RBI kept the repo rate unchanged at 6.5%, indicates a temporary pause

#

6th Apr, 2023

- 2021 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

Comments from Mr. Sampath Reddy, Chief Investment Officer, Bajaj Allianz Life

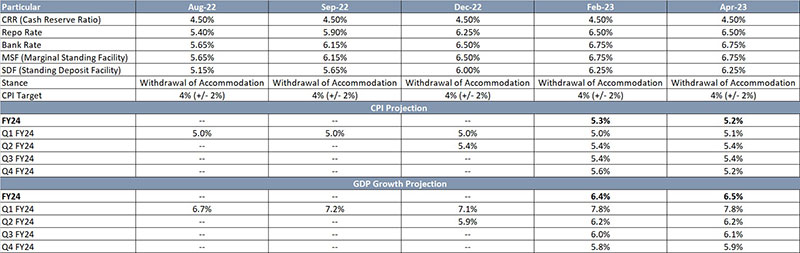

The RBI’s monetary policy committee unanimously decided to keep the repo rate unchanged at 6.50% against market consensus of a 25 bps rate hike. The marginal standing facility (MSF) rate and the Standing Deposit Facility (SDF) rate stands unchanged to 6.75% & 6.25% respectively. Cash Reserve Ratio (CRR) remained unchanged at 4.50%. However, the RBI’s governor in his statement clarified that “the decision to pause on the repo rate is for this meeting only” and that “while closely monitoring the evolving inflation outlook, the MPC will not hesitate to take further action as may be required in its future meetings”, which means that it might be a temporary pause of the current rate hike cycle if inflation print especially core inflation remains elevated. 5 out of 6 MPC members voted in favour of maintaining the policy stance of ‘withdrawal of accommodation’ to ensure that inflation remains within the target going forward, while supporting growth. Cumulatively, RBI has raised repo rate by 250bps since May’22.

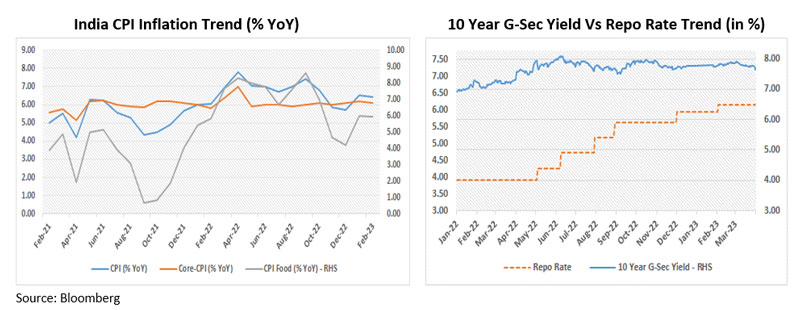

Inflation in India is still above the upper tolerance band of 6% (However, moderated significantly since Sep 2022) but core inflation has remained elevated and sticky. The RBI governor emphasized on the emerging financial stability risks in advance economies. Due to which there are evolving downside risk to the inflation, leading to RBI revising downward its inflation projection at 5.2% vs 5.3% for FY24 earlier (with risks evenly balanced).

Source: RBI

On the domestic economic front, the RBI has mentioned that amidst volatile global developments, the Indian economy remains resilient. The high frequency indicators of Indian economy are expected to be remained robust. The central bank governor highlighted that the headwinds from geopolitical tensions, tightening global financial conditions and the slowing external demand are still some downside risks to the economy. On this backdrop, the RBI has revised upwards India’s GDP forecast to 6.5% vs 6.4% earlier on account of resilience of India’s economic activity.

Outlook:

The policy seemed slightly hawkish while focusing on the elevated inflation trajectory. We believe the relatively strong macro-economic positioning of India will help us in dealing with the prevailing global inflation-growth challenges better.

The RBI’s optimistic economic outlook is on the back of: higher rural demand; continued strength in service sector activity which will help urban demand; and government’s enhanced budget for capex spending in FY24. Investment activity is seen improving led by government’s push to infrastructure spending and above trend capacity utilization in manufacturing.

Post the policy announcement, the bond yields have softened a bit. The RBI maintains that next policy action will depend on the evolving growth and inflation dynamics in India. We believe that we are at the end of the rate hike cycle in India. From a fixed income perspective, we prefer the medium part of the yield curve.

Disclaimer: “The views expressed by the Author in this article/note is not to be construed as investment advice and readers are suggested to seek independent financial advice before making any investment decisions”

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More