CIO Article in ET Markets – Union Budget FY24 Wishlist

#

25th Jan, 2023

- 4732 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

The below article is an un-edited version of the article published on ETMarkets on 25th January 2023 – titled “If I were FM: Sampath Reddy recommends making new tax regime more lucrative for individuals”

You can access the ETMarkets article by clicking on this link

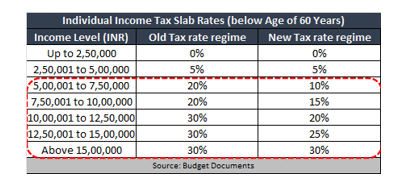

Make the New Tax Regime more lucrative for individuals:

In Union Budget FY20-21 a new (optional) tax regime was introduced, under which the tax rate for certain slabs were reduced in lieu of forgoing various tax deductions or exemptions available in the old tax regime. The objective of the new regime was to make the personal income tax structure more simplified for taxpayers. However, two years on, it appears that not a very large percentage of individual taxpayers have yet shifted to the new tax regime (as perhaps had been anticipated earlier). This is despite a higher volume / number of income tax returns typically being filed in the lower income slabs, and them benefiting from a relatively lower tax incidence compared to the older tax regime. Therefore, to incentivize both lower and higher income individuals to shift to the new regime, it can perhaps be made more lucrative–by providing some additional tax sops, while retaining the overarching simplified tax structure of the new regime.

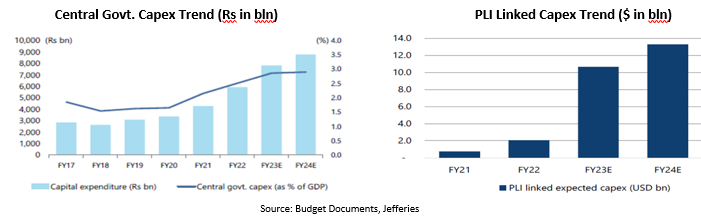

Continued thrust towards Capex & PLI:

The central government has increased its capital expenditure (capex) outlay quite substantially over the past few years in a bid to improve the country’s infrastructure and attract more private investment. Central government capex in FY21 was Rs. 4.26 trillion and is budgeted at Rs. 7.5 trillion in FY23. We have also seen how the government-launched Production Linked Incentive (PLI) scheme has gained strong traction from India Inc & foreign companies; and has the potential to provide a boost to manufacturing for India in the coming years. Growth in manufacturing sector has been sub-par in recent years, with its contribution in overall GDP stagnating. PLI linked capex has also exponentially grown in recent years and is projected at more than $10 billion in FY23 vs just $2 billion in FY22.

Considering that this is the last budget before the general election in 2024, we should use this opportunity to continue to provide a thrust to infra/ capex / PLI and make some major project announcements. With some economic slowdown expected in FY24, it will help to keep the investment engine firing in India, which is very much needed to meet the government’s $5trillion target for the Indian economy by FY27.

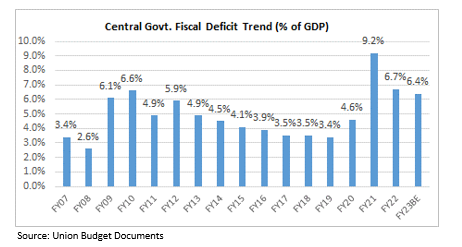

Return to fiscal consolidation glide path:

The Covid-19 pandemic had caused disruption in economic activity in India and globally; and around 2 years of growth in India was lost due to the pandemic. As a result, countries around the world had to provide large fiscal and monetary stimulus to deal with GDP contraction and provide support to the economy. Globally, we saw aggressive fiscal stimulus in some the major advanced economies, which was among the largest fiscal response in past global crises. In India too we saw fiscal stimulus from the government; and because of this and the sharp GDP contraction — our fiscal deficit (as percentage of GDP) rose from 4.6% in FY20 to 9.2% in FY21.

However, with the economy returning to normalcy we have started on our path of fiscal normalization and fiscal deficit is budgeted to come down to 6.4% in FY23. Given that India has managed the Covid pandemic crisis quite well (esp. from a macro perspective), and there has been healthy tax buoyancy, the government should be comfortably able to meet the fiscal deficit target for FY23. Therefore, in this budget we need to continue on this path of fiscal consolidation (despite some economic slowdown expected) to help achieve our fiscal deficit target of 4.5% by FY26 outlined earlier.

Further aid to informal & rural sector:

The informal/unorganized sector had been quite severely impacted due to the Covid pandemic and we had seen unemployment also rising quite sharply in that segment during the pandemic. Although the formal economy has returned to normalcy, the informal sector doesn’t seem to have recovered to the same extent and some economists have even talked about a K-shaped recovery in the Indian economy post the pandemic.

Although the government had provided several schemes (including some cash transfer schemes) for the rural and underprivileged sections of population during the pandemic, there is scope to do more. Therefore, we need to announce more aid and support schemes & sops in this budget for both the rural and especially the informal sector, to ensure our goal of “inclusive” growth for the country. This is on the back of healthy tax collections this year, but care should be taken not to compromise on the above-mentioned fiscal consolidation.

Disclaimer: “The views expressed by the Author in this article/note is not to be construed as investment advice and readers are suggested to seek independent financial advice before making any investment decisions”

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More