CIO comments on Union Budget FY2020-2021

#

1st Feb, 2020

- 9347 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

Overall, the budget is inclusive–encompassing various sectors and sections of society, and also focusing on revival of the economy by increasing the disposable income in the hands of individuals, and thereby improving their purchasing capabilities.

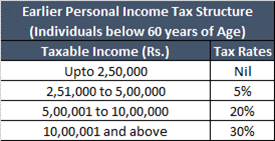

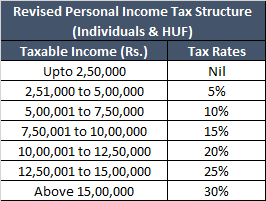

Income tax relief to aid in consumption recovery: Tax relief has been provided to individuals by introducing a new income tax regime (revised income tax slabs), and individuals can decide to shift to the new tax regime or stay under the existing regime (whichever is more beneficial)—as a number of exemptions/deductions have been done away with under the new regime. This measure would aid to provide a consumption boost especially for the urban economy, and address some of the demand related issues amidst the economic slowdown. The government also reiterated the stance of doubling farmer’s income by 2022 and this would be beneficial for the rural economy from a consumption perspective, over the medium term.

Source: Budget Documents. Surcharge and cess also applicable. For more details please refer to the budget document and Finance Bill

The government has earlier addressed the supply side, by providing fiscal stimulus through a significant corporate tax cut. These measures should help in a gradual recovery in the economy going forward in FY21.

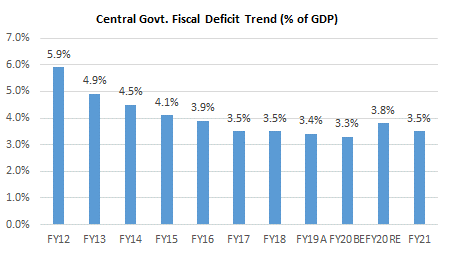

Some leeway in fiscal slippage allowed: The fiscal deficit for FY20 has been revised to 3.8% of GDP (vs 3.3% earlier), and for FY21 at 3.5% (from 3.0% earlier). This has been done to deal with the economic slowdown and due to lower tax collections. Net market borrowing for FY20 has been revised to Rs. 4.74 crore (from Rs. 4.73 lakh crore earlier) and for FY21 at Rs. 5.44 lakh crore. This borrowing figures is along expected lines.

Source: Budget Documents

Other key measures and figures announced in budget:

Disclaimer: “The views expressed by the Author in this article/note is his personal opinion and readers are advised to seek independent financial advice before taking any investment decisions. For any tax specific queries/clarifications, please contact your tax advisor. For more details please refer to the Budget document and Finance Bill.”

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More