CIO Market Outlook for 2022

#

27th Dec, 2021

- 9967 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

Comments from Mr. Sampath Reddy, Chief Investment Officer, Bajaj Allianz Life

It’s been almost 2 years since the COVID-19 pandemic began to disrupt economies across the globe. After seeing an unprecedented lock-down and disruption to economic activity in 2020, governments and central banks around the world responded swiftly with massive fiscal and monetary stimulus to counter this shock. Post a significant second wave in India in the early part of 2021 (the human impact was more severe than economic impact), we gradually started seeing a calibrated opening-up of the economy and healthy recovery in economic activity and corporate earnings. This helped several global markets including India to touch record highs, supported by the global liquidity surge.

However, inflation reared back to a near 40-year high in the US on the back of surge in commodity prices and supply chain disruptions. Inflation also started moving up across the other countries as well, which has led central banks around the world to start to normalize their monetary stimulus. The year 2021 has also been marked by rapid expansion in Covid vaccination drive globally and even in India, which has helped boost the sentiment. Corporate earnings have continued to surprise on the positive side and contributed to the strong market rally.

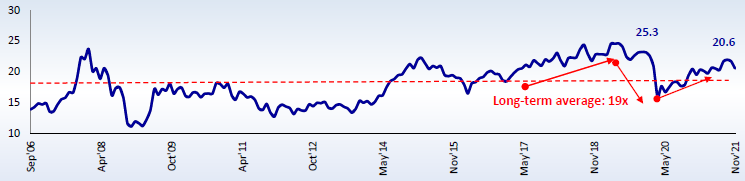

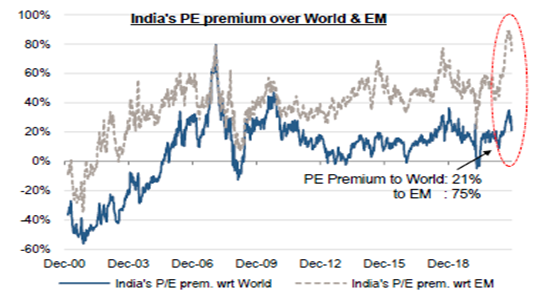

Earnings growth surprised on the upside, but valuations are still quite elevated

In FY21, we saw India’s GDP contract by a record 7.3%, but Nifty EPS grew by a healthy 18%, contrary to earlier expectations of around 10% contraction in earnings growth. Despite the second wave in India, the earnings for FY22 and FY23 have not seen any significant downgrades and are anticipated to grow by ~25% and ~20% respectively. Therefore, this uptrend in corporate profitability cycle, helped by cost-cutting initiatives by corporates, have contributed to the positive market sentiment and rally, besides the global liquidity surge. However, with the sharp market rally, market valuations have also expanded in India and are presently at elevated levels (above the long-term average).

Nifty 1 Year Forward P/E Ratio

Motilal Oswal

India P/E Premium over World & EM

Source: Credit Suisse

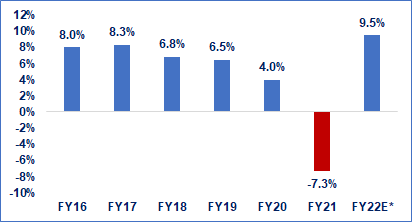

Strong economic recovery

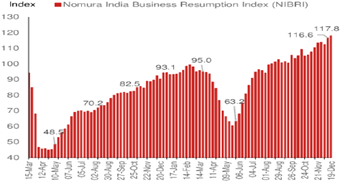

The overall demand scenario seems to be improving which is implied by various high frequency economic indicators. The Nomura India Business Resumption Index is now higher by nearly 18 points since the pre-pandemic levels. India’s GDP plunged by a record 7.3% in FY21 (the biggest contraction since independence) but is expected to grow at a strong +9.5% in FY22. In several sectors of the economy, pre-pandemic levels of output have now been crossed, and nominal GDP is also now above pre-pandemic levels.

India Fiscal Year-Wise GDP Growth (%YoY)

Source: MOSPI. *FY22 is RBI forecast

Nomura India Business Resumption Index

Source: Nomura

Normalization of global monetary stimulus

The US Federal Reserve decided to gradually reduce their bond-buying program. So, this year, the Fed has lowered their bond-buying from $120 billion per month to $105 billion from November 2021—reducing the monthly bond purchases by $15 billion. In the month of December 2021, the Fed accelerated the pace of monthly taper to $30 billion, at which pace the buy-back program should end by March 2022.

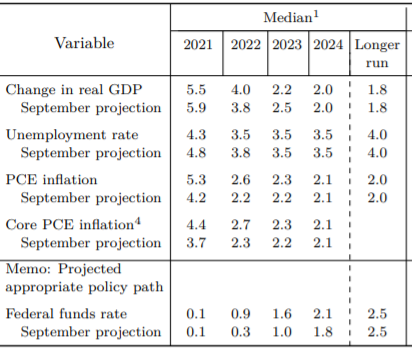

The Fed has also indicated 3 rate hikes in 2022 compared 1-2 rate hikes earlier and dropped using the word “transitory” while discussing inflation. In December meeting, the Fed reduced its GDP forecast for 2021 to 5.50% from 5.90% earlier and increased the Core PCE Inflation forecast for the year to 4.40% from 3.70% earlier.

US Dec 2021 Fed Meeting Projections

Source: Federal Reserve

In India, the RBI remains accommodative but has started normalizing liquidity in the system. We expect the central bank to continue its liquidity normalization with a reverse repo rate hike in early 2022 (to reduce the present policy corridor) followed by repo rate hikes later in the year—which will lead to some hardening of bond yields in 2022. However, with inflation relatively better placed in India, it provides some elbow room on the monetary policy front. Also, the RBI has indicated that it will conduct OMOs & Operation Twists to help manage the yield curve in an efficient manner.

Other trends: New-age digital businesses, EV disruption, public divestment and infrastructure

New-age digital businesses are gaining traction and have also received strong investor response via IPOs in recent months. We like companies that are embracing technology with disruptive business strategies. However, some of these companies would take longer to establish a profitable track record. Investors in these new age businesses should thereby have a long-term investment horizon.

The IPO market has been very buoyant in 2021, and we expect the similar trend to continue into the early part of year 2022 as well. On the divestment side, we have not seen much traction during 2021, but we expect to see some large public sector divestments in the coming year (like LIC, Concor, BPCL etc.).

Electric Vehicles (EV) as a segment in the auto sector is also seeing healthy adoption especially in the 2-wheeler segment. Government has already incentivized the sector with attractive subsidies and we may see an additional boost in the forthcoming budget, especially in the EV charging infrastructure segment. We also expect to see a continued support towards infrastructure sector, affordable housing segment and health infrastructure.

The government’s initiative of boosting domestic manufacturing through the PLI (Production Linked Incentive) scheme has been gaining good traction with large number of companies looking to use this for expanding their manufacturing capacities. This scheme may continue to get more allocation in the upcoming budget.

Outlook:

The new Omicron Covid variant has raised some uncertainty of a possible third wave, although it is still a developing situation. However, the increased vaccination coverage in India and globally may help to deter the impact if another wave transpires. We have seen from the second Covid wave (primarily of Delta variant) that lock-downs have been more calibrated and businesses too have adapted well—resulting in less economic and earnings impact than the first lockdown in 2020. The corporate earnings revival in India, after a lull for quite a few years, also helps to boost sentiment. If the earnings growth momentum pans out as expected, it may help to support and moderate current elevated market valuations to some extent.

The year 2022 will also be one of further normalization of global monetary policies by major central banks. Several central banks of countries like Russia, Brazil, Turkey, South Africa, South Korea etc. and recently the Bank of England have already started hiking rates in 2021. If the policy normalization is quicker than expected, then we may see increased market volatility and outflows from emerging markets (including India). However, we don’t expect the same severity as that of the Fed taper tantrum of 2013.

Therefore, we believe that any market correction may not be that significant and we have already seen some it in late 2021. The long-term India growth story remains intact with India remaining a preferred investment choice among peer emerging markets on the back of strong fundamentals. We presently prefer the large-cap segment from a valuation perspective. If there is any market correction, it can be capitalized as a buying opportunity by the investor (as per their individual risk profile). However, return expectation from equities is expected to be more moderate in 2022. From a fixed income perspective, we presently prefer the medium-term part of the yield curve.

Disclaimer: “The views expressed by the Author in this article/note is not to be construed as investment advice and readers are suggested to seek independent financial advice before making any investment decisions”

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More