In a surprise move, RBI hiked the key policy rate (Repo Rate) by 40 bps

#

5th May, 2022

- 2133 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

Comments from Mr. Sampath Reddy, Chief Investment Officer, Bajaj Allianz Life

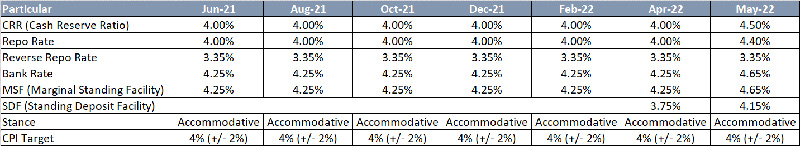

In its intermittent meeting, RBI’s Monetary Policy Committee (MPC) unanimously voted to hike the benchmark policy rate (repo rate) by 40 bps to 4.40% with immediate effect. The marginal standing facility (MSF) rate and the newly instituted Standing Deposit Facility (SDF) rate adjusted to 4.65% & 4.15% respectively. MPC has also decided to increase the Cash Reserve Ratio (CRR) by 50 basis points to 4.50%, effective from the fortnight beginning May 21, 2022. The MPC reiterated to remain accommodative while focusing on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth.

In the continuation of its outlook during the last month policy meeting, RBI noted that the economy has been showing signs of recovery and private consumption is also picking up. The normal monsoon forecast for 2022 will lead to the better agriculture aspects that would help in revival of rural demand. However, uncertainty in the ongoing geopolitical framework, along with tightening global financial conditions and surge in global crude and commodity prices are likely to hurt growth outlook.

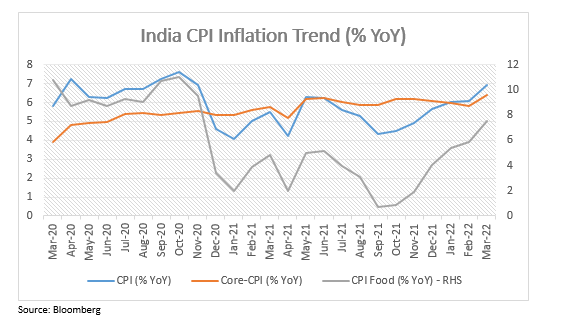

Heightened inflationary risks driven by high food and commodity prices, and resilience in domestic growth made the MPC to increase the rates in between the scheduled policy meetings. The extended geopolitical tensions continue to disrupt commodity prices & supply chain that is keeping the global inflation trajectory high. RBI has also indicated that the upcoming CPI print for April 2022 will remain elevated.

India CPI Inflation Trend (%YoY)

The RBI said that system liquidity continues to remain robust; the average surplus liquidity in the banking system – reflected in total absorption through SDF and variable rate reverse repo (VRRR) auctions – amounted to Rs. 7.5 lakh crore during April 8-29, 2022. The large liquidity overhang in the form of daily surplus funds parked under the SDF (average of Rs. 2.0 lakh crore during April 8-29, 2022) has resulted in the weighted average call money rate (WACR) – the operating target of monetary policy – dipping below the SDF rate. In view of its earlier stated stance of gradual withdrawal of excess liquidity, RBI increased the CRR rate by 50bps that would lead to reduction of liquidity by about Rs. 87,000 crore.

Outlook:

It is now evident that the RBI’s intention is to counter inflation and reduce the excess liquidity in the system. RBI’s surprise move to hike rate intermittently and hawkish commentary on inflation led to hardening of bond yields post the policy announcement.

However, we expect bond yields to continue to rise further during the year, on the expectation of additional rate hikes, normalization of monetary policy by major global central banks, elevated inflation and supply side pressures due to the large market borrowing in FY23. From a debt markets perspective, we presently prefer the short to medium term of the yield curve.

The earlier than expected policy rate hike resulted correction in equity markets today. We believe the economic recovery will continue as pandemic effect slows down in the economy. However, persistent geopolitical tensions, elevated market valuations and, higher commodity prices would continue to cause some market volatility in the short term.

Disclaimer: “The views expressed by the Author in this article/note is not to be construed as investment advice and readers are suggested to seek independent financial advice before making any investment decisions”

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More