RBI Reaffirms Impetus to Support Economic Growth

#

7th Apr, 2021

- 3747 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

Comments from Mr. Sampath Reddy, Chief Investment Officer, Bajaj Allianz Life

As expected, the RBI Monetary Policy Committee (MPC) unanimously voted to keep the key policy rate (repo rate) unchanged at 4.0%, and the reverse repo rate unchanged at 3.35%. The MPC also unanimously voted to maintain an accommodative stance to sustain growth on a durable basis; but did remove the earlier time-based guidance (of maintaining accommodative stance into this fiscal year).

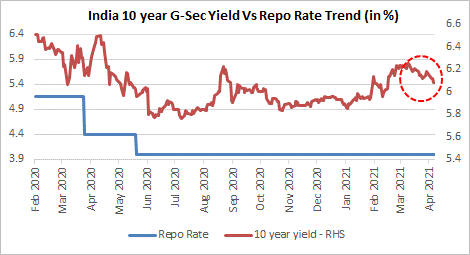

However, the overall tone of the monetary policy was dovish.The central bank announced a secondary market G-Sec acquisition programme (GSAP 1.0), which indicates an intention to calendarize its G-sec purchases and may help to manage the yield curve and reduce the term premium as well. Under the GSAP 1.0, the RBI announced a Rs. 1 lakh crore purchase of G-Secs in Q1 FY22, with Rs. 25,000 crore scheduled to be purchased on April 15, 2021. The government has a large market borrowing programme to manage this year, therefore–this may help to control the bond market volatility to some extent.

The central bank also intends to lengthen the tenor of variable rate reverse repo auctions, thereby helping to manage the system liquidity depending on evolving conditions and keeping it stable. However, the RBI Governor said it should not be read as liquidity tightening.

Source: Bloomberg

RBI kept CPI inflation forecasts broadly unchanged. Quarterly inflation forecasts are 5.0% for Q4 FY21, 5.2% for both Q1 & Q2 Y22, 4.4% for Q3 FY22 and 5.1% for Q4, with risks broadly balanced.

On the economic front, the RBI has retained GDP growth forecast for FY22 at 10.5%. However, this estimate is slightly lower than that of some other international agencies (eg. IMF & OECD projects ~12.5% growth in FY22). The government’s estimate is of -8.0% GDP contraction in FY21.

Some other additional measures announced by the RBI were as follows:

•Extension of on-tap TLTRO deadline by six months to Sep 2021 end.

•Additional liquidity facility of Rs. 50,000 crore for financial institutions like NABARD, SIDBI, NHB for fresh lending in FY22.

•The outstanding balance limit for payment banks and wallets (with KYC) enhanced to Rs. 2 lakhs from Rs. 1 lakh earlier.

•Bank lending to NBFCs (other than MFIs) for on-lending to agriculture, MSME and housing was earlier allowed to be classified as priority sector lending from 13th August 2020 to 31st March 2021. This has further been extended by another 6 months till Sep 2021 end.

Outlook:

The RBI’s intention is to keep borrowing cost in control, by conducting measures such as GSAP, OMOs etc. It has been taking various steps to manage the large upcoming market borrowing programme in a smooth and efficient manner.

The current run rate also indicates that the fiscal deficit may come in lower than the revised 9.5% estimate for FY21—helped by some improvement in tax & revenue collections in the last quarter. India’s fiscal deficit for 11 months of the fiscal year (April 2020 to February 2021) stood at 76% of the revised annual estimate, compared to 135% in the corresponding period of the previous fiscal year.

With the dovish undertone in today’s policy, bond yields have fallen, especially at the longer end. Although we are at the end of the rate cycle, the central bank will continue to remain accommodative till economic recovery is visible, while closely monitoring the evolving inflation trajectory. However, any further rise in global bond yields and commodity prices could once again put some pressure on bond yields. From a fixed income perspective, we prefer the medium-term part of the yield curve.

The fall in bond yields should also benefit the equity markets by keeping borrowing costs in check for some time. However, the second Covid wave in India, and more lock-downs/restrictions could impact the pace of economic recovery and also cause some market volatility in the short term. Investors can use any market volatility / dips to increase their equity exposure gradually (as per their individual risk profile).

Disclaimer: “The views expressed by the Author in this article/note is not to be construed as investment advice and readers are suggested to seek independent financial advice before making any investment decisions”

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More