Union Budget 2025-26: Supporting growth while adhering to the path of fiscal prudence

#

1st Feb, 2025

- 8445 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

Comments from Mr. Srinivas Rao Ravuri, Chief Investment Officer, Bajaj Allianz Life

The Union Budget 2025-26 has focused on continued fiscal consolidation while supporting India’s economic expansion. The budget’s broad themes were Agriculture, MSME, Investment & Exports while keeping the Middle-Class segment at the center stage. With a strong focus on consumption-led growth, the budget ensures sustained capital expenditure and structural tax reforms.

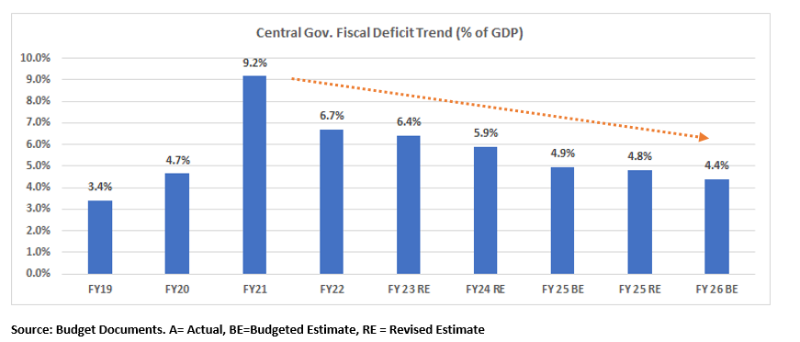

Fiscal Consolidation Continues

A key highlight of the budget is the government’s commitment to fiscal prudence while sustaining growth. The fiscal deficit for FY25 is estimated at 4.8% of GDP, with a target to bring it down to 4.4% by FY26. This marks a notable improvement from the 9.2% fiscal deficit seen in FY21 after COVID-19, achieved in a time when many other countries continue with relatively expansionary fiscal policies. Although the effects of such a sharp fiscal consolidation can be debated, it appears one of the main motivations for the government is to secure a sovereign ratings upgrade by showcasing its commitment to fiscal prudence. Even for the future, the government has provided a road map to bring down the debt to GDP below 50% by 2031 thereby indicating continued adherence to the path of fiscal discipline. This is a long-term positive for the bond markets, however, the government’s gross market borrowing at Rs 14.82 trillion was higher than market expectations.

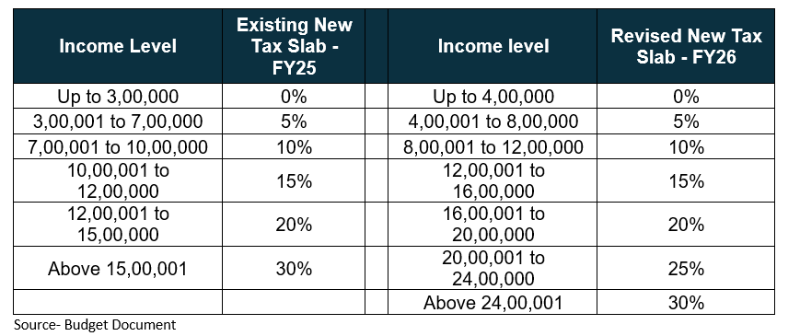

Rationalization of Taxes

Taxation reforms bring much-needed relief to individuals. The minimum income level that attracts no tax has been raised to Rs. 12 lakhs from Rs. 7 Lakhs earlier, increasing disposable income and improving demand. The significant changes have been proposed in the new tax slabs under the new tax regime which will result in saving of Rs. 80,000 with an income of Rs. 12 lakhs (which is 100% of tax payable as per existing rates). Similarly with an income of Rs. 18 lakhs will get a benefit of Rs. 70,000 in tax (30% of tax payable as per existing rates).

Additionally, TDS/TCS reforms simplify compliance, with the TDS threshold for senior citizens raised to Rs. 1 lakh and TCS on education loans removed. The FDI cap in the insurance sector has been raised to 100%, encouraging global investment, while the Jan Vishwas Bill 2.0 decriminalizes over 100 business-related provisions, making compliance easier for companies.

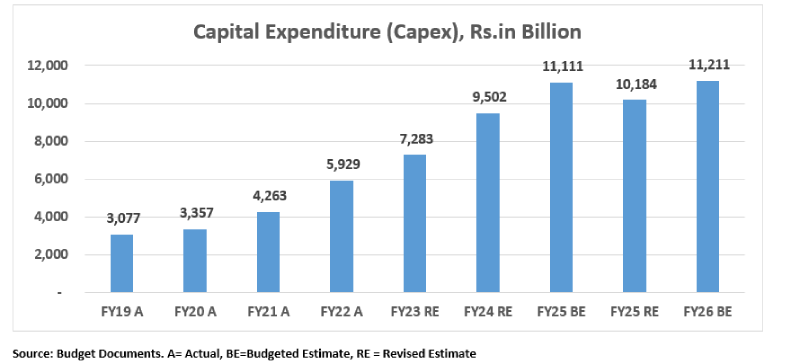

Capital expenditure

While personal disposable incomes would be supported by the proposed changes in tax rates it seems to have come at the cost of allocation for capital expenditure. The revised estimates for capital expenditure in FY25 are 8% lower than the budget estimates and is expected to grow by 10% in FY26. The estimates for FY26 are only 1% higher than the number that was originally budgeted for FY25. No growth in capital expenditure in key segments like Roads and Railways are the key contributing factors for the modest capital expenditure estimates for FY26. The government has extended the Rs. 1.5 lakh crore in interest-free loans to the states for capital investments.

This budget focuses on Technology and digital transformation. The Deep Tech Fund of Funds is set to boost AI, semiconductor manufacturing, and clean energy startups, positioning India as a global tech hub. The launch of Bharat Trade Net, a unified platform for trade documentation and financing, is expected to smoothen exports and supply chains, while the National Geospatial Mission will modernize land records and urban planning.

For manufacturing and MSMEs, the budget offers significant impetus. Credit guarantees for MSMEs have been doubled from Rs. 5 crores to Rs. 10 crores, translating into Rs. 1.5 lakh crore in additional financing. The Fund of Funds for MSMEs aims to provide long-term capital, while clean tech manufacturing incentives, particularly for EV batteries, solar PV cells, and electrolyzers, will strengthen India’s green economy. Additionally, micro-enterprises will now have access to Rs. 5 lakhs in credit through Udyam Portal, easing financial constraints for small businesses.

Agriculture also remains a priority, with financial inclusion for farmers receiving a major push. The Kisan Credit Card (KCC) limit has been increased from Rs. 3 lakhs to Rs. 5 lakhs, offering greater financial security. The Prime Minister Dhan-Dhaanya Krishi Yojana will improve irrigation and post-harvest storage, while the Mission for Aatmanirbharta in Pulses aims to enhance domestic production of key crops like Tur, Urad, and Masoor, reducing reliance on imports.

In the energy and infrastructure sectors, the government is taking long-term steps to enhance sustainability. The Nuclear Energy Mission aims for 100 GW of nuclear capacity by 2047, with Rs. 20,000 crores allocated for Small Modular Reactors (SMRs). A Rs. 25,000 crore Maritime Development Fund will boost shipbuilding and logistics, while power sector reforms will incentivize states to improve electricity distribution networks.

Overall, the budget has delivered on the expectations of supporting consumption by way of personal tax changes that would leave more money in the hands of the consumer. As the first full-fledged budget of the incumbent government’s third tenure, it also lays out several long-term initiatives aimed at strengthening India’s structural growth across key sectors like agriculture, MSMEs, exports, and manufacturing. The budget has continued with the trend of demonstrating a steadfast focus on macroeconomic stability, simplification of taxes, and improving the credibility of government. Additionally, the capital markets are relieved by the absence of any negative surprises. We believe that the budget has addressed the key economic headwinds while maintains a fair balance between fiscal discipline and economic expansion.

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More