Union Budget 2024-2025: Emphasis on fiscal prudence along with tax revisions

#

23rd Jul, 2024

- 16266 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

Comments from Mr. Sampath Reddy, Chief Investment Officer, Bajaj Allianz Life

Union Budget for 2024-25 has focused on further fiscal consolidation while continuing recent initiatives on capital expenditure and supporting economic growth. The budget’s themes were Skilling, Employment, MSMEs and Middle Class. The budget shows the government’s commitment towards fiscal prudence.

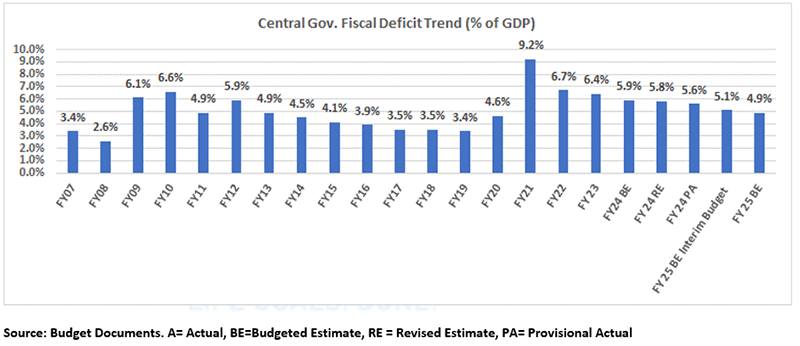

Fiscal consolidation to continue: The government has lowered its fiscal deficit target to 4.9% for FY25, down from the 5.1% estimated earlier in February 2024 (interim budget), better than the market expectations. The government has reiterated its intention to reach the Fiscal deficit target to 4.5% by FY26. This commitment extends to managing debt, with gross borrowing projected to be slightly lower than previous year at Rs. 14 Lakh crore and the net borrowing of Rs. 11 Lakh crore, reflecting a responsible approach to fiscal consolidation.

Capex remains a focus: After a significant increase in the previous year’s capital expenditure, the projected outlay for capital expenditure remains unchanged at Rs. 11.11 lakh crore (3.4% of GDP), indicating the government’s intent for continued investment in infrastructure.

Revenue receipts remain healthy: The broader tax projections have been largely unchanged versus Interim Budget. FY25 Gross Tax Revenue is projected to grow at 10.8% YoY (vs 13.4% YoY in FY24) with GST expected to increase by 11% (vs 12,7% in FY24) and direct taxes likely to go up by 12.8%. Non-tax revenues for FY25 have been increased to Rs. 5.5 Lakh crore, reflecting higher RBI dividend payout.

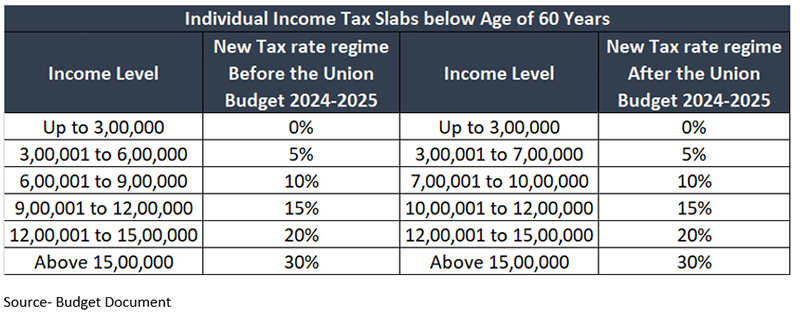

Taxation & Incentives: The government has provided further tax incentives under the new income tax regime by increasing the standard deduction from Rs. 50,000 to Rs. 75,000 and proposing changes in the existing tax slabs, making it more attractive for taxpayers in the new tax regime.

However, short-term capital gain has been revised upwards from 15% to 20% whereas the Long-term capital gain has been revised from 10% to 12.5% earlier. Buybacks will now be taxed in the hands of the shareholder at marginal tax rate. This change harmonizes the tax treatment of dividends and buybacks. The removal of indexation benefits while calculating capital gains tax in case of immovable property is potentially negative for the real estate sector. The applicable long term capital gains tax rate on sale of immovable assets now stands at 12.5% without the benefit of indexation.

Significant cut in duty on gold and silver: The budget has announced a cut in custom duty on gold and silver to 6%. Additionally, the finance minister also reduced the customs duty on platinum to 6.4%, to enhance domestic value addition in gold and precious metal jewellery in the country. The existing duty on gold and silver is 15% which comprises 10% of basic custom duty and 5% as Agricultural Infrastructure Development cess.

Outlook: Overall, the union budget 2024-2025 exhibits continuity and stability, emphasizing fiscal prudence, infrastructure development, clean energy adoption, and inclusive growth. It lays the foundation for a future-oriented path towards economic prosperity. This careful balancing act positions India to navigate the upcoming transition while maintaining its focus on long-term goals, creating an optimistic outlook for the nation’s economic trajectory. The bond yields were flat post the announcement of Union Budget, as most of the announcement was in line with expectations.

Disclaimer : The views expressed by the Author in this article/note is not to be construed as investment advice and readers are suggested to seek independent financial advice before making any investment decisions. For any tax specific queries/clarifications, please contact your tax advisor. For more details please refer to the budget document and Finance Bill.”

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More