CIO comments on RBI Bi-monthly Policy, October 2018

#

6th Oct, 2018

- 2691 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

RBI surprises markets by keeping rates unchanged and changing policy stance to “calibrated tightening” The RBI Monetary Policy Committee (MPC) went against broad market expectations and kept the policy unchanged (with five MPC members voting for keeping rates unchanged and one member voting for a rate hike). It also surprised, by changing its monetary policy stance from “neutral” earlier to “calibrated tightening”.

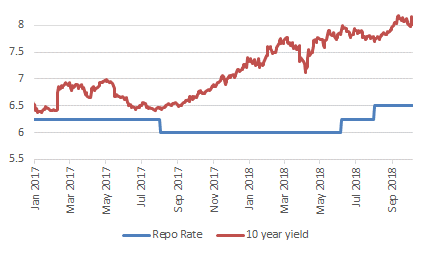

RBI Repo Rate Vs 10 year yield

Source: Bloomberg

RBI revised the CPI headline inflation trajectory downwards as follows:

This downward revision of CPI headline inflation has been guided by benign food inflation–which has come in below estimates and imparts a downward bias trajectory in the second half of fiscal, risk to food inflation from uneven rainfall has been mitigated as advance estimates for production kharif crops for FY19 has been placed higher than last fiscal, and finally the HRA impact is dissipating along expected lines. However, on the flipside, inflation uncertainties persist from rising crude oil prices, implementation of MSP hike, global financial markets, rising input cost, centre and state fiscal slippage, and state’s HRA impact.

On the economic front, the RBI has retained the GDP forecast of 7.4% for FY19 (with risks evenly balanced), and projection for Q1 FY20 GDP growth is revised down marginally to 7.4% (from 7.5% earlier).

Market Outlook: Bond markets reacted positively to RBI keeping rates unchanged and also revising its inflation trajectory downwards—and the 10 year yield fell by 12-13 bps post the policy announcement. However, by changing the policy stance to “calibrated tightening”, the RBI has indicated that future policy tightening will continue to be data dependent—and has left the avenue open for further rate hikes—if inflation trajectory doesn’t pan out as per its forecast.

The RBI also re-iterated that the central bank’s mandate is flexible inflation targeting and not the exchange rate, which spooked the currency markets—with the rupee falling to 74.2/USD at one point, and finally closing near the 73.8/USD mark. We could see some further depreciation in the rupee in the short term, in case of rise in crude oil prices, and any further foreign outflows due to EM / global risk aversion.

However, with liquidity drying up in the system, the RBI has been supporting on the liquidity front proactively. It announced OMO purchase of Rs. 20,000 crore in the month of September and an additional Rs. 36,000 crore OMO purchase announcement in the month of October. The government has also reduced the borrowing programme for H2 FY19, and all these factors have provided some respite to bond yields lately.

From an investment perspective, we continue to prefer the shorter end of the yield curve.

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More