RBI maintains status quo on key policy rates & raises inflation projection, as expected

#

10th Aug, 2023

- 7119 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

Comments from Mr. Sampath Reddy, Chief Investment Officer, Bajaj Allianz Life

As per expectation, the RBI’s Monetary Policy Committee (MPC) has unanimously decided to maintain the policy repo rate at 6.5%. The marginal standing facility (MSF) rate and the Standing Deposit Facility (SDF) rate stand unchanged at 6.75% & 6.25% respectively. Cash Reserve Ratio (CRR) remained unchanged at 4.50%. Additionally, in a majority of 5:1 vote, the MPC has decided to remain focused on “withdrawal of accommodation” stance, to ensure that inflation remains within the target going forward, while supporting growth. The RBI governor highlighted that the cumulative rate hike of 250 basis points undertaken by the MPC is working its way into the economy. Nonetheless, domestic economic activity is holding up well and is likely to retain its momentum, despite weak external demand.

On the inflation front, the central bank has increased the headline consumer inflation projection for FY24 to 5.4% from 5.1% earlier, and re-emphasized its intention of bringing inflation to a level of 4% on a durable basis. The central bank governor also indicated that the headline inflation is likely to witness a spike in the near months on account of supply disruptions due to adverse weather conditions. It seems like the RBI would likely to keep a cautious watch on the inflation trajectory in the near term on the back of volatile food and energy prices. However, core inflation (excluding food and fuel) has softened by more than 100 basis points from its recent peak in January 2023.

The RBI remains comfortable on the domestic growth front. The GDP growth projection for FY24 remains unchanged at 6.5%, though risks to the growth outlook would largely be from the external sources. Also, the central bank mentioned that the current account deficit will remain manageable in the current fiscal year as well.

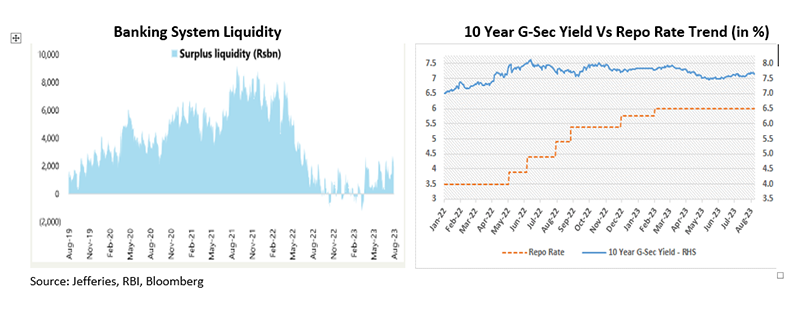

On the liquidity front, it has highlighted that the level of surplus liquidity in the system has gone up in the recent months on the back of return of Rs. 2000 denomination rupee notes to the banking system. Presently the systemic surplus liquidity is around Rs. 2 lakh crore. Therefore, the RBI introduced a temporary Incremental Cash Reserve Ratio (ICRR) of 10% on incremental NDTL between mid-May and July 2023, and it will be reviewed on September 8, 2023 or earlier—ahead of the festival season. It is expected that the introduction of ICRR is likely to withdraw liquidity of around Rs. 1 lakh crore.

The central bank also introduced a transparent framework for resetting of interest rate for floating rate loans, which will bring some uniformity, and is a positive step for borrowers.

Outlook:

We believe, given the recent inflationary pressures in India (due to higher vegetable and cereal prices), elevated global monetary policy outlook, and RBI’s commitment to bring down domestic inflation to 4%; rate cut expectations have been further pushed back (with an extended pause expected), and will depend on evolving data. Due to introduction of incremental CRR (ICRR), there may be some upward pressure on short term rates.

MPC will continue to monitor the evolving inflation conditions and this will remain its priority. The RBI governor said that given the seasonal factors for recent rise in inflation, the central bank is fine to look through the elevated inflation prints over the next few months. But the recent rise in crude oil prices, on the back of US recession prospects dwindling, also needs to be monitored. This may pose some further upside risk on inflation.

Following the policy announcement, bond yields remained flattish as it was along expected lines. From a fixed income perspective, we prefer the medium to long part of the yield curve.

Disclaimer: “The views expressed by the Author in this article/note is not to be construed as investment advice and readers are suggested to seek independent financial advice before making any investment decisions”

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More