RBI Maintains Status Quo, Despite Expectations For a Rate Cut

#

5th Dec, 2019

- 2037 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

RBI surprises by maintaining status quo, against expectations of a rate cut

In a surprise move, the RBI Monetary Policy Committee (MPC) voted to keep the key policy rate unchanged at 5.15%, against market consensus expectations of a 25 bps rate cut. All MPC members unanimously voted for the decision, while continuing with the ‘accommodative’ stance. The rationale for the status quo seems to be the recent rise in inflation and the need of more visibility on fiscal developments (with the Union Budget expected to precede the next monetary policy review).

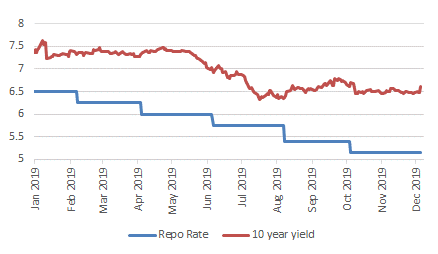

RBI Repo Rate Vs 10 year yield

Source: Bloomberg

The RBI raised its headline CPI inflation projection to 4.7-5.1% in H2 FY20 (from 3.5-3.7% earlier) and to 3.8-4.0% in H1 FY21 (from 3.6% in Q1 FY21), with risks broadly balanced. RBI said that going forward inflation will be influenced by the following factors:

a) The recent rise in vegetable prices is expected to continue in the near term, but the late kharif season along with measures taken by the government to augment supply will help to soften prices by February 2020. Food items like milk, pulses and sugar are also putting pressure on inflation. b) Inflation expectations of households have risen lately as per surveys. c) Domestic markets have exhibited volatility, and domestic demand has slowed down, which is being reflected in softening of core inflation (ex food & fuel). d) Crude oil prices are expected to remain range bound, barring any supply disruptions due to geo-political tensions.

On the economic front, with the recent Q2 FY20 GDP print coming below RBI’s projections, the central bank revised down the GDP growth forecast for FY20 sharply to 5.0% YoY (from 6.1% earlier). GDP growth for H1 FY21 is now projected at 5.9-6.3% YoY from 7.2% YoY earlier for Q1 FY20.

Outlook:

Bond yields have hardened post the RBI policy announcement, which suggests an unwinding of rate-cut expectations. We feel that at this juncture, the RBI wants to pause and see the impact of past rate cuts, and their transmission. The RBI said that the various measures taken by the government and monetary easing undertaken by the central bank should start to feed into the economy. Transmission of rate cuts has been higher for the bond markets, than for the credit markets—with the RBI mentioning that the 1-year median marginal cost of funds-based lending rate (MCLR) has declined by 49 bps compared to 135 bps cut in the policy rate (repo rate). However, surplus liquidity, linking of new loans to external benchmarks, easing of term deposit rates, and annual reset of floating rate loans due for renewal—is expected to augur well for increased pace of monetary transmission to credit markets (compared to before).

The policy statement mentioned that the MPC recognized that there is monetary policy space for future action and has kept the policy stance as “accommodative”. However, it will be dependent on incoming data. From an investment perspective we presently prefer the shorter end of the yield curve.

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More