RBI hiked Repo Rate by 50 bps and increased inflation target for FY23 along expected lines

#

8th Jun, 2022

- 1578 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

Comments from Mr. Sampath Reddy, Chief Investment Officer, Bajaj Allianz Life

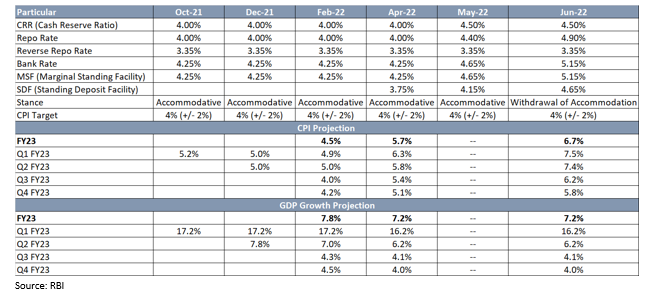

RBI’s Monetary Policy Committee (MPC) unanimously voted to hike the benchmark policy rate (repo rate) by 50 bps to 4.90%. The marginal standing facility (MSF) rate and the newly instituted Standing Deposit Facility (SDF) rate adjusted to 5.15% & 4.65%, respectively. However, Cash Reserve Ratio (CRR) remained unchanged at 4.50%, which is a breather for markets (especially for banks). The MPC is focusing on the withdrawal of accommodation to ensure that inflation is brought under control, while supporting growth.

On the domestic economic front, the RBI has retained its GDP growth forecast for FY23 at 7.2%, as the MPC believes economic recovery is gathering strength. High-frequency indicators, such as-railway freight volumes, port cargo, air passenger traffic and GST collection, have shown signs of pick up in the Apr-May’22 period. In addition, RBI believes that a normal monsoon will support rural consumption. Further, improvement in capacity utilization (74.5% in Q4FY22) and the government’s commitment to the FY23 budget to boost CAPEX spending; will aid investment growth this year, leading to healthy bank credit growth.

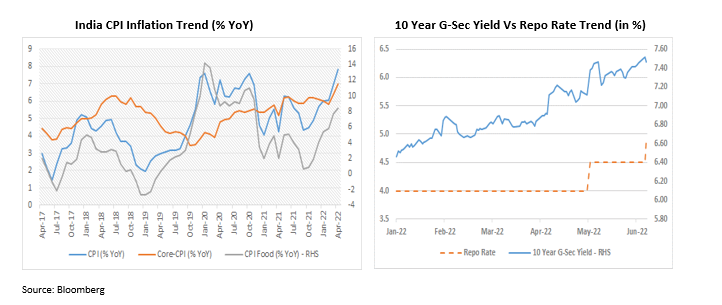

On the inflation front, the RBI revised the inflation projection upward by 100bps to 6.7% in FY23 from an 5.7% estimated earlier. The entire trajectory for FY23 has been upwardly revised. For Q1, headline CPI is expected to be 120bps higher at 7.5% from 6.3% earlier, for Q2, it is expected to be 160bps higher at 7.4%, for Q3, 80bps higher at 6.2% and for Q4, 70bps higher at 5.8%. The policy statement indicated the significant upside risks to inflation. Notably, in the current policy document average crude price assumption has been kept at US$ 105/bbl, which is also subject to considerable risks, considering the current run rate at ~US$ 120/bbl.

On the liquidity front, RBI said that system liquidity continues to remain in large surplus however has moderated in recent period, as reflected in average daily absorption under the liquidity adjustment facility (LAF) at Rs. 5.5 lakh crore during May 4-May 31 was lower than Rs. 7.4 lakh crore during April 8-May 3, 2022.

Standing deposit facility rate (SDF) introduced in the Apr’22 policy as the floor of LAF corridor, was set at 3.75% (+40bps). Following to May’22 policy decision this was hiked to 4.15% and after today’s decision it stands at 4.65%, implying a cumulative increase of 130bps since the start of FY23. This has built upward pressure on all tenures of interest rates and reduced systemic liquidity in the system, indicating that RBI is on track for “gradual withdrawal of accommodation”. However, RBI has noted there remains an overhang of excess liquidity in the system, which is keeping average overnight rates below the repo rate.

Some other key additional measures announced by the RBI were as follows:

• Regulatory measures were announced for corporative banks;

1- The limits for individual housing loans being extended by Urban Cooperative Banks (UCBs) and Rural Cooperative Banks (RCBs- State Cooperative Banks and District Central Cooperative Banks) which were last fixed in 2011 and 2009 respectively are being revised upwards by over 100% taking into account the increase in house prices.

2- it is now proposed to permit Rural Cooperative Banks (RCBs- State Cooperative Banks and District Central Cooperative Banks) to extend finance to ‘commercial real estate – residential housing’ (i.e. loans for residential housing projects), within the existing aggregate housing finance limit of 5% of their total assets.

3- It has also been decided to permit UCBs to extend doorstep banking services to their customers. This will enable UCBs to meet the needs of their customers, especially senior citizens and differently abled.

• e-Mandates on Cards for Recurring Payments – Limit Enhancement; To further facilitate recurring payments like subscriptions, insurance premium, education fee, etc. of larger value under the framework, the limit is being enhanced from ₹5,000 to ₹15,000 per transaction.

• Unified Payments Interface (UPI) – Linking of RuPay Credit Cards; It is now proposed to allow linking of credit cards on the UPI platform. To begin with, the Rupay credit cards will be linked to the UPI platform.

Outlook:

RBI’s hawkish policy is focused largely on heightened inflationary concerns. The 50bp rate hike in the policy repo rate is in line with the expectations, and this has led to softening of bond yields post the policy announcement as the market was already pricing in the rate hike. The markets were relieved, as there was no CRR hike.

The inflation forecast for the FY23 has been raised to 6.7% from 5.7% earlier due to the elevated commodities prices, which we believe is realistic. Also, GDP growth rate estimates retained at 7.2% for FY23, which is a healthy growth rate in the current backdrop. Overall, a significant part of the pandemic-led “policy accommodation” has been reversed. Bond yields will track global crude oil prices, the major central banks’ monetary policy stance, and the inflation trajectory.

Equity market valuation has moderated substantially due to recent correction, and is now trading below its long-term average. Even though the market valuation has come down significantly from earlier highs, there is still a possibility that it could further decline in near term. Hence, this year could be moderate in terms of returns, but the long-term India growth story remains intact.

Disclaimer: “The views expressed by the Author in this article/note is not to be construed as investment advice and readers are suggested to seek independent financial advice before making any investment decisions”

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More