RBI Bi-monthly Policy, February 2019

#

7th Feb, 2019

- 7269 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

RBI changes policy stance and goes in for a rate cut, with price stability being achieved

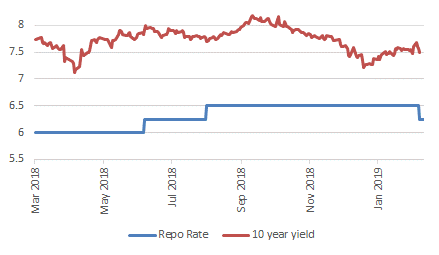

The RBI Monetary Policy Committee (MPC) cut the policy repo rate by 25 bps (with 4 MPC members voting for the same, and 2 MPC members voting to keep rate unchanged). It also changed the monetary policy stance to “neutral” from “calibrated tightening” earlier. The change in policy stance was broadly discounted by the markets, but the markets were divided on whether a rate cut would happen at this point. So this development will be a bit positive for the markets, and we have seen bond yields react accordingly.

RBI Repo Rate Vs 10 year yield

The central bank also continued to revise the inflation projections downwards, after cutting them in the December 2018 policy as well. CPI headline inflation forecast has been cut to 2.8%YoY in Q4 FY19 (from 2.7-3.2% for H2 FY19 previously in December policy). For FY20, the RBI projects inflation at 3.2-3.4% in H1 FY20 (versus 3.8-4.2% earlier), and 3.9% in Q3 FY20–with risks broadly balanced. This downward revision reflects lower food and oil prices, despite some unfavourable base effect for inflation expected, going forward.

On the economic front, the central bank forecast GDP growth for FY20 at 7.4%YoY–with risks evenly balanced. The RBI MPC noted in the policy statement that the output gap has opened up modestly, as actual output has been lower than potential. Investment activity is recovering but supported mainly by public spending, and there is a need is to strengthen private investment activity and private consumption.

On the NBFC front, the RBI said that NBFCs would be risk-weighted as per the ratings assigned (currently the risk weights for all NBFCs are at 100%). This should help the better rated NBFCs to reduce their borrowing costs, given lower risk weights.

Market Outlook:

The overall tone of the policy was bit more dovish than expected, and therefore bond yields have softened a bit, post the policy announcement. The RBI has also not ruled out further rate cuts, and said that it will be data-driven. The cut in rates will help to reduce the cost of capital, provided the pass-through by banks happen soon. The RBI governor, in his speech has also categorically said that the central bank is ready to support on the liquidity front, if there is any constraint, and it is an evolving situation. The RBI has already been supporting through OMO purchases

Overall, we feel that RBI’s focus has changed from inflation primarily, to a combination of inflation and supporting growth, considering that price stability has been achieved and inflation is presently well below the official targets.

However, some concerns still remain on the fiscal front for FY20, and the higher bond supply. Further, there could also be some pressure on yields if there is a liquidity & credit crunch, or any further rise in crude oil prices. From an investment perspective, we continue to prefer the shorter to medium term part of the yield curve.

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More