RBI Bi-monthly Policy Feb 2018

#

8th Mar, 2018

- 994 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

RBI maintains status quo with a slightly hawkish undertone on inflation, as expected.

The RBI Monetary Policy Committee (MPC) kept key policy rates unchanged (in a 5-1 vote) and maintained its ‘neutral’ stance, as broadly anticipated by the markets. Only one of the MPC members was in favour of a 25 bps repo rate hike while the others opted for a status quo. The central bank highlighted various upside risks to inflation as follows:

RBI has said that it would need to be vigilant on inflation as it expects CPI headline inflation at 5.1% in Q4 FY18. It further added that CPI headline inflation is projected at 5.1%-5.6% in H1 FY19 and it could moderate to 4.5%-4.6% in H2 FY19. However, RBI has also mentioned some mitigating factors to inflation like—subdued capacity utilization, expected softening of oil price due to production response and muted rural real wage growth. Overall, the MPC reiterated its commitment to keep headline inflation close to 4% on a sustainable basis.

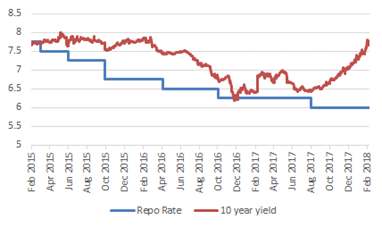

RBI Repo Rate Vs 10 year yield

Source: Bloomberg

On the growth front, the RBI has revised the GVA growth for FY18 to 6.6% from 6.7% earlier, and for FY19 to 7.2% from 7.4% earlier. However, the RBI MPC noted that the economy is on a recovery path, including early signs of a revival in investment activity. Global demand is also improving, which should help supplement domestic investment activity.

The RBI has also provided some relief to MSME borrowers registered under GST, by easing NPA recognition norm to some extent, and by removal of credit caps on MSMEs under priority sector. The MPC highlighted that a large proportion of bank loans continue to be linked to the Base Rate despite introduction of the Marginal Cost of Funds based Lending Rates (MCLR) system. Therefore, the RBI has decided to link the Base Rate to the MCLR with effect from April 1, 2018.

Market Outlook:

Bond yields remained relatively stable as the policy was along expected lines. The RBI highlighted various upside risks to inflation over the coming year, which remains a cause of concern. We feel that the inflation trajectory will need to be tracked closely, and therefore additional policy action would be data dependent. Further, global bond yields have hardened significantly over the past few months, due to expectations of a gradual pick-up in growth and inflation globally. Any pick-up in pace in monetary tightening by the global central banks could pose risk to flows into emerging markets. This could result in some volatility in the Indian markets also. Overall, most of the risks like rising inflation and fiscal slippage have been priced in by the market. Therefore, we expect bond yields to remain range-bound over the coming few months.

India is on a revival path, and is projected to be one of the fastest growing large economies in FY19. Policyholders would be well placed to participate in the economic revival of the India growth story, if they remain invested and continue to pay their premiums regularly.

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More