CIO Comments on RBI Bi-monthly Policy, August 2019

#

7th Aug, 2019

- 5794 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

RBI cuts rates by 35 basis points to address concerns of some slowdown in economic growth

The RBI Monetary Policy Committee (MPC) voted to cut the policy repo rate by 35 bps, with all MPC members unanimously voting for a rate cut (4 members for 35 bps cut and 2 members for 25 bps cut). The policy stance remains ‘accommodative’.

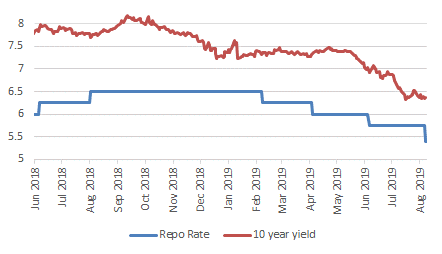

RBI Repo Rate Vs 10 year yield

Source: Bloomberg

Consumer Price Index (CPI) headline inflation has risen marginally, as expected, but remains below the central bank’s target. Also, core inflation (ex food & fuel) has come down. RBI’s inflation projection remains broadly unchanged from the previous policy, at 3.1%YoY for Q2 FY20, and 3.5-3.5% in H2 FY20–with risks ‘evenly balanced’.

On the economic front, the central bank revised down the GDP growth forecast for FY20 marginally to 6.9%YoY (from 7.0% earlier)–with risks somewhat tilted to the ‘downside’. This is in the context of concerns of global growth slowdown (accentuated by the recent escalation in trade war), and also the recent slowdown in domestic growth.

For the NBFC sector, the RBI has made some announcements to help reduce the ongoing stress in the sector. Bank’s exposure limit to a single NBFC has been increased to 20% of Tier 1 capital from 15% previously. Also, there has been a reduction in the risk weighting for consumer credit (except credit card receivables) to 100% from 125% previously, and banks are now being permitted to on-lend to priority sectors through NBFCs.

Outlook:

As we have mentioned in the past also, with inflation being in control, the RBI’s focus has shifted to addressing the recent slowdown in macro-economic environment. The RBI’s emphasis is on reviving private investment, and transmission of the policy rates would help to bring down cost of capital for corporates and aid to revive the investment cycle. Liquidity conditions have improved significantly over the past couple of months, and this will make transmission easier compared to the past.

The central bank said that benign inflation outlook provides headroom for policy action to close the negative output gap—indicating a continued environment of easy monetary policy. Future monetary policy action will be data dependent.

From an investment perspective, we presently prefer the shorter end of the yield curve and have positioned our bond fund portfolio accordingly. We feel that markets may have largely discounted a large part of rate easing cycle, with bond yields having come down significantly over the past few months.

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More