RBI Announces Various Liquidity & Credit Measures, Policy Rates Remain Unchanged

#

9th Oct, 2020

- 4154 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

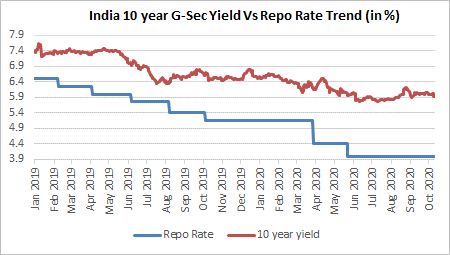

As expected, the RBI Monetary Policy Committee (MPC) voted to keep the key policy rate (repo rate) unchanged at 4.0%, and the reverse repo rate unchanged at 3.35%. All MPC members (including the newly inducted 3 external members) unanimously voted for the decision. The MPC also mentioned that it will continue with the ‘accommodative’ stance for current fiscal year and into next fiscal year as well, to revive growth on a durable basis and mitigate the impact of Covid-19.

Source: Bloomberg

Headline consumer inflation has been above the RBI MPC’s 6% upper limit for some months now, and RBI said that it is primarily due to supply related disruptions. As supply chains are restored and base effect becomes favourable–inflation is expected to moderate, and the central bank also termed the current elevated inflation as transient in nature. The RBI projects headline consumer inflation at 6.8% in Q2 FY21, and expects it to moderate to 5.4% in Q3 FY21 and to 4.5% in Q4 FY21.

On the economic front, RBI said that various high frequency indicators are pointing to a recovery in the economy. For the first time since the Covid-19 pandemic the central bank gave an official GDP forecast of 9.5% contraction during FY21, with risks titled to downside. It expects economic activity to gradually normalize in H2 FY21, and GDP growth to turn positive (+0.5%) in Q4 FY21.

Some of the other key measures announced were as follows:

• RBI extended the earlier enhanced HTM limit of 22% of NDTL on SLR securities to March 2022 end. This will reduce the hit to profitability of banks on account of any rise in yields and encourage investment by banks in G-secs.

• RBI has announced a liquidity measure of On-Tap 3-year TLTROs of Rs. 1 lakh crore upto March 31, 2020 for investment in corporate bonds and commercial paper of certain sectors.

• RBI extended the earlier enhanced HTM limit of 22% of NDTL on SLR securities to March 2022 end. This will reduce the hit to profitability of banks on account of any rise in yields and encourage investment by banks in G-secs.

• RBI also announced various credit enhancing measures–by increasing credit limit of retail loans and also rationalizing risk-weight of housing loans, which will be positive for the sector.

• Round the clock availability of RTGS (Real Time Gross Settlement System).

Outlook:

As expected, the RBI maintained status quo on policy rates, but said that it will maintain accommodative stance in current and next fiscal year—indicating a dovish undertone. The central bank announced various liquidity measures and other measures to help improve credit growth esp. for certain segments.

On inflation, the RBI said that current elevated inflation is transient in nature and expects it to moderate in H2 FY21. It also indicated that revival of the economy from the Covid pandemic disruption assumes the highest priority in conduct of monetary policy. This opens-up space for further rate cuts going forward, considering inflation remains within the projected territory. The central bank mentioned that the weighted average borrowing cost for the govt. has been the lowest in last 16 years (at 5.82%) in H1 FY21, and this provides some relief to stressed government finances as result of the growth slowdown.

The bond markets have therefore reacted positively, with G-Sec yields softening and corporate bond yields falling even more. For the equity markets–sectors like banking, NBFCs, and especially HFCs have reacted most positively.

Overall, the monetary policy has been very supportive of growth with ample liquidity measures. We also believe that the worst is behind, and that the economy is on a healthy recovery path. From an investment perspective on the fixed income side, we continue to prefer the medium-term part of the yield curve, as the curve is relatively flat at the longer end.

“The opinion expressed by the Author in this article/note is his personal opinion and readers are advised to seek independent financial advice before taking any investment decisions.”

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More