Indian economy demonstrates resilience; anticipates robust economic growth in 2024

#

18th Dec, 2023

- 12814 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

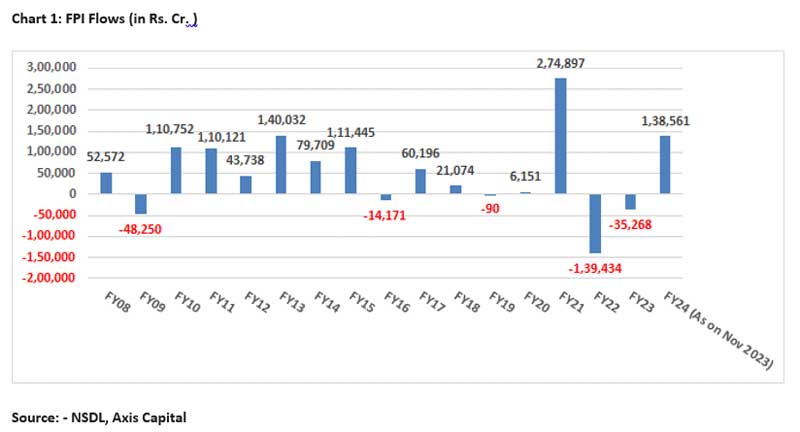

The year 2023 marked a year of resilience for the Indian economy and markets in spite of headwinds due to the monetary tightening by global central banks, led by the US Federal Reserve and high inflation. US Fed hiked interest rates by 5.5%, this along with “quantitative tightening program” of reduction in balance sheet, resulted in multi-decade high interest rates in the US and around the world. As a result, the foreign portfolio investor (FPI) flows turned negative on emerging markets like India, leading to significant outflows and putting downward pressure on Indian equities at the start of the year. The year started with the persistence of inflation at elevated levels across economies, continuing geo-political uncertainties and tightening financial conditions. The banking turmoil in US (Silicon Valley Bank) and Europe (Credit Suisse) increased risk aversion with the expectations of an early reversal of the monetary tightening cycle leading to Equity markets to correct and softening of bond yields.

During the later part of the year the concerns of a significant growth slow down softened, globally inflation started to moderate, most of the central banks have taken a pause on interest rate hike boosted the positive sentiments among investors. With the brightening prospects of a “soft landing”, FPIs & DIIs have been a net buyer so far during the year led to market rally and most of the tracked domestic indices trading at their all-time highs.

The year 2023 has been a good year for Indian Equity markets with the Nifty50 on track to deliver around 20% gains. The Midcap & Small cap indices are on track to deliver substantially higher returns of around 50% for the year. The gains during the year have been fairly broad-based with most sectors participating in the rally. Amongst the large sectors, only Oil& Gas has seen some underperformance while PSUs, Autos and IT stood out in terms of outperformance.

Nifty earnings growth for FY23 stood at 12%, and there’s an optimistic outlook with expectations of around 13% growth in both FY24 and FY25. As such the earnings growth trajectory of India Inc remains strong in the post COVID era thereby supporting market performance. Indian equity valuations remain at a premium compared to emerging and developed markets, this reflects investors’ continued confidence in the long-term growth story. However, sustained focus on delivering robust earnings growth remains crucial to maintain these valuations. We expect Indian equity markets are expected to deliver positive returns in 2024, although potential volatility remains due to global uncertainties. Continued earnings growth and supportive global liquidity conditions are likely to drive market performance.

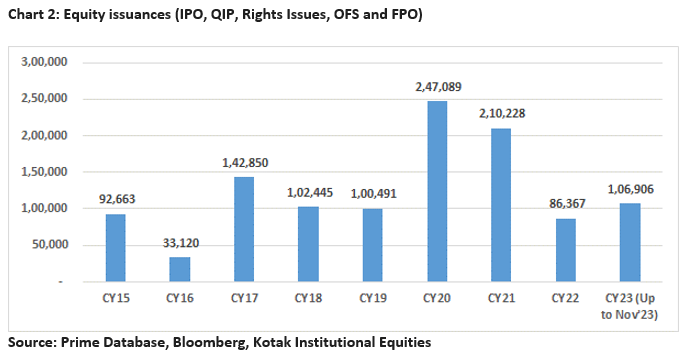

Besides the secondary market performance, India emerged as the global leader in terms of number of IPOs in 2023. Activity in the primary markets have been buoyant through 2023 with a number of companies accessing the capital market for either an IPO or to raise money through the QIP route.

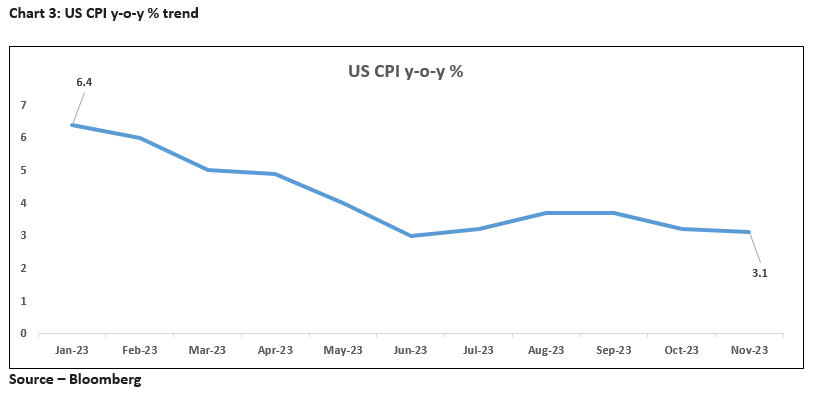

As the year progressed the liquidity support extended by western central banks were successful in stabilizing the financial markets – with no further incidents of bank collapses. US economy continued to be robust with good GDP growth (Q1CY23 2.2%, Q2CY23 2.1% and Q3CY23 5.2%), low unemployment rate along with robust job gains. US CPI inflation too showed signs of moderation (6.5% in Jan’23 to 3.1% in Nov’23).

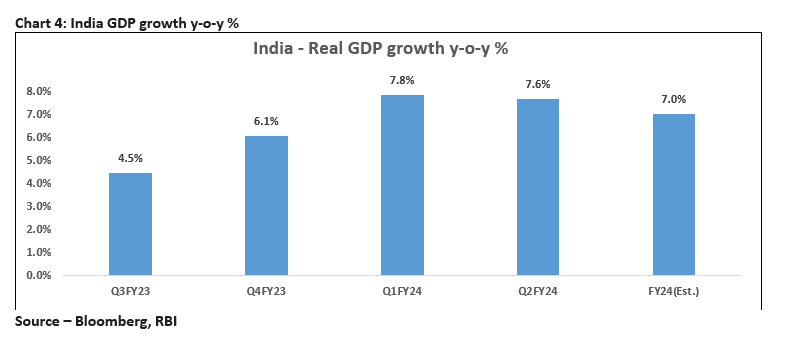

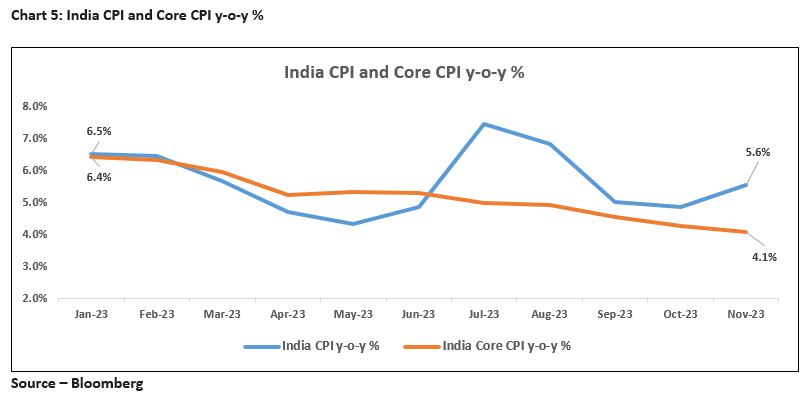

India’s macroeconomic fundamentals too have been relatively strong during this cycle of monetary tightening – on the back of strong GDP growth (Q1FY23 7.8% and Q2FY23 7.6%, moderating inflation (CPI 6.5% in Jan’23 to 5.6% in Nov’23) and stable Rupee on the back of robust external sector and Forex reserves.

India’s economic growth is projected to remain robust in 2024, with RBI estimating a growth rate of 7% for FY24, supported by domestic consumption, government spending, and a gradual recovery in private investment.

Going forward the global as well as India’s inflation are expected to moderate, creating a more stable environment for businesses and investors. As inflationary pressures ease, governments and central banks are likely to shift focus towards economic growth, leading to increased investments in key sectors.

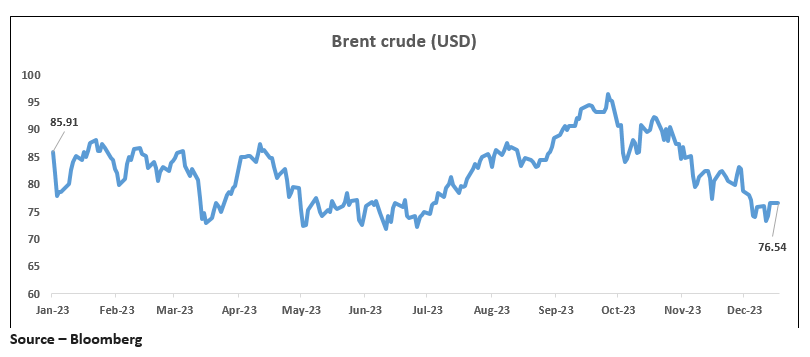

Another key factor was the volatile crude oil prices, driven by geopolitical events during 2023. The year started with a surge fueled by the conflict between Russia & Ukraine, pushing up domestic fuel prices and impacting inflation to remain in the upward trajectory. However, recessionary fears in the second half led oil prices to fall, bringing some relief to price rises.

Despite global uncertainties, the Indian economy and equity markets remain resilient and well-positioned for continued growth in 2024. The global interest rate trajectory, the direction of crude oil prices, and the outcome of upcoming domestic elections will all play a key role in determining market movement. Investors should focus on a balanced portfolio approach, investing in high-quality companies with strong fundamentals, long-term growth prospects. The Indian growth story remains compelling, offering investors the potential for wealth creation over the years.

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More