CIO Comments on RBI Bi-monthly Policy, June 2019

#

6th Jun, 2019

- 3507 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

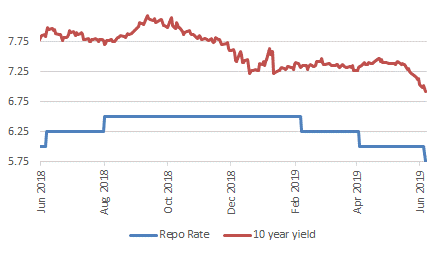

RBI MPC unanimously votes to cut rates, and also change policy stance to “accommodative” The RBI Monetary Policy Committee (MPC) voted to cut the policy repo rate by 25 bps, which was broadly along expected lines. And on a positive note, the RBI MPC also unanimously voted for a change in policy stance from ‘neutral’ to ‘accommodative’. This dovish undertone is also being reflected in bond yields further softening post the policy announcement.

Source: Bloomberg

Consumer Price Index (CPI) headline inflation remains well below the central bank’s target, and also within the forecast trajectory. The RBI raised its inflation projection marginally to 3.0-3.1%YoY from 2.9-3.0% in H1 FY20; and lowered it to 3.4-3.7% from 3.5-3.8% in H2 FY20–with risks ‘broadly balanced’. Risks emanate from uncertainties surrounding — unseasonal spike in vegetable prices, monsoon, crude oil prices, financial market volatility and fiscal scenario.

On the economic front, the central bank revised down the GDP growth forecast for FY20 to 7.0%YoY (from 7.2% earlier)–with risks ‘evenly balanced’. This is in the context of concerns of global growth slowdown (accentuated by the recent escalation in trade war), and also the recent slowdown in domestic growth.

Outlook:

Bond yields have fallen sharply over the past month or so, on the back of expectation of further monetary easing by the RBI, positive election outcome, sharp fall in global bond yields (due to growth concerns and escalating trade tensions), recent fall in crude oil prices, benign inflation, FII debt inflows, stable/appreciating rupee, and some improvement in the liquidity scenario. The sharp fall in bond yields has benefited duration and bond funds.

On the growth front, the RBI acknowledged the recent slowdown in domestic growth. However, on a positive note— it said that there is scope for the central bank to support growth, by aiding aggregate demand and also private investment activity. We had earlier also commented that with inflation well below its target, the central bank’s focus will shift more from inflation to supporting domestic economic growth—and this statement by the RBI seems along expected lines.

Liquidity conditions have relatively improved a bit lately, and the RBI also said that it has set up a committee to comprehensively review the liquidity management framework by mid-July. This will be important for transmission of the rate cuts in the system. The RBI governor commented that partial transmission of the earlier cumulative 50 bps rate cut has happened at a slightly faster rate than previously. However, the future pace of transmission will be dependent on the liquidity environment, credit conditions, and considering the relatively elevated bank credit to deposit ratio (with deposit growth lagging credit growth).

The governor indicated that the central bank is closely monitoring the stress in the NBFC/HFC sector, and will not hesitate to act in case of any financial instability.

From an investment perspective, we presently prefer the short to medium term end of the yield curve

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More