RBI maintains status quo; reduces inflation target & hints at gradual liquidity normalization

#

8th Oct, 2021

- 2089 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

Comments from Mr. Sampath Reddy, Chief Investment Officer, Bajaj Allianz Life

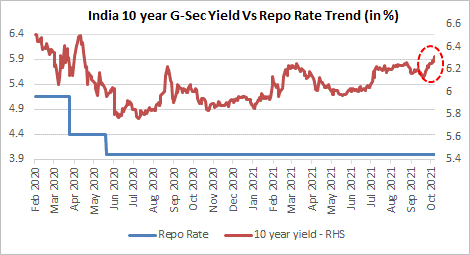

RBI’s Monetary Policy Committee (MPC) unanimously voted to keep the key policy rate (repo rate) unchanged at 4.0%, and the reverse repo rate unchanged at 3.35%, as expected. The MPC voted 5-1 in favour of maintaining an accommodative stance–to revive and sustain growth on a durable basis and mitigate economic impact of Covid, while ensuring that inflation is within the target going forward.

Source: Bloomberg

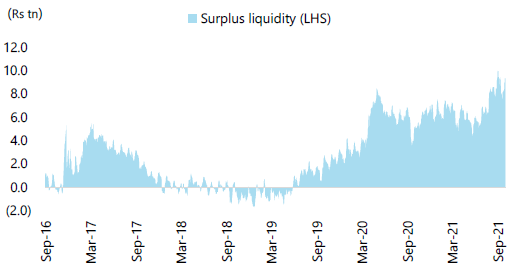

The RBI has taken various measures to maintain ample surplus liquidity since the onset of the pandemic to ensure easing of financial conditions in support of domestic demand. System liquidity averaged at a surplus of Rs. 7.7 lakh crore in July-August 2021, rose to an average of Rs 9 lakh crore in the month of September and further to Rs. 9.5 lakh crore in the first week of October. The RBI governor indicated that the exceptional liquidity measures instituted during the Covid crisis will need to evolve in-line with macro developments and economic recovery. However, this process needs to be gradual, calibrated and non-disruptive to the economic growth recovery.

Banking System Liquidity (Rs. In Trln)

Source: RBI, Jefferies

The RBI’s secondary market G-Sec Acquisition Programme (G-SAP) has been successful in addressing market concerns and anchoring yield expectations in the context of the large government borrowing programme this fiscal year. But, given the liquidity overhang the RBI felt that the need to undertake further G-SAP operations doesn’t arise at this juncture and didn’t announce a G-SAP 3.0 tranche. The RBI said that it will ready to conduct G-SAP if liquidity conditions warrant so and will continue to flexibly conduct Operation Twists (OTs) and Open Market Operations (OMOs). The central bank also said that it will gradually increase the quantum of 14-day variable reverse repo rate (VRRR) auctions from Rs. 4 lakh crore to Rs. 6 lakh crore on December 3, 2021. Although, the RBI governor once again re-iterated that this move should not interpreted as a reversal of the monetary policy stance.

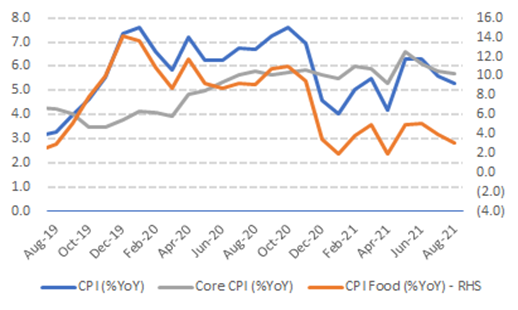

On the inflation front, the RBI said that inflation prints in the months of July and August 2021 were lower than expected. Given that, the central bank has revised down the CPI inflation forecast for FY22 to 5.3% from 5.7% earlier, with risks broadly balanced.

India CPI Inflation Trend (%YoY)

Source: Bloomberg

On the economic front, domestic economic activity has gained traction with the moderation in the second Covid wave. The RBI said that elevated commodity prices & input costs and potential global financial market volatility are key downside risks to domestic growth prospects. The central bank maintained its GDP growth forecast for FY22 at 9.5%. As per the detailed monetary policy report, the structural model estimates GDP growth at 7.8% for FY23, although this is not the official RBI forecast.

Some other key additional measures announced by the RBI were as follows:

• Extension of the On Tap SLTRO scheme for small finance banks of Rs. 10,000 crore by another 3 months to end of December 2021.

• IMPS per transaction limit to increase from Rs. 2 lakh to Rs. 5 lakh.

• Bank lending to registered NBFCs for on-lending to Agriculture, MSME and Housing, classified as priority sector lending is extended till March 2021 from the earlier deadline of September 2021. This will provide enhanced funding to the NBFCs.

Outlook:

The discontinuance of G-SAP operations and gradual increase in VRRR auctions indicates that the RBI wants to normalize the surplus liquidity in the system in a calibrated manner, as the economy continues to recover. This has led to long-term bond yields to harden a bit post the policy announcement.

The MPC notes that outlook for aggregate demand is improving, but the output is still below pre-covid level and recovery is even. The governor emphasized that they want to take a calibrated approach towards policy normalization and there would be no sudden moves. Therefore, we believe that the central bank will continue to be accommodative for some time (at least through this calendar year), with an eye on the inflation trajectory. The RBI may start by reducing the corridor between the repo & reverse repo rate (by increasing the reverse repo rate) in its December policy review or in early 2022.

The RBI is expected to use Operation Twist and OMOs to effectively manage the yield curve and especially keep long term bond yields in check amidst the large market borrowing programme this fiscal. Although, any further rise in crude oil prices and the US Fed taper later this year could cause some bond market volatility and needs to be tracked. For the fixed income markets, we presently prefer the medium-term part of the yield curve.

The accommodative monetary policy stance should benefit the equity markets by keeping borrowing costs in check for some time, although they seem to have bottomed out. Corporate earnings have surprised on the upside amidst the pandemic and we expect a strong corporate earnings trajectory in FY22 & FY23 as well, which should help to support the current elevated market valuations. Therefore, we believe that any market correction may not be too deep and should be used as a buy on dips opportunity by the investor (as their individual risk profile). Meanwhile, investors should continue to invest systematically in equities.

Disclaimer: “The views expressed by the Author in this article/note is not to be construed as investment advice and readers are suggested to seek independent financial advice before making any investment decisions”

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More