CIO Article – Four key areas the Budget will seek to address & how it may impact us

#

4th Jul, 2019

- 5246 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

The incumbent NDA party won the general elections in 2019 with a strong mandate, and even bettered their performance from the 2014 elections. This will help the government in continuity in its reforms agenda, and possibly try out more bold measures to help revive economic growth–amidst the recent slowdown being seen, both domestically and globally as well. On a broader scale, one of the key agendas of the government is to try to make India into a $5 trillion economy in its second term (by 2024) from currently a $2.8 trillion economy, and also to improve ease of living. Some of the key expectations from the upcoming Union Budget FY20 scheduled for July 5, 2019 are as follows:

Government expected to focus on infrastructure and in reviving the capex cycle The government wants to revive India’s economic growth trajectory, and also wants it to be investment-led, going forward. Investments or Gross Fixed Capital Formation (GFCF) as a percentage of GDP had peaked out at above 34% (of GDP) in FY12-13, and then reduced to 30.8% of GDP by FY17. From there, it has recovered gradually to ~32% of GDP in FY19, and the government’s goal is to raise the investment rate (or GFCF) to 36% of GDP by 2023.

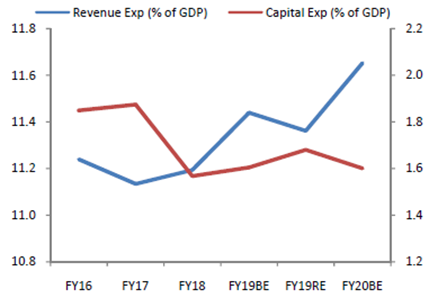

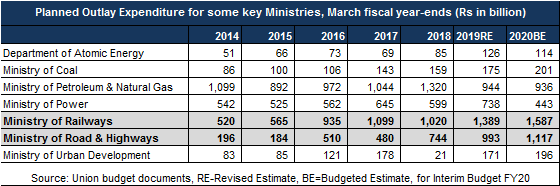

For this to happen, a greater push from the government towards capital / public expenditure and infrastructure investment is required over the coming years. It is also important to help revive private investment, which has been fledgling for a while, and the government needs to provide some impetus for that. Capital expenditure as a percentage of GDP has reduced over the past few years, while the share of revenue expenditure (as a % of GDP) has increased. However, the government has increased plan outlay expenditure to some key ministries like railways, road & highways etc. over the past few years.

Revenue & Capital Exp. Trend (% of GDP)

Source: Budget Documents, Phillip Capital

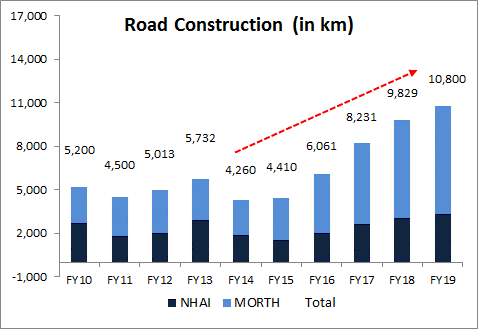

On the infrastructure and road/highway construction front, the government had announced the ambitious Bharat Mala Project (BMP), and its objective is to optimize and increase the efficiency of road freight and passenger movement across the country through development of identified corridors, key routes and expressways. The total scope of BMP is 66,100 kms at an outlay of Rs 8 trillion and the government had approved Phase-I of BMP to be implemented between FY18-FY22, totalling to 34,800 kms projects worth Rs 5.4 trillion. Data from NHAI (National Highway Authority of India) and MORTH (Ministry of Road Transport & Highway) shows that progress in road construction of the government (in its previous term) has been quite robust. More such big projects are required, along with timely execution of existing projects to help spur the investment cycle in India again.

Source: NHAI, MORTH, Bajaj Allianz Life Research

Source: NHAI, MORTH, Bajaj Allianz Life Research

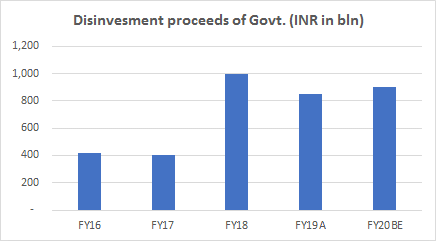

Disinvestment and privatization The government has indicated its inclination for further disinvestment and privatization/merger of public sector enterprises / undertakings, particularly in sectors like PSU banks, general insurance, airlines etc. We feel that consolidation / merger and privatization may help to bring more efficiency to PSUs over time, and also help to provide more fiscal space to the government (from stake sale), going forward. The government has already provided recapitalization to some of the PSU banks, and gradually seems to be going in for consolidation within the sector. However, this consolidation & privatization is likely to happen outside the budget, in separate announcements, in a gradual manner.

Source: Budget Documents, Phillip Capital, A=Actual, BE= Budgeted Estimate as per Interim Budget

As part of the Union budget, the government has been increasing its disinvestments proceeds over the past few years. In the Interim Budget announced in Feb 2019, the government had budgeted for disinvestment proceeds of Rs. 900 billion, and we feel that achievement of the target (and revised amount in the upcoming budget) will depend on market conditions.

Measures to improve distress in the agriculture/rural sector The need of the hour for the government is to resolve some of the impending stress in the agriculture sector, and the strong mandate may provide elbow room to the government to launch more schemes / initiatives.

The current government has already taken some initiatives in its first term, like making Minimum Support Price (MSP) for crops at 1.5X the cost of production. The government also launched a farm package (PM-KISAN scheme) in the Interim Budget in Feb 2019, where there would be a direct benefit transfer of Rs. 6,000 p.a. to small and marginal farmers with cultivable land up to 2 hectares. Post the general elections the government has extended the scheme to all farmers in India, as promised in the NDA manifesto. Besides this, interest subvention benefit was also announced on loans for both the farming and animal husbandry sectors in the interim budget. We expect that there may be further ramping up of the PM-KISAN scheme, or also other similar schemes to provide minimum support income or other benefits to small and marginal farmers. More important is the execution of the current scheme.

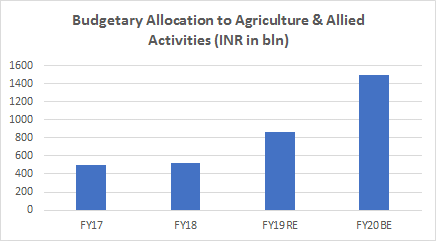

The government has also been increasing budgetary allocation to agriculture and allied sectors over the past few years (as highlighted in the chart). Besides this, there has been a significant focus on rural schemes, and budget documents shows that allocation to various rural schemes like food subsidy to FCI (which is a large allocation), MNREGA (for rural employment), PM Awas Yojana (PMAY) and other schemes, has been going up over the past few years. Estimates show that the cumulative allocation to rural schemes has gone up from Rs. 2,428 billion in FY17 budget to Rs. 4,346 billion in Interim Budget FY20.

Source: Budget Documents, RE-Revised Estimate, BE=Budgeted Estimate, for Interim Budget FY20

Source: Budget Documents, RE-Revised Estimate, BE=Budgeted Estimate, for Interim Budget FY20

Fiscal and tax expectations from the budget: The government had also promised to gradually bring down the corporate tax rate to 25% in a phased manner, over the time in its first term. Some actions have been taken on this front already with the government first bringing down the corporate tax rate from 30% to 25% for companies with annual turnover of up to Rs. 50 crore in Budget FY18, and this was extended to companies with annual turnover of up to Rs. 250 crore in Budget FY19. We feel that there is space for the government to widen its scope to more companies in gradual manner, considering the current stress in certain corporates, and a recent slowdown been seen in economic growth. The government may choose to remove some existing tax exemptions, while further rationalizing the corporate tax rate. There may be some possibility that the government also re-looks at the capital gains tax structure for equities in the upcoming budget (in terms of differential rate of taxation between long term and short term capital gains, and also the holding period).

On the fiscal deficit front, we expect the government to announce a fiscal deficit target of 3.4-3.6% of GDP for FY20. It is worth noting that the government was able to achieve, its revised fiscal deficit target of 3.4% of GDP for FY19, despite a 1% of GDP or Rs 1,674 billion shortfall in net tax revenue collections from revised estimate (primarily helped by curtailing expenditure, and through surpassing non-tax revenue, disinvestment etc.). Also, the government may outline a fiscal consolidation roadmap in its second term.

Overall, it is not necessary that the government has to make all announcements only through the medium of the upcoming Union Budget. Certain things like further streamlining the GST (GST is now reviewed by the GST council in its periodic meetings), and announcing other reforms may happen outside the purview of the budget, during the course of the year.

Disclaimer: The opinion expressed by the Author in this article is his personal opinion and readers are advised to seek independent financial advice before taking any investment decisions.

Above article is published on “ETmarkets.com” online news portal, for more information visit: – https://economictimes.indiatimes.com/markets/stocks/news/four-key-areas-the-budget-will-seek-to-address-how-it-may-impact-us/articleshow/70061228.cms

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More