RBI keeps the policy rates steady, revised growth estimate upwards while inflation under watch

#

8th Dec, 2023

- 1888 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

Comments from Mr. Sampath Reddy, Chief Investment Officer, Bajaj Allianz Life

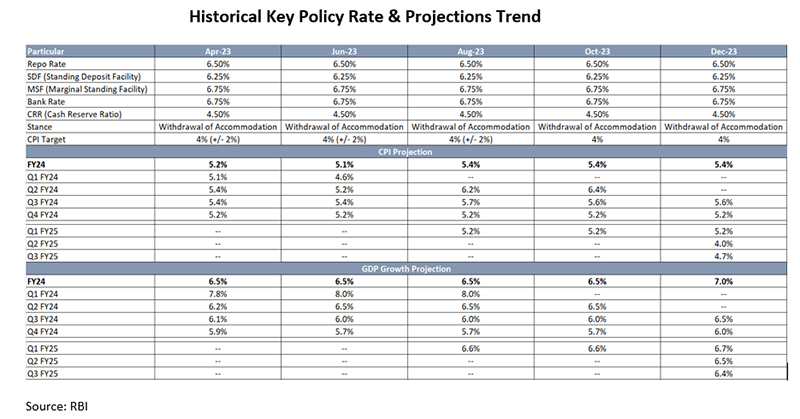

The RBI’s Monetary Policy Committee (MPC) has unanimously decided to keep the policy repo rate unchanged at 6.5%. The marginal standing facility (MSF) rate and the Standing Deposit Facility (SDF) rate stand unchanged at 6.75% & 6.25% respectively. Additionally, in a majority of 5:1 vote, the MPC has decided to remain focused on “withdrawal of accommodation” stance, to ensure that inflation remains within the target going forward, while supporting growth. This is the fifth meeting wherein the MPC decided to maintain the status quo on the repo rate. The MPC last raised the repo rate by 25 bps to 6.50% in its Feb 2023 meeting.

The RBI governor said that the we have made significant progress in bringing down inflation to below 5% in Oct’23 despite occasional blips due to intermittent supply shocks. Our policy of prioritizing inflation over growth, hiking policy rate by 250 basis points in a calibrated manner and draining out excess liquidity have worked well, alongside supply-side measures taken by the government, to bring about this disinflation.

On the inflation front, the MPC maintained its projection at 5.4% for FY24. However, the committee acknowledged the volatility of headline inflation due to recent supply-side shocks, particularly concerning the trajectory of food inflation. There has been broad-based easing in core inflation, which is indicative of successful disinflation through monetary policy actions. The near-term outlook however remains uncertain due to risks to food inflation, which might lead to an inflation uptick in Nov’23 and possibly in Dec’23. The RBI emphasized its commitment to closely monitoring the situation and taking necessary steps to maintain price stability. The RBI highlighted that the monetary policy will remain actively disinflationary to achieve the inflation target and inflation is expected to remain above the target of 4% in the near term. Hence, the RBI retained inflation projected to 5.4% which is projected to decline towards closer to the target of 4% by the end of FY25.

On the Growth front, the MPC revised its growth projection for the current financial year FY24 to 7%, up from the previous estimate of 6.5%. This upward revision is attributed to buoyant domestic demand and higher capacity utilization in the manufacturing sector, indicating a positive outlook for the Indian economy. This reflects the resilience of the Indian economy despite global uncertainties.

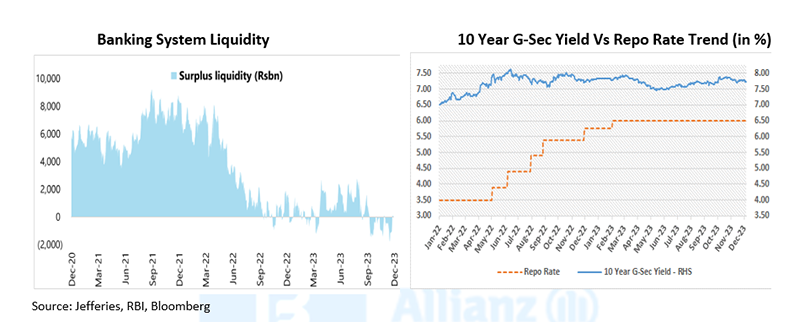

On the liquidity front, the system liquidity has recently turned into deficit mode for the first time since May 2019. This is primarily due to factors such as higher currency leakage during the festive season, government cash balances, and RBI’s market operations. The RBI assured that it will remain nimble in managing liquidity to ensure financial stability.

Reversal of liquidity facilities under SDF and MSF

The RBI governor has noticed high utilisation of MSF and SDF by banks. It has been decided to allow reversal of liquidity facilities under both SDF and MSF even on weekends. It is expected that this will facilitate better fund management. This will be reviewed in 6 months or earlier.

Outlook:

The policy was more balanced, with the focus on the 4% inflation target. The upward revision of the GDP growth projection indicates a robust economic outlook, while the focus on managing inflation volatility highlights the RBI’s commitment to price stability. We believe, the RBI will continue to monitor the evolving economic situation closely, particularly the trajectory of food inflation and external uncertainties. Going forward, the MPC will take necessary actions to maintain price stability and support economic growth in the medium term.

Overall, the RBI’s policy reflects a cautious approach to managing the trade-off between growth and inflation. While the economy is performing well, inflationary pressures remain a concern for now. The RBI’s focus on maintaining stability and anchoring inflation expectations will be crucial in guiding the Indian economy through the challenging global environment. We believe that the RBI’s future actions will depend on evolving data, and we continue to expect a long pause. The 10-year bond yield remained flattish post the policy announcement as the policy was in line with the market expectations.

Disclaimer: “The views expressed by the Author in this article/note is not to be construed as investment advice and readers are suggested to seek independent financial advice before making any investment decisions”

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More