RBI keeps policy rates unchanged, upwardly revises growth projection to 7.2% in FY25

#

7th Jun, 2024

- 2331 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

Comments from Mr. Sampath Reddy, Chief Investment Officer, Bajaj Allianz Life

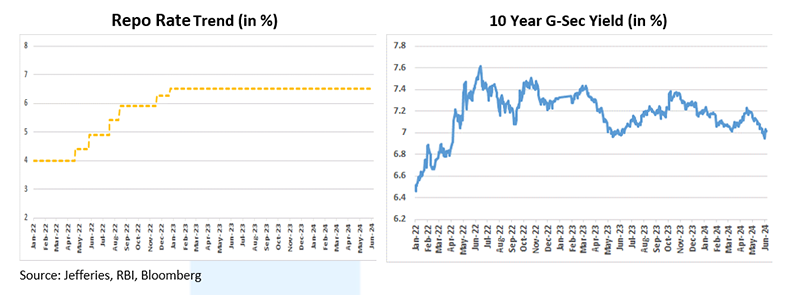

The RBI’s Monetary Policy Committee (MPC) for the 8th consecutive time kept the policy rates unchanged, by keeping repo rate steady at 6.5%, SDF at 6.25% and MSF and bank rate at 6.75%. Stance was also retained at “withdrawal of accommodation”. However, both decisions were not unanimous and were passed with 4-2 vote, a change from 5-1 vote in Apr’24. The MPC last raised the repo rate by 25 bps to 6.50% in its Feb 2023 meeting.

On the inflation front, for FY25, RBI has held its inflation projection at 4.5%. Even the quarterly projections remain unchanged, with Q1 at 4.9%, Q2 at 3.8%, Q3 at 4.6% and Q4 at 4.5%. No revisions have been made, as it is yet to be seen how IMD’s above normal monsoon forecast for this season will play out. For the time being, RBI has taken note of upside risks to inflation emanating from ongoing heat wave conditions and low reservoir levels, putting pressure on summer vegetable and fruit crops. Further, current increase in global food and commodity (non-oil) prices, and volatility in oil prices, may also add to the inflationary pressure. However, in case of good rainfall, domestic pressures will reduce, thus helping bring down cereal and pulses inflation.

On the growth front, following 8.2% growth in FY24 (up from 7.6% as per NSO’s advanced estimates), RBI has upwardly revised its FY25 GDP projection to 7.2% (7% as of Apr’24 policy). Robust growth in FY25 is predicted on the back of sustained momentum in urban demand (PV sales, air passenger traffic); revival in rural demand (2-wheeler sales, decline in MGNREGA demand); continued improvement in investment activity (steel consumption, cement/capital goods production, government led infrastructure development and PLI scheme investments) and robust credit growth. Going forward, the expectation of above normal monsoon is likely to support Kharif output and thus boost rural demand further. It is also expected that the expansion in services sector will be driven by urban consumption. Also, the government spending will also help investment activity.

On the liquidity front, RBI noted that liquidity has moved from deficit to surplus in early Jun’24. In order to remain “nimble and flexible in liquidity management and in view of the shifting liquidity dynamics” the central bank will continue conducting VRRR auctions to mop up the surplus, and VRR auctions to inject liquidity. Further, robust economic conditions in the country, RBI has retained risk provisioning under the contingent reserve buffer (CRB) at 6.5%. Going forward, RBI will “deploy an appropriate mix of instruments to modulate both frictional and durable liquidity”.

Outlook:

As RBI’s policy statement was broadly in line with market expectations, 10Y yield is currently trading flat at 7.01%. The RBI governor stressed that the Central Bank is focused on bringing inflation back to targeted levels (4%) while sustaining growth momentum. No change in stance can be looked at from the point of view of anchoring inflation expectations and still incomplete transmission of rates. We believe RBI to maintain status quo on the repo rate till next MPC meeting and the first-rate cut is expected in later part of this fiscal year if inflation- growth dynamics remain as per RBI’s target level.

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More