Government Announces Rs. 1.7 Lakh Crore Aid Package

#

27th Mar, 2020

- 6744 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

RBI Monetary Policy Committee (MPC) preponed its early April policy meeting and announced a bold and large monetary stimulus package on 27 March 2020, in light of the Coronavirus pandemic and its impact on the economy.

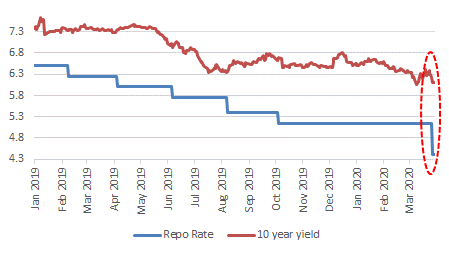

RBI Repo Rate Vs 10 year yield

Source: Bloomberg

Here are the key highlights of mid-term RBI policy review:

• The key policy rate (repo rate) has been reduced by 75 bps to 4.4%, from 5.15% earlier.

• The reverse repo rate (rate at which RBI borrows from banks) has been reduced by a higher 90 bps to 4%.

• RBI decided to continue with its monetary policy stance as “accommodative”, as long as it is necessary to revive growth and mitigate the impact of coronavirus (COVID-19) on the economy.

• RBI announced large liquidity measures as follows:

• Cash Reserve Ratio (CRR) was reduced by 100 bps to 3% for a 1-year period. This will release liquidity of Rs. 1.37 lakh crore into the banking system.

• Announced Targeted Long-Term Repo Operations (TLTRO) of an amount of Rs. 1 lakh crore for a tenor of 3 years, wherein the banks need to deploy such funds in investment grade bonds and CPs. This has resulted in corporate bond spreads reducing significantly especially in the shorter end of the yield curve.

• Minimum daily CRR maintenance balance reduced from 90% to 80% (up to June 26, 2020)

• Enhanced liquidity accommodation under MSF from 2% to 3% (up to June 30, 2020). This will release liquidity of Rs. 1.37 lakh crore.

• Overall, the RBI estimates that the total liquidity injection into the system will be around Rs. 3.74 lakh crores from these measures.

• All lenders are allowed a moratorium of 3 months on repayment of installments for term loans outstanding as on March 1, 2020. The moratorium on deferment of payment of term loans will not lead to asset classification downgrade. Also, there has been deferment of interest for working capital by 3 months—helping to ease working capital financing.

• The RBI mentioned that there is risk to 5% GDP growth forecast for FY20. Also, the earlier GDP forecast for FY21 by RBI was 6%, and the RBI said that despite continuing resilience of agriculture sector, most other sectors of the economy will be adversely impacted by the pandemic. However, the central bank did not elaborate on the quantum of impact on GDP growth, due to the fluid (and developing) state of affairs.

• On the inflation front, the RBI said that food prices may soften further, and the collapse in crude oil prices should work towards easing both fuel and core inflation pressures.

Government announces Rs. 1.7 lakh crore fiscal aid package

The government announced a Rs. 1.7 lakh crore fiscal aid package (~0.8% of GDP) on 26 March 2020, primarily benefiting the under-privileged sections of society (who are likely to be more impacted by the Coronavirus pandemic and need immediate attention). The key highlights of the package were:

• The government will offer 5kg of rice or wheat per person, and 1kg of pulses per household, free of cost, for the next three months. This is intended to benefit 800 million people.

• Below poverty line households that have been beneficiaries of the government’s ‘Ujjwala’ scheme for transitioning into cooking gas will now be given free LPG cylinders for the next three months. This is intended to benefit 83 million people.

• The government will front-load the installment of Rs. 2,000 to the first week of April offered to farmers under the existing PM KISAN scheme of cash transfers that was introduced earlier. The PM KISAN scheme will provide cash transfer of Rs. 6,000 per annum to a farmer (in 4 quarterly installments of Rs. 2000 each) and is intended to benefit 89 million farmers.

• For widows, senior citizens, differently abled, a one-time ex gratia payment of Rs. 1,000 for next three months offered in two installments. Women under the government’s financial inclusion scheme, Jan Dhan Yojna are to receive an ex gratia payment of Rs. 500 per month for the next three months.

• The government is amending its pension regulations, so that workers can draw upto 75% of provident fund corpus for their contingency expenditure (non-refundable) or three months of wages in advance, whichever is less. This is intended to benefit 48 million workers.

•States have been directed to use the welfare fund for building and construction labourers, consisting of ~Rs.30,000 crore.

Outlook: The RBI’s monetary policy stimulus has been above expectations. Bond yields had hardened earlier due to FII selling, pressure on the rupee and higher government borrowing concerns, but has softened a bit in past few days in anticipation of some monetary action from the RBI. Post today’s announcement bond yields have fallen further. This monetary stimulus provides space to banks to lend more, although we need to see how demand for bank credit pans out amidst this economic slowdown, and also how transmissions of rate cuts pan out. The RBI has also announced measures on moratorium, which was much demanded by the industry.

The central bank indicated that there is space for more policy action, if the situation demands, and it will be data dependent. From an investment perspective on the fixed income side, we presently prefer the shorter to medium term part of the yield curve.

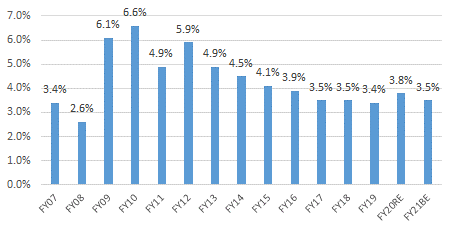

The fiscal stimulus from the government (~0.8% GDP) announced on 26 March 2020, has been a starting point and will benefit the under-privileged sections of society (who need immediate assistance). However, we feel that at-least a 1.5-2% of GDP fiscal stimulus is needed in the current situation, and there should be more measures from the government over time. During the global financial crisis, we have seen the central fiscal deficit expanded from 3.4% of GDP in FY07 to 6.1% in FY09 and 6.6% in FY10 (see chart below)—so that was quite a large and extended fiscal stimulus. We are not saying that the fiscal stimulus needs to last for so long (as it can be damaging in the long term for the economy), but in short-term it is required—to help aid the economy and prevent a severe shock.

Central Fiscal Deficit Trend (% of GDP)

Source: Bloomberg, Ministry of Finance. RE=Revised Estimate, BE=Budgeted Estimate

From an equity markets perspective, with the sharp fall in markets, we have been advising investors (though various notes/ commentaries) that they should gradually start deploying money in equities. Market valuations have become quite attractive, therefore presenting a buying opportunity for long term investors. There still maybe some short-term volatility in markets (from time to time) as the Coronavirus cases continue to escalate, and uncertainty persists. As we know, it is difficult to predict or time the market bottoms and tops accurately. However, the prudent thing is to at-least get started, or not to panic and sell-off. Historical data has shown that investments made in challenging times have been quite rewarding for investors over the medium to long term.

We wish you and your family good health. Please be safe!

“The opinion expressed by the Author in this article/note is his personal opinion and readers are advised to seek independent financial advice before taking any investment decisions.”

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More