposure gradually (as per their individual risk profile). As we know, market timing is difficult, but historical data has shown that investing in past market corrections has generally been quite rewarding for investors over the medium to long term. We also recommend investors to not resort to panic-selling.

Equity market returns over the past year has been robust, with markets having recovered from their March 2020 pandemic lows, and India has been among the top performing markets globally over this period. The outlook for economic and corporate earnings growth recovery looks promising, albeit it is on a lower base (of last year). This coupled with continuation of global easy monetary policy and expansion of the Covid vaccination drive–helps to provide comfort for long term investors. Overall, 2021 is going to be the year of “normalization”, which should set the pace and trajectory for future growth.

Disclaimer: The note is not intended to be construed as any advisory from Bajaj Allianz Life Insurance Co. Ltd. for any investment or any other purpose. Any reliance of the same by the individual for any purpose, is on the sole independent understanding and requirement of the individual. The Public is advised to consult their advisor with regards to their investment.

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More