RBI Maintains Rates, Cuts CRR to Ease Liquidity, While Revising Inflation Projection Upward And Growth Projection Downward

#

6th Dec, 2024

- 14612 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

Comments from Mr. Srinivas Rao Ravuri, Chief Investment Officer, Bajaj Allianz Life

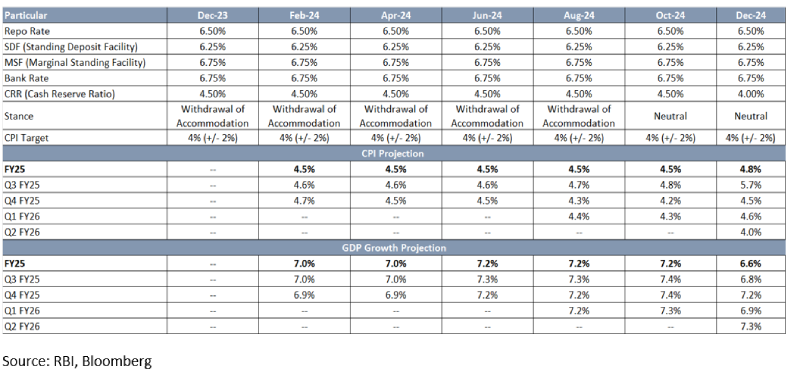

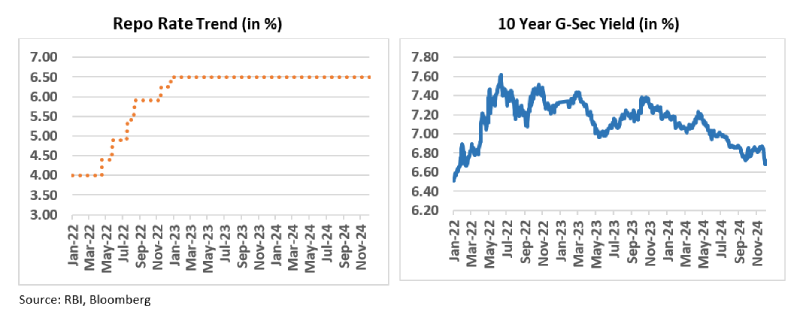

The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) has maintained policy rates for the 11th consecutive time. The repo rate remains at 6.5%, the Standing Deposit Facility (SDF) at 6.25%, and the Marginal Standing Facility (MSF) at 6.75%. The committee unanimously retained its neutral stance, emphasizing inflation alignment with targets while supporting growth.

CRR Cut to Address Liquidity Stress

To ease potential liquidity stress and support economic activity, the RBI has decided to reduce the cash reserve ratio (CRR) by 50 basis points, restoring it to 4% of net demand and time liabilities (NDTL). The reduction, implemented in two tranches from December 14 and December 28, 2024, which will release Rs. 1.16 lakh crore into the banking system.

Economic Challenges and Adjustments

The central bank governor highlighted that the near-term inflation and growth outcomes in India have turned somewhat adverse since the October policy. The medium-term prospect on inflation suggests further alignment with the target, while growth is expected to pick up its momentum. He also added that the persistent high inflation reduces the purchasing power of consumers and adversely affects both consumption and investment demand. The overall implication of these factors for growth is negative. Therefore, price stability is essential for sustained growth. On the other hand, a growth slowdown – if it lingers beyond a point – may need policy support.

On the inflation front

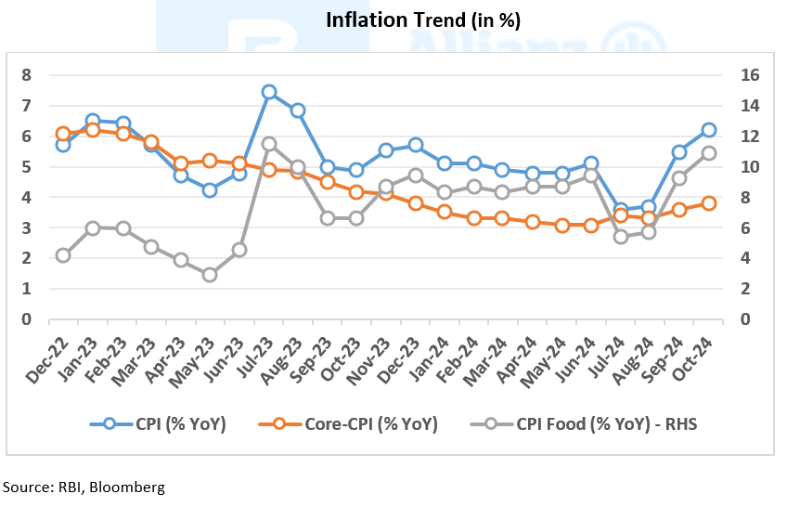

The inflation has increased sharply in September and October 2024 due to an unanticipated increase in food prices. The RBI acknowledged persistent food inflation pressures in Q3 but expects a moderation in Q4, supported by higher agricultural output. On this backdrop, the FY25 Consumer Price Index inflation forecast has been revised upward to 4.8% from the earlier 4.5%, reflecting these short-term pressures.

On the Growth front

The CRR cut follows a lower-than-expected Q2 FY25 GDP growth number, which prompted the RBI to revise its FY25 GDP growth projection downward to 6.6% vs 7.2% earlier projection. However, the central bank remains optimistic about the economy’s recovery, the RBI attributes the revival to strong festive season spending and a rebound in rural demand, signaling that the economic slowdown likely bottomed out in Q2.

On the Liquidity front

System liquidity remained in surplus in October-November due to higher government spending, despite increased currency circulation and capital outflows. The RBI balanced liquidity via variable rate operations, ensuring alignment of overnight interbank rates with the policy rate.

Outlook:

RBI’s neutral stance and CRR reduction by 50bps was largely in line with market consensus. There was a segment of market participants who expected rate cut from RBI in this policy, which did not materialize on account of RBI’s concerns of persistent high inflation. A reduction in the CRR lowers the proportion of deposits banks are required to hold as reserves with the RBI. This move by RBI will release Rs. 1.16 tn in the banking system which is expected to be utilized over the coming few weeks for liquidity requirements of the economy.

Going forward, as per RBI’s projection inflation is expected to moderate to 4% by Q2FY26 which is in line with our expectations. Based on the same, we believe this will provide sufficient comfort to RBI for a rate cut in February 2025 policy meeting. In addition, we feel the rate cut cycle will be shallow of 50bps based on the current economic landscape. Such a move would provide a medium-term boost to the economy, particularly for rate-sensitive sectors, and enhance fixed-income market sentiment.

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More