CIO Comments on Union Budget FY20

#

5th Jul, 2019

- 8011 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

Overall, the budget has tried to reach out to various sections of the society, and has been a balanced and forward-looking one—promoting ease of living. It has focused on segments like digital economy, infrastructure, and provided various benefits to electric vehicles–to increase penetration and adaption.

For the digital economy, the government wants to promote digital transactions and cash-less economy, by imposing 2% TDS on cash withdrawals above Rs 1 crore per year from a bank account. Also, no transaction costs or merchant discount rate on various digital modes of payment will be imposed. Budget proposed pre-filled tax returns from various income sources, which will boost the tax compliance and ease the paper work on tax payers.

For electric vehicles (EVs), the various measures announced include– GST rate on EVs to be lowered to 5% from 12% which is significant given the two wheelers and small cars are taxed at GST of 28%. And additionally, tax deduction of Rs 1.5 lakhs per year on interest paid on Loans taken to purchase Elective vehicles. Budgetary support for FAME (Faster adoption & manufacturing of electric vehicles) scheme has been announced at Rs 10,000 crore.

Infrastructure push continues: For infrastructure, the government intends to provide Rs. 100 lakh crore over the next 5 years, which may help to revive the investment cycle. It imposed additional cess of Rs. 1/litre on petrol and diesel, to fund infra and road sector. A new integrated water ministry to be formed, for supply of water to each home.

Banking and Financial sector measures: For the financial sector, PSU bank recapitalization of Rs. 70,000 crore has been provided (which is above expectations), and also to address the stress in NBFC sector, credit guarantee of upto 10% first loss on Rs. 1 lakh crore of loans purchased from NBFCs by PSU banks. Also, the government has proposed the regulator for housing finance companies (HFCs) to be changed to RBI from National Housing Bank (NHB) so that one regulator can oversee entire lending services.

For the insurance sector, the government announced intent to increase FDI for insurance companies, and also increased FDI for insurance intermediaries to 100%, which is a positive, and may help to provide more capital and help better insurance penetration.

From a markets perspective, the government’s proposal to increase the minimum free float (public shareholding) limit from 25% to 35%, can lead to an increase in supply of equity paper in the markets.

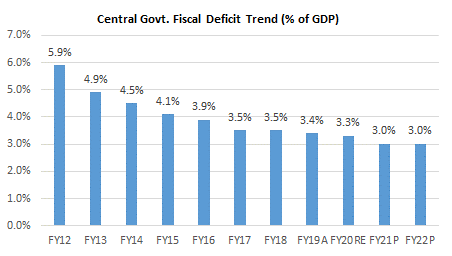

On the positive side the government has maintained fiscal discipline (announced fiscal deficit target of 3.3% for FY20 vs 3.4% earlier, and plans to reduce it to 3.0% by FY22). Gross market borrowing has been maintained at Rs. 7.1 lakh crore and net market borrowing at Rs. 4.7 lakh crore (in line with interim budget estimate). Government also announced intent to borrow from overseas markets, which thereby helps in bringing foreign currency, and also reduces the burden on local market borrowings. These measures are beneficial for the bond markets and has led to a further fall in bond yields, post the budget announcement.

Source: Budget Documents

On the taxation front, the government has extended lower corporate tax rate of 25% for companies having annual turnover upto Rs. 400 crore (compared to Rs. 250 crore before), and this was along expected lines. However, the increase in effective tax rate on high net worth individuals (those earning more than Rs. 2 crore annually), and especially for the super-rich (those earning Rs. 5 crore and above annually)—where effective tax rate has been increased by 7%, has been a surprise move.

Other key announcements that have impact on markets or sectors:

1. Additional deduction of Rs. 1.5 lakhs for affordable housing loans taken in this fiscal year.

2. Custom duty on gold has been raised to 12.5% from 10% earlier.

3. Custom duty on News print is raised to 10% from Nil.

4. Customs duty on split air conditioners raised form 10% to 20%

5. Disinvestment target increased to Rs. 1.05 lakh crore (from Rs. 90,000 crore in interim budget), and the govt. also intends to do strategic sale.

6. Tax of 20% imposed on buy back shares of listed companies.

7. Capital requirement for reinsurance companies is reduced from Rs. 5000 crore to Rs. 1000 crore.

To conclude, we feel that the markets will soon digest the budget and move on to more fundamental factors and global events. Investors should continue to invest systematically in equities to benefit from India’s long-term growth story and expected recovery in corporate earnings.

For any tax specific queries/clarifications, please contact your tax advisor. For more details please refer to the budget document and Finance Bill.

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More