CIO Comments on RBI Bi-monthly Policy, April 2019

#

5th Apr, 2019

- 3379 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

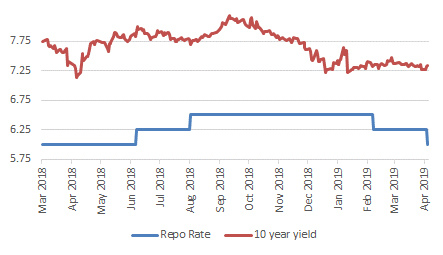

RBI cuts policy rate by 25 bps, and keeps stance unchanged

The RBI Monetary Policy Committee (MPC) cut the policy repo rate by 25 bps (with 4:2 majority). However, it kept the monetary policy stance unchanged at “neutral” (with 5:1 majority). These actions were along our expectations, but the markets seem to have expected a more dovish undertone from the central banks (with some segments expecting a change in policy stance to “accommodative”). As a result, bond yields have hardened a bit post the policy announcement.

RBI Repo Rate Vs 10 year yield

Source: Bloomberg

The central bank also continued to trim the inflation projection downwards, after cutting them in the past two policies as well, with inflation currently tracking below the earlier trajectory target. CPI headline inflation forecast has been cut to 2.9-3.0%YoY in for H1 FY20 (from 3.2-3.4% YoY earlier). For H2 FY20, the RBI projects inflation at 3.5-3.8%YoY (down from 3.9% for Q3 FY20 projected earlier)–with risks broadly balanced. However, the RBI has highlighted that there are several uncertainties that cloud the inflation outlook, which include–some probability of El Niño effects in 2019 (causing lower than average monsoon), risk of reversal in vegetable prices esp. in summer months, hazy outlook on crude oil prices, global growth and trade uncertainty.

On the economic front, the central bank cut the GDP growth forecast for FY20 at 7.2%YoY (from 7.4% earlier)–with risks evenly balanced. Earlier, the second estimate of GDP growth for FY19 by CSO was revised down to 7.0%YoY, from 7.2% in first estimate, and 7.4% in advance estimate.

Market Outlook:

The RBI has also not ruled out further rate cuts, and said that it will be data-driven. The RBI governor again indicated that central bank’s focus will remain on the evolving macro & growth situation, in guiding monetary policy—going forward, and the MPC not changing its stance to ‘accommodative’ (with 5:1 majority), further reiterates that. On the liquidity front, the RBI provided some relief by allowing additional 2% of SLR to be recognized under the liquidity coverage ratio (LCR). The transmission of this policy rate cut by banks should be tracked, and at the moment–we believe that transmission would be limited, given the elevated credit-to-deposit (CD) ratio.

The higher bond supply, rising crude oil prices, concerns on the fiscal deficit front may provide some headwinds to the bond markets, and need to be tracked. From an investment perspective, we continue to prefer the shorter to medium term end of the yield curve.

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More