RBI hikes rate by 50 bps to 5.9% and keeps policy stance unchanged

#

30th Sep, 2022

- 4753 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

Comments from Mr. Sampath Reddy, Chief Investment Officer, Bajaj Allianz Life

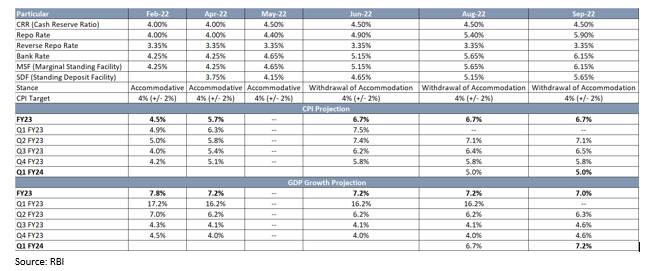

RBI’s Monetary Policy Committee (MPC) hiked the benchmark policy rate (repo rate) by 50 bps to 5.90%. 5 out of 6 MPC members voted in favour of hiking the Repo rate by 50 bps while 1 member voted to increase it by 35 bps. The marginal standing facility (MSF) rate and the Standing Deposit Facility (SDF) rate stands adjusted to 6.15% & 5.65% respectively. Cash Reserve Ratio (CRR) remained unchanged at 4.50%. RBI maintained its policy stance of ‘withdrawal of accommodation’, citing that the real policy rate (adjusted for inflation) is still trailing pre-pandemic levels. The RBI governor also stated that with the inflation rate expected to be elevated at 6% in H2FY23 and with liquidity still in surplus, overall monetary and liquidity conditions remain accommodative, despite the 190 bps of cumulative rate hikes (April-Sep).

On the domestic economic front, the RBI has mentioned that the Indian economy remained resilient in the midst of distressing global macroeconomic environment. The high frequency indicators of Indian economy are showing signs of recovery. Capacity utilization has improved to 74.3% in Q1FY23, government capex is picking pace and bank credit growth has risen to 16%. This suggests that domestic demand has continued to witness traction. However, headwinds from geopolitical tensions, tightening global financial conditions and the slowing external demand pose downside risks to net exports. On this backdrop, real GDP is expected to be 7% in FY23 vs 7.2% earlier. Meanwhile, RBI’s FY24 GDP forecast stands at 6.5%.

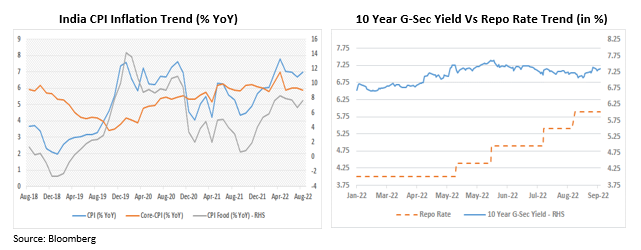

On the inflation front, the central bank said that global geopolitical developments are weighing heavily on the domestic inflation trajectory and there are some upside risks to food prices. However, RBI kept inflation projection unchanged at 6.7% FY23, with risks evenly balanced. For Q1FY24, the RBI expects CPI inflation at 5%.

Outlook:

The policy was more neutral with concerns on incremental inflationary pressures seemingly easing from earlier policies, on the back of softening in global commodity prices. RBI’s policy was in line with expectations of a 50 bps rate hike. India’s economic growth forecast, inflation outlook and currency depreciation stands better placed than peer emerging economies. Therefore, RBI seems like it is somewhat comfortable with the macro-economic situation in India relative to peers. As a result, we have seen a rally in equity markets and bond markets post the policy announcement today.

Liquidity in the banking system has substantially moderated in the past few months as a result of which the shorter end of the yield curve has hardened more than the longer end this year. However, RBI expects liquidity to remain in surplus in the banking system on the back of pick-up in government expenditure as a result of high GST and direct tax collections. Therefore, the MPC decided to remain focused on withdrawal of accommodation.

Globally, we have seen central banks engaging in aggressive monetary tightening to deal with multi-decade high inflation. With the macro situation and especially the inflation scenario relatively better placed in India, we feel that the RBI may be nearing the end of the rate hike cycle in India. Future rate hikes will have more to do with supporting the Indian currency and also to some extent the inflation trajectory. From a fixed income perspective, we prefer the short-medium part of the yield curve.

Disclaimer: “The views expressed by the Author in this article/note is not to be construed as investment advice and readers are suggested to seek independent financial advice before making any investment decisions”

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More