RBI hikes rate by 25 bps to 6.5% and keeps policy stance unchanged

#

8th Feb, 2023

- 2301 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

Comments from Mr. Sampath Reddy, Chief Investment Officer, Bajaj Allianz Life

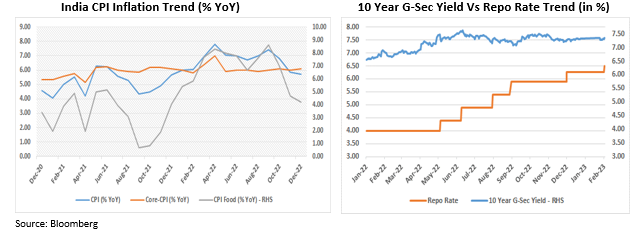

RBI’s Monetary Policy Committee (MPC) hiked the benchmark policy rate (repo rate) by 25 bps to 6.50%. 4 out of 6 MPC members voted in favour of hiking the Repo rate by 25 bps while 2 members were against the repo rate hike. The marginal standing facility (MSF) rate and the Standing Deposit Facility (SDF) rate stands adjusted to 6.75% & 6.25% respectively. Cash Reserve Ratio (CRR) remained unchanged at 4.50%. RBI maintained its policy stance of ‘withdrawal of accommodation’ to ensure that inflation remains within the target going forward, while supporting growth. Overall banking system liquidity has moderated but remains in slight surplus, despite the 250 bps of cumulative rate hikes (April 22-Feb 23).

Inflation in India has moved below the upper tolerance band of 6% (moderated significantly since Sep 2022) but core inflation has remained elevated and sticky. RBI revised its inflation projection slightly downwards at 6.5% in FY23 Vs 6.7% earlier and forecast for FY24 was at 5.3% (with risks evenly balanced). The RBI has mentioned that the global commodity price outlook, including crude oil, is subject to uncertainties on demand prospects as well as from risks of supply disruptions due to geopolitical tensions.

Commodity prices are expected to face upward pressures with the easing of COVID related mobility restrictions in some parts of the world.

On the domestic economic front, the RBI has mentioned that amidst volatile global developments, the Indian economy remains resilient. The high frequency indicators of Indian economy are expected to be remained robust. Capacity utilization in manufacturing is now above its long term average. The central bank governor highlighted that the headwinds from geopolitical tensions, tightening global financial conditions and the slowing external demand are still some downside risks to the economy. On this backdrop, real GDP is expected to be 7% in FY23 vs 6.8% earlier and RBI gave a healthy growth estimate of 6.4% for FY24, compared to market participants pricing in a lower growth number for FY24.

On the liquidity front, the central bank said that the system liquidity remains in surplus, although significantly lower compared to peak liquidity seen in April 2022. In the period ahead, liquidity conditions are likely to improve due to moderation in currency in circulation, pick up in government expenditure and higher forex inflows due to the return of portfolio investors.

Outlook:

The policy seemed slightly hawkish and the RBI didn’t give any forward guidance on policy action, as was being expected by some market participants. The RBI’s policy was in line with expectations of a 25 bps rate hike, although the central bank didn’t change its policy stance as was expected by some. We believe the relatively strong macro-economic positioning of India will help us in dealing with the prevailing global inflation-growth challenges better.

Globally, we have seen central banks engaging in aggressive monetary tightening to deal with multi-decade high inflation. With the macro situation and especially the inflation scenario relatively better placed in India, we believe that we are at the end of the rate hike cycle in India. Post the policy announcement bond yields hardened a bit. From a fixed income perspective, we prefer the medium part of the yield curve.

Disclaimer: “The views expressed by the Author in this article/note is not to be construed as investment advice and readers are suggested to seek independent financial advice before making any investment decisions”

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More