RBI maintains status quo on policy rates, Inflation & growth projections remain unchanged for FY25

#

8th Aug, 2024

- 18602 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

– Team Investment at Bajaj Allianz Life

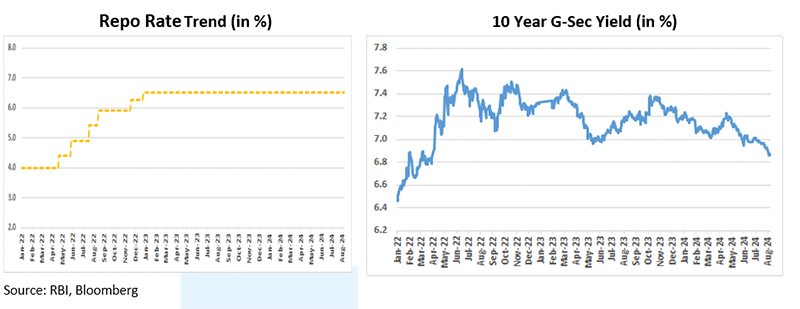

The RBI’s Monetary Policy Committee (MPC) for the 9th consecutive time kept the policy rates unchanged, by keeping repo rate steady at 6.5%, SDF at 6.25% and MSF and bank rate at 6.75%. Stance was also retained at “withdrawal of accommodation” with 4-2 vote. The MPC last raised the repo rate by 25 bps to 6.50% in its Feb 2023 meeting.

On the inflation front, for FY25, RBI kept its inflation projection unchanged at 4.5%. However, increased quarterly estimates for 2QFY25 & 3QFY25 by 60 & 10 bps respectively while 4QFY25 estimate reduced by 20 bps. The central bank governor highlighted that the high inflation pressures persisted across major food items which has a significant weight in the CPI basket, resulting in elevated inflation headline print. However, it is expected to moderate due to large favourable base effects. A degree of relief in food inflation is expected from the pick-up in the south-west monsoon and healthy progress in sowing. Buffer stocks of cereals continue to be above the norms. Global food prices showed signs of easing in July, after registering increases since March 2024

On the growth front, RBI maintained its FY25 GDP projection to 7.2% on the back of improved agricultural activity which brightens the prospects of rural consumption, while sustained buoyancy in services activity that would support urban consumption. The healthy balance sheets of banks and corporates; thrust on capex by the government; and visible signs of pick up in private investment that would drive fixed investment activity. Improving prospects of global trade are expected to aid external demand. The spillovers from protracted geopolitical tensions, volatility in international financial markets and geoeconomic fragmentation, however, pose risks on the downside.

Key regulatory decisions

Regulations

• Public Repository of Digital Lending Apps: To aid the customers in verifying the claim of Digital Lending App’s (DLAs) association with REs, Reserve Bank is creating a public repository of DLAs deployed by the REs which will be available on RBI’s website. The repository will be based on data submitted by the REs (without any intervention by RBI) directly to the repository and will get updated as and when the REs report the details, i.e., addition of new DLAs or deletion of any existing DLA.

• Frequency of Reporting of Credit Information to Credit Information Companies: With a view to provide a more up-to-date picture of a borrower’s indebtedness, it has been decided to increase the frequency of reporting of credit information to CICs from monthly intervals to fortnightly basis or at such shorter intervals as mutually agreed between the CI and CIC. The fortnightly reporting frequency would ensure that credit information reports provided by CICs reflect a more recent information. This will be beneficial to both borrowers and lenders (CIs). Borrowers will have the benefit of faster updation of information, especially when they have repaid the loans. Lenders will be able to make better risk assessment of borrowers and also reduce the risk of over-leveraging by borrowers.

Payments

• Enhancing Transaction Limits for Tax Payments through UPI: It has been decided to enhance the limit for tax payments through UPI from Rs0.1 mn to Rs0.5 mn per transaction.

• Introduction of Delegated Payments through UPI: It is proposed to introduce "Delegated Payments" in UPI. “Delegated Payments” would allow an individual (primary user) to set a UPI transaction limit for another individual (secondary user) on the primary user’s bank account. This product is expected to add to the reach and usage of digital payments across the country.

• Continuous Clearing of Cheques under Cheque Truncation System (CTS): To improve the efficiency of cheque clearing and reduce settlement risk for participants, and to enhance customer experience, it is proposed to transition CTS from the current approach of batch processing to continuous clearing with ‘on-realization-settlement’. Cheques will be scanned, presented, and passed in a few hours and on a continuous basis during business hours. The clearing cycle will reduce from the present T+1 days to a few hours.

Outlook:

As RBI’s policy statement was broadly in line with market expectations, 10 yr yield is currently trading flat at 6.87%. However, the policy tone was slightly hawkish, indicating that a drop in core inflation does not justify a rate cut. The central bank cautioned that persistent high food inflation could spill over into core inflation in the long term. Despite two MPC members reiterating an interest rate cut, the RBI is on the side of caution as ongoing food price pressures are affecting the disinflation process. While healthy Kharif sowing and improved reservoir levels are positive signs for food inflation, uncertainty remains due to the expected onset of La Niña during the harvest period. With resilient GDP growth and unchanged CPI projections at 4.5% for FY25, we believe RBI to maintain status quo on the repo rate till next MPC meeting and the first-rate cut is expected in later part of this fiscal year if inflation- growth dynamics remain as per RBI’s target level.

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More