The RBI keeps the policy rates unchanged amid evolving inflation & growth dynamics

#

1st Oct, 2025

- 156 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

Monetary Policy Decision – RBI retains status quo

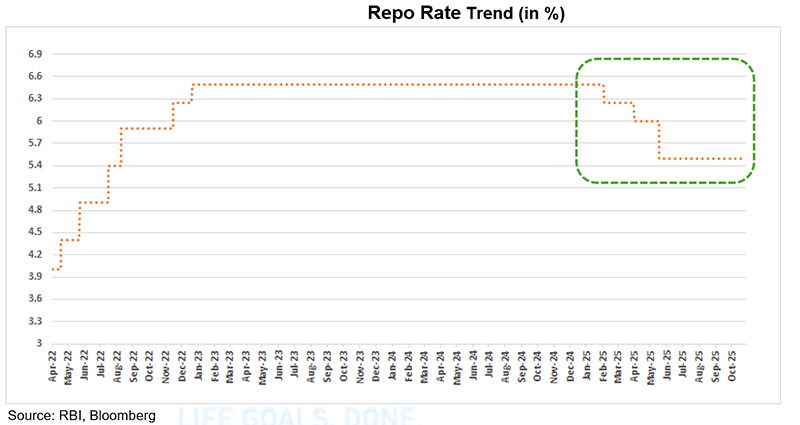

The RBI’s Monetary Policy Committee (MPC) kept the repo rate unchanged at 5.5%, with SDF at 5.25% and MSF/Bank Rate at 5.75%. The stance was retained at neutral, reflecting RBI’s flexibility to act based on growth and inflation trends. The RBI highlighted that the benefits of front-loaded rate cuts (100 bps since Feb’25) and GST reforms are still unfolding, and further moves will depend on evolving data.

Growth: Resilient but Facing External Headwinds

India’s economy posted strong momentum in Q1 FY2025-26, with GDP growth at 7.8% and GVA at 7.6%. The outlook remains optimistic, rural demand is buoyed by a good monsoon and kharif sowing, while services PMI hit 15 years high (62.9) and manufacturing PMI touched a ~18 years high (59.3) in August. GST rationalisation, rising capacity utilisation, and steady employment are expected to further support demand. Although, the RBI flagged external trade headwinds from weak external demand, ongoing tariff disputes, and global geopolitical tensions pose downside risks. The RBI projects FY2025-26 growth at 6.8% vs 6.6% earlier, with risks evenly balanced.

Inflation: Benign Outlook Driven by Food Prices and GST Cuts

Headline inflation has moderated sharply, driven by falling food prices and GST rationalisation. The RBI revised its inflation forecast for FY2025-26 down to 2.6% from 3.1% in August, with Q2 and Q3 expected at 1.8% each. While base effects may push inflation higher in Q4 (4.0%) and Q1 FY2026-27 (4.5%), risks remain evenly balanced. Comfortable foodgrain stocks, good monsoon progress, and healthy reservoir levels are expected to keep inflation under control.

Liquidity & Transmission: Easing Continues

System liquidity remains in surplus, daily averaging Rs. 2.1 lakh crore, supported by the ongoing CRR cuts and fiscal spending. Transmission has improved: since February, lending rates on fresh loans have fallen by 58 bps, while deposit rates declined by over 100 bps. The RBI reiterated its commitment to ensuring adequate liquidity to support growth and smooth policy transmission.

External Sector: Buffers Hold Despite Trade Strain

India’s current account deficit narrowed to 0.2% of GDP in Q1 FY2025-26, supported by strong services exports and remittances, even as the merchandise trade deficit stayed elevated. Foreign exchange reserves touched USD 700.2 billion (as on 26th Sep 2025), covering more than 11 months of merchandise imports, highlighting resilience. FDI inflows remain robust, though portfolio flows have seen outflows. The RBI remains watchful of rupee volatility.

Financial System & Reforms: Stability with a Reform Push

Scheduled Commercial Banks (SCBs) and NBFCs continue to report healthy capital adequacy, asset quality, and profitability. The GNPA ratio for banks improved to 2.22% (multi year lows) in June 2025, while NBFCs also posted stronger capital buffers. Non-bank credit flows have increasingly supported commercial sector financing, offsetting moderation in bank credit growth.

Measures in Banking Sector

The RBI announced several measures to improve credit growth & ease of doing business. Some of them include:

• Expected Credit Loss (ECL) guidelines to be implemented from 1st April 2027. Glide path till FY31 to smoothen impact of higher provisioning.

• Lower risk weights in certain segments – specifically MSME and home loans among others. Final Guidelines awaited.

• RBI has removed the proposed restriction on overlap in businesses undertaken by a bank and its group entities.

• Risk-based deposit insurance premium instead of flat normalized premium.

• Enabling framework to allow banks to finance acquisitions to come through soon. Banks can’t fund M&A transactions currently.

• Drafting revised Basel III norms aligned with global standards.

• Remove ceiling against lending on listed debt and enhanced limits for lending by banks against shares from Rs 20 lakh to Rs 1 crore and for IPO financing from Rs. 10 lakh to Rs 25 lakh per person.

• Withdrawal of 2016 framework disincentivizing lending to borrowers with total exposure of Rs 10k crore and above.

• Reduction in risk weights for NBFCs for funding operational, high quality infra projects.

• Restriction on CC/OD and current account openings to be relaxed.

• Greater flexibility in FEMA regulations and simplified export procedures.

• Enhancing consumer protection via stronger Ombudsman mechanisms.

• Steps to internationalise the Rupee, including INR lending to neighbouring countries and wider use of SRVA balances.

These steps are expected to stimulate credit growth, improve risk management, and reduce funding costs for priority sectors like MSMEs, housing, and infrastructure. Over the medium term, they also align India’s regulatory framework more closely with global Basel III standards, enhancing both competitiveness and financial stability.

Key Takeaways

• GST rationalisation and benign food inflation led to one of the lowest CPI prints in decades, creating more policy space.

• Domestic growth remains resilient, but tariff and global trade uncertainty remain key drags.

• Liquidity easing and improved transmission point to lower borrowing costs in the coming months, supportive of consumption and investment.

• RBI’s reform package marks a structural shift – Expected Credit Loss (ECL) provisioning, risk-based deposit insurance, and relaxed lending norms will expand credit availability and strengthen banking stability.

• Steps towards rupee internationalisation and financial market deepening highlight a long-term policy push beyond short-term rate action.

Outlook: Patience with Policy Space Intact

The RBI’s policy outcome was largely in line with expectations, with the RBI highlighting that the impact of earlier rate cuts and GST reforms is still unfolding. The focus now is on supporting growth, making credit more accessible, and improving the ease of doing business through new banking measures like better provisioning rules (ECL), risk-based deposit insurance, relaxed lending norms, and lower risk weights for MSMEs, housing, and infrastructure. These steps should make it easier and cheaper for banks to lend.

With inflation at historic lows and strong domestic demand, the possibility of a rate cut in December 2025 has significantly increased, especially if global risks start to weigh on growth.

Given this backdrop, we expect the 10-year government bond yield to stay in the 6.40%–6.70% range. In this environment, we prefer 3–5-year corporate bonds.

Annexure:

CRR – The share of a bank’s total deposits that must be kept with the RBI in cash.

Stance – It gives an indication to the future policy action.

SDF – The rate at which Banks lend to RBI without collateral.

MSF –The rate at which RBI lends (provides emergency liquidity) to Banks.

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More