RBI Lowers Repo Rate to 6%, Shifts Stance to ‘Accommodative’

#

9th Apr, 2025

- 939 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

Comments from Mr. Srinivas Rao Ravuri, Chief Investment Officer, Bajaj Allianz Life

Monetary Policy Decisio

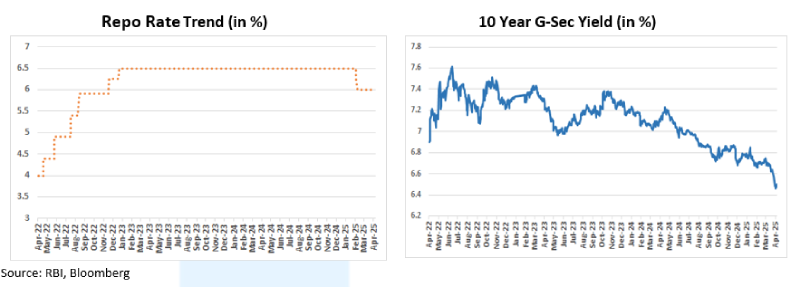

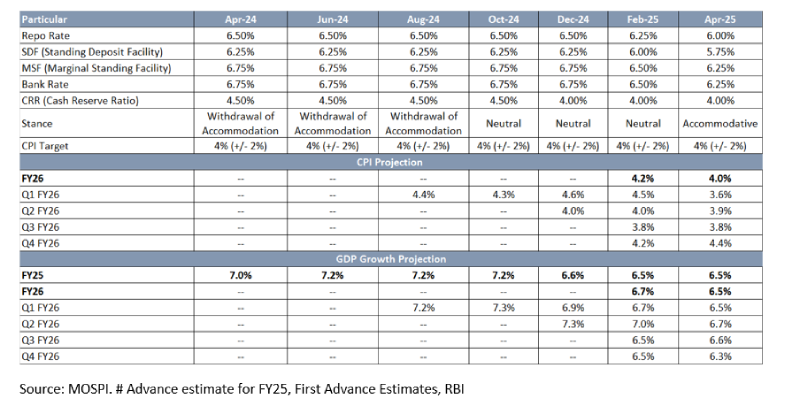

The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) has unanimously decided to cut repo rate (the rate at which RBI lends to Banks) by 25 basis points (bps) to 6.0% from 6.25% earlier, in line with market expectations. Consequently, Standing Deposit Facility (SDF) rate has been reduced to 5.75% from 6.0%. The Marginal Standing Facility (MSF) rate was also lowered to 6.25% from 6.75%.

The MPC also shifted its policy stance from ‘neutral’ to ‘accommodative’, indicating a supportive approach towards growth amidst a favorable inflation outlook. The decision comes at a time when the global economy is experiencing heightened uncertainty, with trade tensions, volatile markets, and a slowdown in growth projections of major global economies, clouding the outlook.

Economic Growth and Inflation Outlook

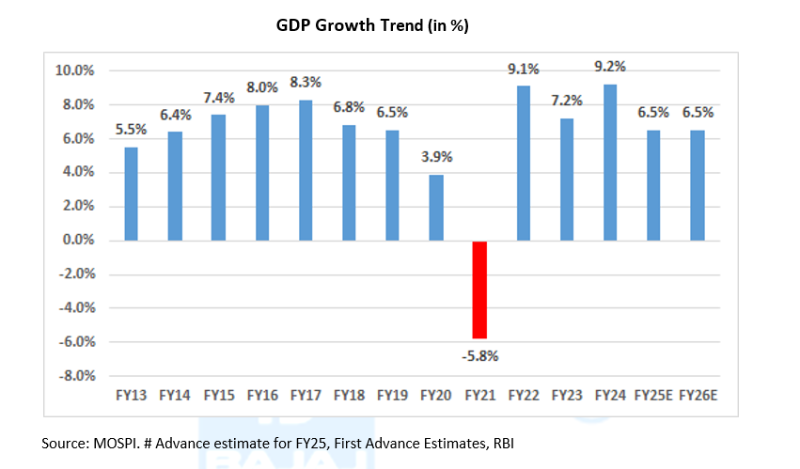

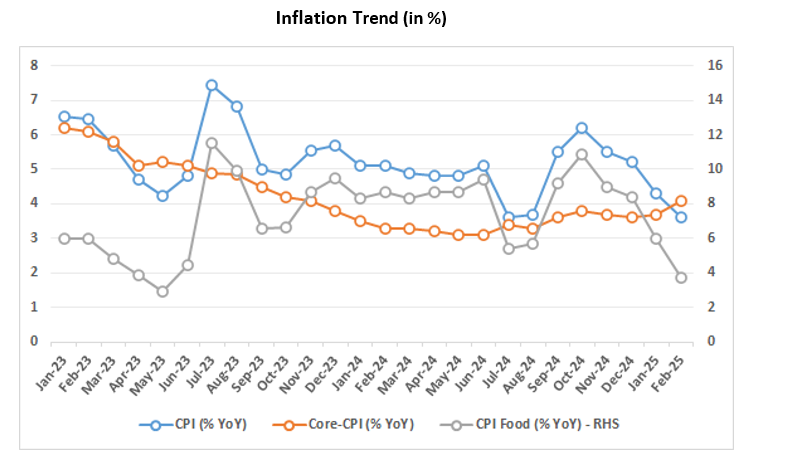

Despite global headwinds, the Indian economy has shown resilience. Economic growth was slower in the first half of FY 2024–25 but improved in the second half due to a decline in food prices and stronger performance in the agriculture and services sectors. The Reserve Bank of India (RBI) now projects GDP growth at 6.5% for FY 2025–26, slightly lower than its earlier estimate of 6.7%, primarily due to global uncertainties.

On the inflation front, the outlook has improved significantly. CPI inflation moderated to 3.6% in February 2025, with the RBI now projecting an average of 4.0% for FY 2025–26 from 4.2% earlier, assuming normal monsoon conditions.

The RBI has changed its approach (Stance) from “neutral” to “accommodative,” which means it is now more open to keeping interest rates the same or even cutting them further to help the economy growth. It also said that it will make sure there is enough money (liquidity) in the system to support this growth.

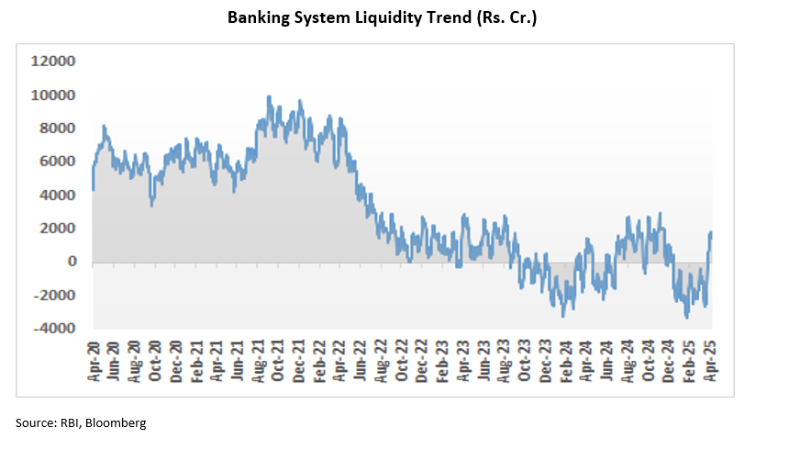

To do this, the RBI has already added about ₹8 lakh crore into the banking system in the second half of FY25. This was done using different tools like buying government bonds (called OMOs), reducing the CRR (the amount banks must keep with RBI), and lending money to banks through special auctions.

External Sector and Currency Stability

India’s external position remains strong. As of April 4, 2025, the country had foreign exchange reserves of $676.3 billion, enough to cover 11 months of imports—though slightly down from the peak of $704.9 billion in September 2024, which covered 16 months. Services exports continue to do well. While foreign direct investment (FDI) coming into India has slowed, foreign portfolio investment (FPI) brought in $1.7 billion during 2024–25, mainly through debt (on account of Index inclusion flows which was one-time), as the equity segment recorded net outflows. Borrowings from abroad (External commercial borrowings) and deposits by Indians living overseas (non-resident deposits) also increased compared to last year. The central bank reassured that it would continue to monitor global developments closely and act decisively to safeguard macroeconomic stability.

Outlook:

The market was expecting 25 bps rate cut; however, stance change to accommodative was a positive surprise for the market. The rate cut move comes on the back of a sharply improved inflation outlook and moderated growth expectations, with the Monetary Policy Committee (MPC) shifting its stance from ‘neutral’ to ‘accommodative’. This pivot reflects the central bank’s clear intent to prioritize growth support while maintaining caution on inflation risks.

The past week has been marked by significant turbulence in global markets, following the United States’ announcement of reciprocal tariffs. This development has introduced a heightened level of uncertainty, which is expected to affect global growth projections, including those for India. The scale and implications of the U.S. tariff measures are considerably large and could potentially reshape the long-established global economic order. While the full impact is likely to unfold over the coming months, there is a reasonable possibility that the situation may worsen further before improving after at least partial roll back of tariffs.

Comparatively, India is expected to be less adversely affected, owing to its relatively lower export dependency on the U.S. Additionally, India’s macroeconomic fundamentals remain resilient, supported by low corporate and government leverage. The recent decline in crude oil prices further strengthens India’s external balance. A potential trade agreement between India and the U.S. could also serve to mitigate some of the current pressures. Consequently, while we remain confident in India’s long-term growth trajectory and believe the country could ultimately benefit from a shifting global landscape, the prevailing volatility in the macroeconomic environment warrants a cautious near-term outlook, in our opinion.

On this backdrop, the market expects growth to be lower than RBI expectations. Due to downward risks to growth, we believe that the rate-cut cycle will be extended with more rate action to follow—given the current growth & inflation dynamics. With the policy stance turning accommodative and systemic liquidity turning into surplus, we continue to prefer the medium-term portion of the yield curve. The rate cut, along with enhanced liquidity conditions, is expected to act as a medium-term tailwind for the economy— reinforcing positive sentiment in the fixed-income markets. However, given the current uncertainty on tariff war outcome we may see heightened volatility in the short term.

Annexure:

Stance – It gives an indication to the future policy action.

SDF – The rate at which Banks lend to RBI without collateral.

MSF –The rate at which RBI lends (provides emergency liquidity) to Banks.

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More