RBI kept the repo rate unchanged at 6.5% as expected, indicates a cautious pause

#

8th Jun, 2023

- 1865 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

Comments from Mr. Sampath Reddy, Chief Investment Officer, Bajaj Allianz Life

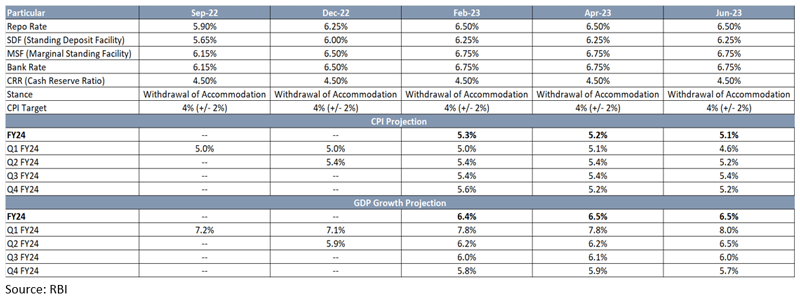

In continuation to the monetary policy in April 2023, the Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) has unanimously decided to maintain the repo rate at 6.5%. The marginal standing facility (MSF) rate and the Standing Deposit Facility (SDF) rate stands unchanged to 6.75% & 6.25% respectively. Cash Reserve Ratio (CRR) remained unchanged at 4.50%.

The RBI governor has emphasized that two major central banks have recently raised their policy rates after a pause, suggesting that the MPC will not hesitate to take further action if necessary. This implies that the RBI may consider increasing rates during the current rate hike cycle if there is a resurgence in inflation. 5 out of 6 MPC members voted in favour of maintaining the policy stance of ‘withdrawal of accommodation’ to ensure that inflation remains within the target going forward, while supporting growth.

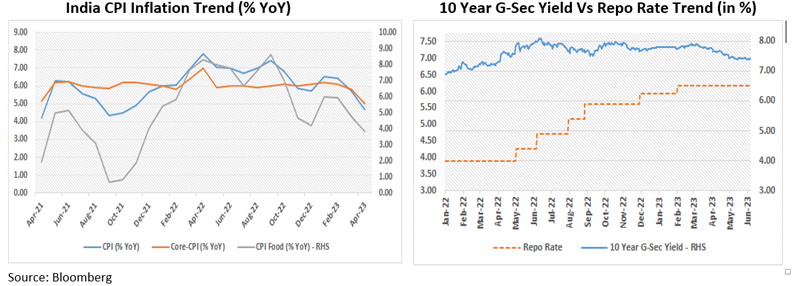

The MPC has taken note of the moderation in consumer price index (CPI) inflation during March and April, falling within the tolerance band and in line with projections. This decline reflects the combined impact of tightening monetary policy and measures to augment supply. However, the projected headline inflation for FY24 is expected to be lower than the previous year but still above the target of 4%, necessitating continuous vigilance. As a result, the RBI has revised its inflation projection for FY24 downward to 5.1% from the earlier projection of 5.2%.

MPC’s assessment on the domestic economic front, it has highlighted that the domestic economic activity remains resilient in Q1FY24 as reflected in high frequency indicators. Purchasing managers’ indices (PMI) for manufacturing and services indicated sustained expansion, with the manufacturing PMI at a 31-month high in May and services PMI at a 13-year high in April-May. In the services sector, domestic air passenger traffic, e-way bills, toll collections and diesel consumption exhibited buoyancy in April-May, while railway freight and port traffic registered modest growth. However, The RBI governor also pointed out the potential downside risks to the economic outlook, including weak external demand, geo-economic fragmentation, and prolonged geopolitical tensions. Despite these risks, the RBI has maintained India’s GDP forecast for FY24 at 6.5% due to the resilience of the country’s economic activity.

Outlook:

The policy had a bit of a hawkish undertone while focusing on the elevated inflation trajectory. We believe, MPC will monitor the evolving inflation conditions for next few months and is likely to pause at this moment to assess the impact of already undertaken rate hikes. Going forward, strong urban discretionary demand, continued momentum in capex and improving rural demand is expected to contribute GDP growth for FY24. We believe the relatively strong macro-economic positioning of India will help us in dealing with the prevailing global inflation-growth challenges better.

The RBI governor also indicated that the demand conditions will remain supportive of growth leading to favorable conditions for pick-up in capex in Indian economy. Although there are concerns such as possibility of adverse impact of El Nino on monsoon, uneven distribution of the rainfall across country and weaker exports due to expectation of global economic slowdown, may pose short term downside risk to the overall growth trajectory of the Indian economy to some extent.

Following the policy announcement, bond yields have inched up slightly on account of cautious comments from RBI. The RBI maintains that next policy action will depend on the evolving growth and inflation dynamics in India. We believe that we are close to the end of rate hike cycle in India. From a fixed income perspective, we prefer the medium part of the yield curve.

Disclaimer: “The views expressed by the Author in this article/note is not to be construed as investment advice and readers are suggested to seek independent financial advice before making any investment decisions”

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More