Prefer Large-Caps to Small / Mid-Caps after recent rally

#

14th Sep, 2023

- 11552 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

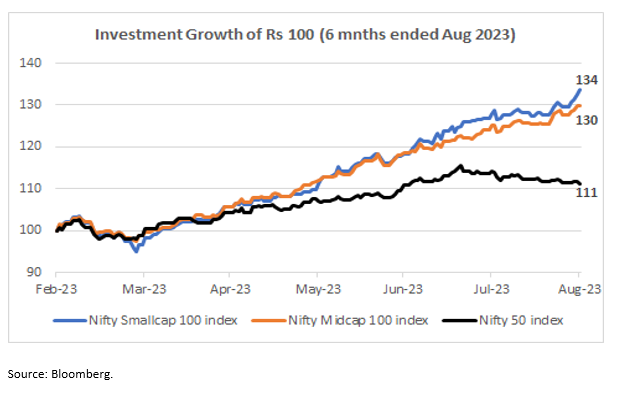

The rally in small/mid-cap stocks has been a sharp and quick one over the past six months, helped by strong domestic fund flows and return of investor risk-appetite. The Nifty 50 index has delivered a return of 11% over a 6-month period (ended August 2023). However, the broader markets have relatively outperformed by a significant margin over same period, with the Nifty Smallcap 100 index and Nifty Midcap 100 index surging 34% and 30% respectively.

Individual small/mid-cap stocks have substantially outperformed:

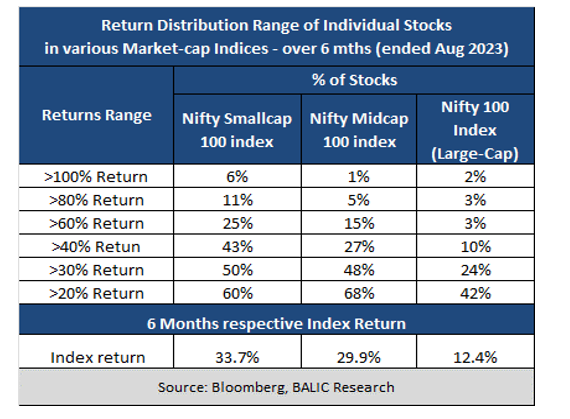

Despite the benchmark small/mid-cap indices faring well over the past six months, several individual stocks of these indices have managed to do much better— indicating that the performance has been quite broad-based in the small/mid-cap segment. The table highlights that even though the Nifty Smallcap 100 index has returned 34% over the past 6 months, around a quarter (or 25%) of the small-cap stocks from the index have delivered a return in excess of 60% over same period, and 43% of small-cap stocks have returned in excess of 40%. A handful of small-cap stocks have managed to even deliver triple-digit return (in excess of 100%). Comparatively, for the large-cap segment (as indicated by Nifty 100 index), the index has delivered 12% return, and only 10% of the index large-cap stocks have returned in excess of 40% return over the past 6-month period.

Strong domestic fund flows have contributed to the small/mid-cap rally:

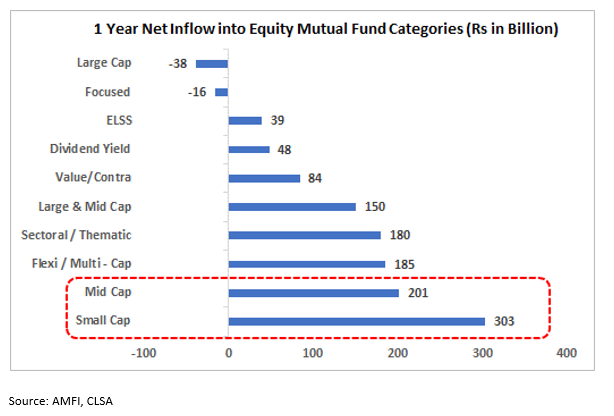

Small/mid-cap equity mutual funds have been receiving significant traction from investors. Among various equity fund categories, the small-cap mutual fund category has received the highest inflow of Rs 300 billion (Rs 30,000 crore) over the past year. The flow as a percentage of beginning assets (better known as organic growth rate) over the past year for the small-cap fund category is ~27%. Mid-cap equity mutual fund category received the second highest net inflow of Rs. 200 billion; 1 year organic growth rate of 12%. Flexi/multi-cap funds, which is the largest equity fund category with combined assets of Rs 3.67 trillion, received a relatively lower net inflow of Rs 185 billion over the same period (1 year organic growth rate of only 6%).

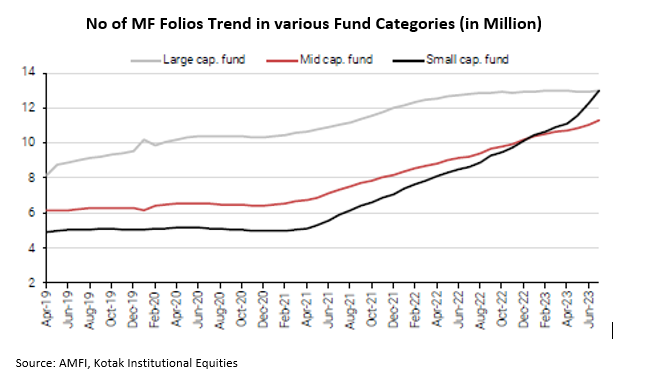

As per mutual fund folio data from AMFI (which indicates the approximate investor count / number of investors) the total number of folios in small-cap mutual fund category has crossed the large-cap and flexi-cap fund categories. The number of folios of mid-cap mutual fund category has also increased substantially over the past few years. This indicates that more individual investors are investing in small/mid-cap fund categories—highlighting the growing investor traction towards this segment.

Outlook:

Post the recent sharp outperformance of small/mid-cap stocks compared to large-cap stocks, we now prefer the latter from a risk-reward perspective. Valuations of small/mid-cap stocks have also gone up on the back of the liquidity fueled rally but is still lower than the earlier highs touched in late 2021. We recommend investors with higher exposure in mid/small-cap segment or funds to pare down some exposure, and switch to the large-cap / flexi-cap oriented funds. The more risk-averse investors, who are looking for lower volatility and more balanced returns, can consider some asset allocation or hybrid funds (which have a mix of equity and debt investments). We presently also have an ongoing new fund offer (NFO) of Bajaj Allianz Dynamic Asset Allocation Fund, which will dynamically allocate between equity and fixed income asset classes based on an in-house quantitative model and market conditions.

However, investors who have a long investment horizon and higher risk appetite (and not much deterred by short term volatility) can stay invested or continue to systematically invest in small/mid-cap funds.

Disclaimer: “The views expressed in this article/note is not to be construed as investment advice and readers are suggested to seek independent financial advice before making any investment decisions. Past performance is not indicative of future performance.

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More