RBI front-loaded with a 50bps rate hike but retains inflation and GDP targets for FY23

#

5th Aug, 2022

- 6280 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

Comments from Mr. Sampath Reddy, Chief Investment Officer, Bajaj Allianz Life

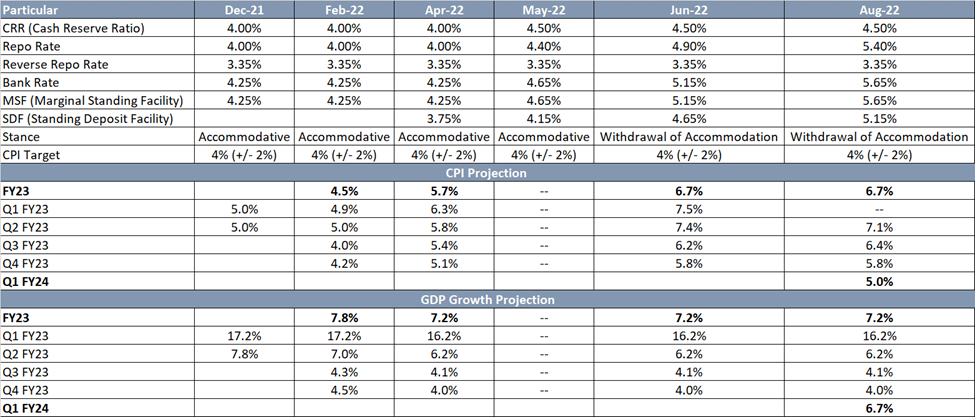

RBI’s Monetary Policy Committee (MPC) unanimously voted to hike the benchmark policy rate (repo rate) by 50 bps to 5.40%. The marginal standing facility (MSF) rate and the newly instituted Standing Deposit Facility (SDF) rate adjusted to 5.65% & 5.15%, respectively. However, Cash Reserve Ratio (CRR) remained unchanged at 4.50%. The MPC is focusing on the withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth.

On the domestic economic front, the RBI has mentioned that the domestic economic activity is showing signs of broadening with improving credit growth, pick-up in investment activity, rising capacity utilization and capex spending by government. Money supply (M3) and bank credit from commercial banks rose (y-o-y) by 7.9% and 14.0%, respectively, as on July 15, 2022. Global factors such as risks of recession, continued war in Eastern Europe, financial market volatility and tightening liquidity conditions remain key risks to the outlook. Overall, RBI noted that risks to the growth outlook remain broadly balanced. Notably, GDP growth in Q1FY24 is pegged at 6.7%.

On the inflation front, the RBI said that the spillover from geopolitical shocks have resulted in uncertainty to inflation trajectory. Global commodity, metal and food prices have eased off from their recent highs, however they still remain elevated. On domestic front, higher sowing of Kharif crops augurs well for food price outlook. The shortfall in paddy sowing is being watched closely, even though rice stock remains above buffer norms. The RBI survey has indicated to softening of cost pressure across sectors in H2. Yet, transmission of input cost pressure might create fresh price pressures. Considering on these factors and assuming the crude oil price at US$ 105/bbl along with normal monsoon, inflation projection for FY23 has been retained at 6.7% in FY23. For Q2, headline CPI is expected to be 20bps higher at 6.4% from 6.2% earlier, for Q3 and Q4; the projections remain unchanged at 5.8% and 6.7% respectively as estimated earlier. The risks remain balanced. For Q1FY24, the RBI expects CPI at 5%.

On the liquidity front, RBI said that the overall system liquidity continues in surplus, with average daily absorption under the LAF at Rs. 3.8 lakh crore during June-July. India’s foreign exchange reserves were placed at US$ 573.9 billion as on July 29, 2022.

Outlook:

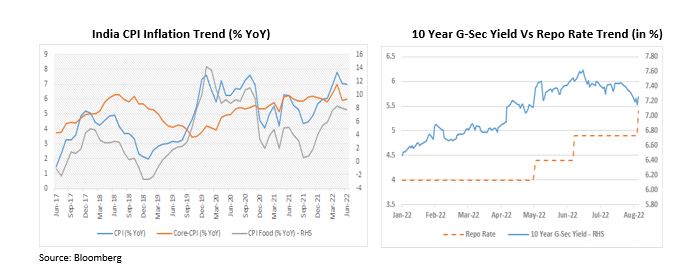

RBI’s policy was quite hawkish as against market expectations (of a 35-40 bps rate hike). Markets were expecting some neutral comments from the central bank on the back of recent softening of global commodity prices and inflation in India being relatively better poised than global economies. As a result, we have seen bond yields hardening quite significantly post the policy announcement.

Liquidity in the banking system has substantially moderated in the past few months, and the RBI has retained its stance of “withdrawal of accommodation”. Due to the moderation of liquidity, the shorter end of the yield curve has hardened more than the longer end this year.

The RBI has observed that the Indian economy is recovering and therefore has retained its earlier GDP forecast for FY23 at 7.2%, despite fears of a global recession. However, geo-political concerns, tightening financial conditions and global market volatility weigh on the growth outlook to some extent. The Indian Rupee has depreciated breaching the 80/USD mark earlier, but has fared relatively better than a number of peer emerging market currencies. This has been on the back of comparatively better macro fundamentals and comfortable forex reserves in India.

We expect bond yields to remain elevated in the near term and further rate hikes for remainder part of this fiscal year. The RBI’s future course of action will continue to be data dependent (especially the inflation trajectory) and influenced by global factors. Globally, we have seen central banks engaging in aggressive monetary tightening to deal with multi decade high inflation. From a fixed income perspective, we prefer short-medium part of the yield curve.

Disclaimer: “The views expressed by the Author in this article/note is not to be construed as investment advice and readers are suggested to seek independent financial advice before making any investment decisions”

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More