Budget FY24 is growth-oriented with a substantial boost to capex

#

1st Feb, 2023

- 12793 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

CIO Commentary on Union Budget FY 2024

The core focus of the budget has been to provide a boost for infrastructure / capex, tax incentives under the new tax regime (which will help to boost consumption), continue on the fiscal consolidation glide path and also offer incentives for MSMEs and informal sector.

Significant Capex/ Infra Thrust: Central government capex is budgeted to rise by 33% to Rs. 10 lakh crore in FY24. Therefore, from pre-pandemic levels of ~1.5% of GDP capital expenditure is now budgeted to increase to 3.3% of GDP in FY24. This should provide a big boost to the capex and the investment cycle in India, which is already in recovery mode, and will now help to encourage private sector capex as well. With some economic slowdown expected in FY24, it will help to keep the investment engine firing in India, which is very much needed to meet the government’s $5 trillion target for the Indian economy by FY27.

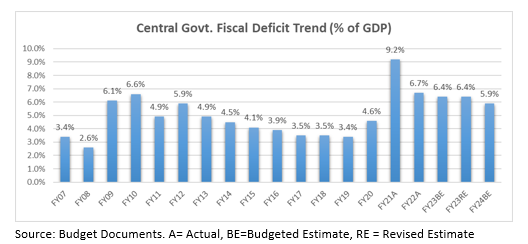

Fiscal Consolidation to Continue: The Covid-19 pandemic had caused disruption in economic activity in India and globally; and around 2 years of growth in India was lost due to the pandemic. As a result, countries around the world had to provide large fiscal and monetary stimulus to deal with GDP contraction and provide support to the economy. Globally, we saw aggressive fiscal stimulus in some the major advanced economies, which was among the largest fiscal response in past global crises. In India too, we saw fiscal stimulus from the government which along with the GDP contraction resulted in a sharp spike in the Fiscal deficit from 4.6% of the GDP in FY20 to 9.2% in FY21.

However, post the pandemic the government is trying to return back to fiscal consolidation glide path. Despite the increased capex spending, the fiscal deficit target has been reduced from 6.4% in FY23 to 5.9% in FY24. As a result, the gross market borrowing for FY24 was in line/slightly better than estimates at Rs. 15.4 lakh crore. This has helped the fixed income markets, with bond yields falling significantly post the budget announcement.

Financial Sector Key Announcements: In the financial sector a boost has been provided to small savings schemes. The government has introduced a new small-savings scheme (for women) and also increased the maximum deposit level for senior citizens under various schemes. Therefore, small savings schemes will continue to play an important role in financing the budget deficit, with increased flows expected there.

However, the budget announced that for non-ULIP (traditional) insurance policies issued from the new fiscal year, income from only those policies with aggregate premium up to Rs 5 lakh shall be exempt. This is bit of a dampener for the insurance industry and for increasing penetration of insurance and household financial savings in India. India still has quite low insurance penetration and there is a need to provide measures and incentives to boost that in the coming years. Also, household financial savings have been falling in India and insurance is a critical component of that. Household financial savings (as a % of GDP) has fallen from 8.1% in FY20 to ~6.5% in FY23 (as per MOSL estimates). Discontinuing incentives on insurance plans should put further pressure on household financial savings to some extent.

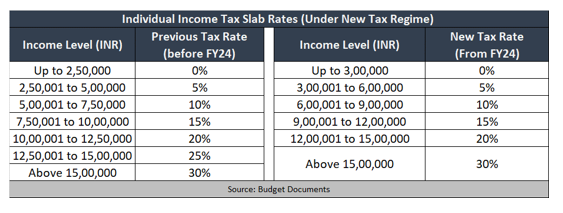

Taxation & Incentives: On the taxation front, the government has provided further tax incentives under the new income tax regime, to incentivize the same and prompt more middle class tax payers to shift to the new regime. The income tax slabs have been changed in the new regime and the government has extended tax rebate under sec 87A from Rs. 5 lakhs to 7 lakhs (implying that individuals with income up to Rs. 7 lakhs will not pay any income tax). Also, standard deduction of Rs. 50,000 has now been introduced under the new tax regime which was not available earlier.

Further, the highest surcharge rate has been reduced from 37% to 25%, which will reduce the peak taxation rate in India from 42.7% to 39%. This could encourage high income and high net worth individuals to also shift to the new tax regime. The government has not introduced any change in the capital gains tax regime, as was expected by some market participants, which is also a positive development.

Outlook: Overall, the budget has been quite positive with clear focus on growth, boost to consumption (from the various tax incentives under new tax regime) and fiscal prudence. Despite the expected global economic slowdown, India’s growth remains resilient and is amongst the fastest growing major economies. As per the Economic Survey, the Indian economy is expected to grow 6-6.8% in FY24 Vs 7% in FY23 (estimated). The long-term India growth story remains intact and therefore we recommend investors to continue to invest systematically in equities. From a fixed income prospective we prefer medium to long duration of the yield curve.

Disclaimer: The views expressed by the Author in this article/note is not to be construed as investment advice and readers are suggested to seek independent financial advice before making any investment decisions. For any tax specific queries/clarifications, please contact your tax advisor. For more details please refer to the budget document and Finance Bill.”

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More