RBI cuts Repo rate to 6.25%, projects 6.7% GDP growth while inflation to moderate to 4.2% in FY26

#

7th Feb, 2025

- 5082 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

Comments from Mr. Srinivas Rao Ravuri, Chief Investment Officer, Bajaj Allianz Life

Monetary Policy Decisio

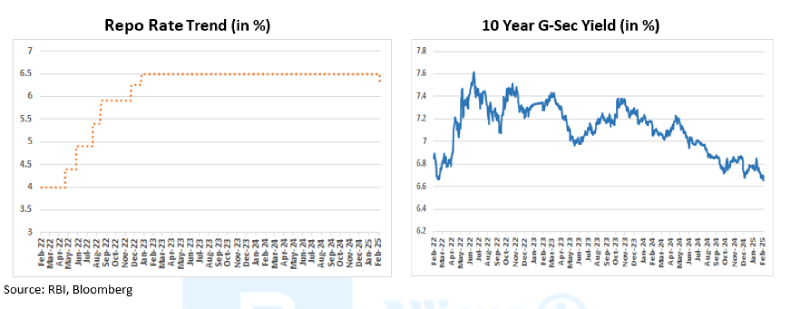

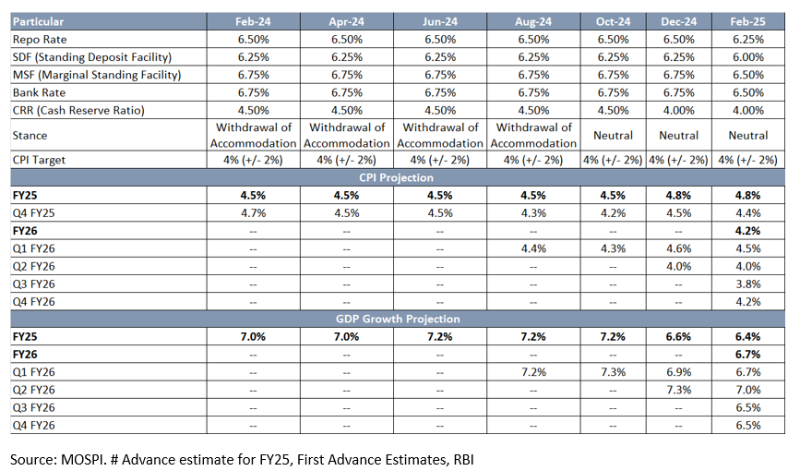

The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) has unanimously decided to cut repo rate (the rate at which RBI lends to Banks with collateral) by 25 basis points (bps) to 6.25% from 6.50% earlier, in line with market expectations. Consequently, Standing Deposit Facility (SDF) rate has been reduced to 6% from 6.25%. The Marginal Standing Facility (MSF) rate was also lowered to 6.5% from 6.75%.

The MPC unanimously retained its neutral stance, ensuring a balance between inflation control and economic growth. The committee acknowledged the challenges posed by global financial conditions, trade uncertainties, and weather-related risks but remained optimistic about India’s economic trajectory. Also, not changing the stance “Neutral” will provide MPC the flexibility to respond to the evolving macroeconomic environment.

Economic Growth and Inflation Outlook

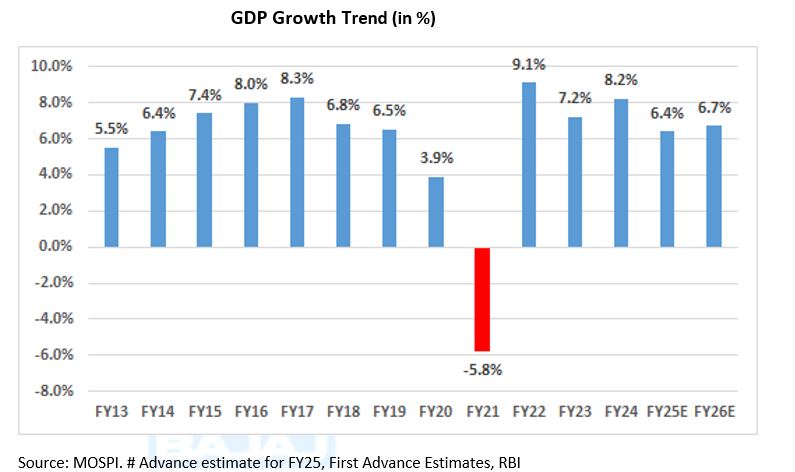

India’s real GDP growth for the current year is estimated at 6.4% (as per First Advance Estimates), following an 8.2% expansion last year. The economy is expected to gain momentum, driven by improving manufacturing output, and steady services sector performance. The RBI projects a GDP growth rate of 6.7% for the next financial year, with quarterly growth estimates ranging from 6.5% to 7.0%.

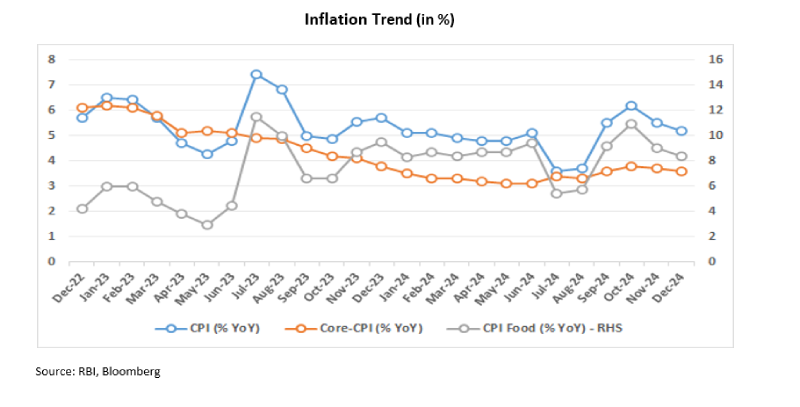

On the inflation front, headline inflation has shown signs of moderation, supported by favorable food prices and a strong kharif harvest. Consumer Price Index (CPI) inflation is projected at 4.8% for the current fiscal year and 4.2% for 2025-26, assuming a normal monsoon. Core inflation remains stable, but external factors such as energy price volatility and geopolitical risks continue to pose challenges.

External Sector and Currency Stability

The Governor highlighted India’s strong external sector position, with the Current Account Deficit (CAD) moderating to 1.2% of GDP in Q2FY25. India remains the world’s largest recipient of remittances, with inflows reaching $129.1 billion in 2024. The country’s foreign exchange reserves stood at $630.6 billion as of 31 January 2025 (10 months of import cover) from a peak of $704.89 billion in Sep-24 (16 months of import cover).

The RBI reiterated its commitment to maintaining exchange rate stability, focusing on managing excessive volatility rather than targeting specific exchange rate levels. The Indian rupee has faced depreciation pressure due to global financial conditions, but the central bank remains prepared to intervene when necessary.

Liquidity and Financial Market Conditions

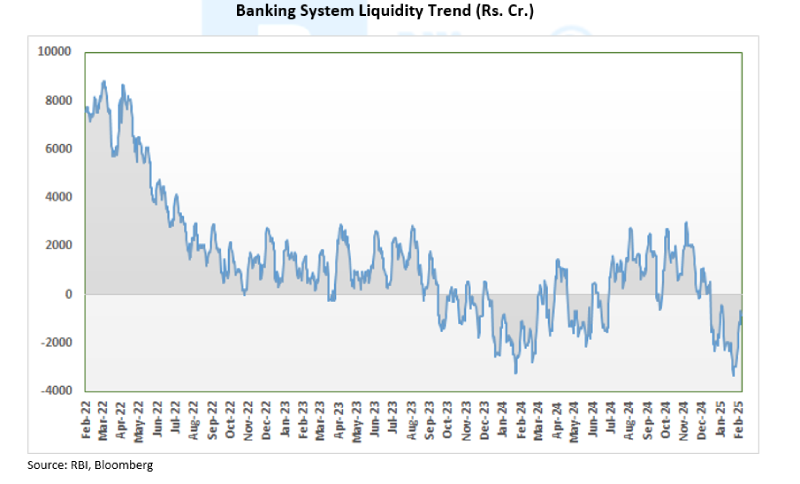

Liquidity in the banking system transitioned from a surplus in mid-2024 to a deficit in recent months, attributed to tax payments, capital outflows, and forex market interventions. The RBI urged banks to enhance market participation, particularly in the uncollateralized call money market, to improve liquidity distribution.

Additionally, the RBI remains committed to ensuring sufficient liquidity through tools such as open market operations (OMOs) and variable rate repos. Recent measures taken in this regard include injecting liquidity via OMO (Rs. 58,835 crores), forex buy sell swap and variable rate repos.

Financial Stability and Regulatory Developments

The Indian banking system continues to exhibit strong financial health, with scheduled commercial banks maintaining a high Capital to Risk-Weighted Assets Ratio (CRAR) of 16.7% and a Gross Non-Performing Asset (GNPA) ratio of 2.5%. The financial stability of Non-Banking Financial Companies (NBFCs) also remains robust, with a CRAR of 26.5% and improving profitability metrics.

Regulatory changes, including modifications to liquidity coverage ratios (LCR) and expected credit loss (ECL) provisioning frameworks, are aimed at ensuring long-term financial stability. The RBI emphasized its commitment to balancing stability with efficiency while ensuring a smooth implementation process through stakeholder consultations.

Key Announcements and Additional Measures

The Governor announced several strategic initiatives to enhance market efficiency:

New Forward Contracts for Government Securities: To help long-term investors manage interest rate risks, forward contracts in government securities will be introduced.

Enhanced Access to Government Securities Market: SEBI-registered non-bank brokers will be allowed access to the NDS-OM platform, improving liquidity and participation.

Review of Market Trading Hours: A working group will assess the need for changes in trading and settlement timings across various financial market segments, with a report expected by April 30, 2025.

Outlook:

The RBI cut the repo rate by 25 bps keeping in mind the evolving growth-inflation dynamics, with focus back on growth as inflation is expected to gradually move towards RBI’s 4% target. The policy was slightly more hawkish than market expectation leading to a selloff by ~0.05% in the bond markets with no guidance on future rate action and additional liquidity measures. MPC indicated that the future rate cuts will be based on a fresh assessment of the macroeconomic outlook hence RBI will be data dependent in upcoming MPC meetings.

Going forward, as per RBI’s projection inflation is expected to moderate to 4.2% by FY26 which is in line with our expectations. We continue to believe that the rate cut cycle will be shallow of 50bps based on the current economic landscape. With the beginning of rate cut cycle and infusion of liquidity, we prefer shorter end of the yield curve. This rate cut would provide a medium-term boost to the economy, particularly for rate-sensitive sectors, and enhance fixed-income market sentiment.

Annexure:

SDF – The rate at which Banks lend to RBI without collateral.

MSF –The rate at which RBI lends (provides emergency liquidity) to Banks.

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More