Interim Budget FY25 indicates fiscal prudence with long-term economic stability

#

1st Feb, 2024

- 8301 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

Comments from Mr. Sampath Reddy, Chief Investment Officer, Bajaj Allianz Life

The interim budget for 2024-25, demonstrated a balance between maintaining the momentum of recent initiatives and outlining a vision for future economic growth. In-spite of the upcoming elections, the budget demonstrates the government’s commitment to fiscal prudence and long-term planning.

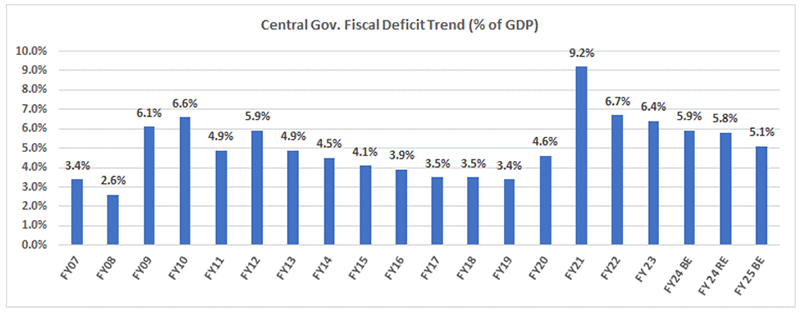

Fiscal Stability at the Forefront: Recognizing the importance of long-term economic stability, the budget places fiscal consolidation at its core. A commitment to bringing the fiscal deficit down to below 4.5% of GDP by FY26, the government has set a fiscal deficit target of 5.1% for FY25 and revised estimate for FY24 is 5.8% of GDP vs 5.9% earlier, exceeding market expectations and showcasing its dedication to sound financial management. Lower borrowing projections through G-Sec offerings and an aim to increase revenue generation demonstrate a prudent approach to public finances, creating a foundation for future investments. This commitment extends to managing debt, with gross borrowing projected to be lower than the previous year, reflecting a responsible approach to fiscal consolidation. Additionally, efforts to control revenue expenditure further demonstrate responsible fiscal management.

Source: Budget Documents. A= Actual, BE=Budgeted Estimate, RE = Revised Estimate

Source: Budget Documents. A= Actual, BE=Budgeted Estimate, RE = Revised Estimate

Capex Thrust to Continue: The budget acknowledges the role of robust infrastructure in propelling economic growth and competitiveness. After a significant increase in the previous years of capital expenditure, the projected outlay to capital expenditure is to grow by 11% to Rs. 11 trillion (3.4% of the GDP), emphasizes the government’s commitment to this crucial sector. This translates into the implementation of three major railway corridor programs, aiming to streamline logistics and reduce transportation costs. Airport expansion initiatives and urban transformation projects hold the potential to unlock economic opportunities and improve regional connectivity.

A Greener Future: The budget highlights the growing importance of environmental considerations, integrating them into several initiatives. Promoting bio-gasification as a cleaner alternative fuel, encouraging the adoption of electric vehicles, and supporting rooftop solarization demonstrate a shift towards responsible energy generation. Investments in rooftop solarization programs highlight the government’s push for modernization and sustainability. The rooftop solarization scheme, targeting 1 crore households with access to free electricity up to 300 units, exemplifies this dual focus on infrastructure development and environmental consciousness.

Taxation: To foster investment and entrepreneurship, the budget extends tax benefits for startups and sovereign wealth funds, acknowledging their potential to contribute to economic growth and innovation. Existing tax exemptions are continued, providing stability and predictability for businesses operating in key sectors. This approach balances the need for revenue generation with encouraging favorable environment for business growth. However, there are no changes proposed in the existing income tax slabs but to retain the same tax rates for direct taxes and indirect taxes including import duties.

Boosting Tourism: Recognizing the potential of tourism to generate employment and economic activity, the budget encourages states to develop iconic tourist centers and provides long-term interest-free loans for infrastructure development. This focus on revitalizing existing destinations and creating new attractions aims to enhance the tourism experience and attract global visitors. Island (including Lakshadweep) tourism receives a boost with projects planned for improved connectivity and amenities, unlocking the potential of these scenic locales, and promoting local economic development.

Additional Measure,

Sustainable Development

• Commitment to meet ‘Net Zero’ by 2070.

• Viability gap funding for wind energy.

• Setting up of coal gasification and liquefaction capacity.

• Phased mandatory blending of CNG, PNG and compressed biogas.

• Financial assistance for procurement of biomass aggregation machinery.

• Adoption of e-buses for public transport network.

• Strengthening e-vehicle ecosystem by supporting manufacturing and charging.

• New scheme of biomanufacturing and bio-foundry to be launched to support environment friendly alternatives.

Health

• Encourage Cervical Cancer Vaccination for girls (9-14 years).

• Saksham Anganwadi and Poshan 2.0 to be expedited for improved nutrition delivery, early childhood care and development.

• U-WIN platform for immunisation efforts of Mission Indradhanush to be rolled out.

• Health cover under Ayushman Bharat scheme to be extended to all ASHA, Angawadi workers and helpers.

Agriculture and Food Processing

• Government will promote private and public investment in post-harvest activities.

• Application of Nano-DAP to be expanded in all agro-climatic zones.

• Atmanirbhar Oilseeds Abhiyaan-Strategy to be formulated to achieve atmanirbharta for oilseeds.

• Comprehensive programme for dairy development to be formulated.

• Implementation of Pradhan Mantri Matsaya Sampada Yojana to be stepped up to enhance. aquaculture productivity, double exports and generate more employment opportunities.

• 5 Integrated Aquaparks to be set up.

Tax Proposals

• Continuity in taxation: Certain tax benefits to Start-ups and investments made by sovereign wealth funds/pension funds, tax exemption of some IFSC units earlier expiring on 31.03.2024 extended up to 31.03.2025.

• Withdrawal of outstanding direct tax demand: –

• Up to Rs. 25,000 pertaining up to FY10

• Up to Rs. 10,000 for FY11-FY15

Retention of same tax rates: –

• For direct and indirect taxes, including import duties.

• For Corporate Taxes-22% for existing domestic companies, 15% for certain new manufacturing companies.

• No tax liability for taxpayers with income up to Rs. 7 lakhs under the new tax regime.

Outlook: Overall, the interim budget exhibits continuity and stability, emphasizing fiscal prudence, infrastructure development, clean energy adoption, and inclusive growth. It lays the foundation for a future-oriented path towards economic prosperity. This careful balancing act positions India to navigate the upcoming transition while maintaining its focus on long-term goals, creating an optimistic outlook for the nation’s economic trajectory. The 10 year benchmark yield softened significantly with the bond market taking the fiscal prudence shown in the budget positively.

Disclaimer:“The views expressed by the Author in this article/note is not to be construed as investment advice and readers are suggested to seek independent financial advice before making any investment decisions. For any tax specific queries/clarifications, please contact your tax advisor. For more details please refer to the budget document and Finance Bill.”

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More