CIO Comments on Union Budget FY22

#

1st Feb, 2021

- 8046 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

The budget has been a pragmatic and growth oriented one. It has given greater emphasis to support growth recovery by allowing some fiscal slippage. The budget has been an inclusive one encompassing different segments of the economy, but the focus was on infrastructure and healthcare (as expected), with higher allocation to these sectors.

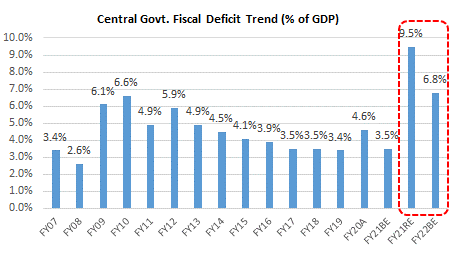

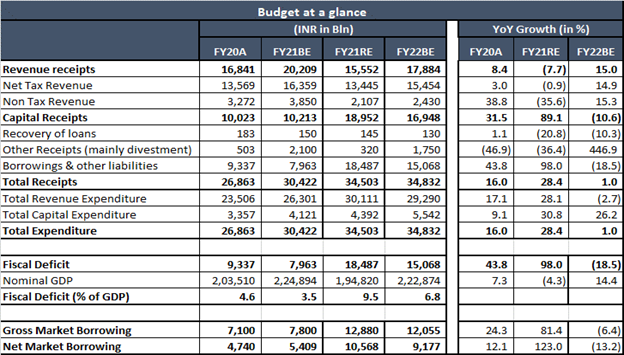

Fiscal slippage allowed to accommodate growth recovery: The shortfall in tax and revenue collections has caused significant slippage on the fiscal side. Fiscal deficit for FY21 has been pegged at 9.5% (versus budgeted estimate of 3.5%) and for FY22 at 6.8%, which has been higher than market estimates. The Finance Minister (FM) mentioned that they would continue on the path of fiscal consolidation and gradually reduce fiscal deficit to 4.5% by FY26. As a result, gross market borrowing for FY22 has been budgeted at Rs. 12 trillion (higher than market estimates) versus a revised estimate of Rs. 12.8 trillion in FY21. Net market borrowing for FY22 is also quite elevated at Rs. 9.2 trillion vs Rs. 10.6 trillion in FY21.

Source: Budget Documents. A= Actual, BE=Budgeted Estimate, RE = Revised Estimate

Higher allocation for Infrastructure & Healthcare: Capital expenditure (capex) budgeted to grow by a healthy 26% in FY22, and total healthcare & wellness outlay increased by a lofty 137% in FY22. The boost for infrastructure should help to revive investment (which has been fledgling over the past few years) and help support the growth recovery.

Divestment push revisited: With buoyancy in capital markets the government has revived its commitment towards PSU divestment drive by announcing a large target of Rs. 1.75 trillion via divestment route in FY22, after significantly underachieving the lofty FY21 target on the back of market volatility and economic contraction. The divestment receipts for FY21 has been revised from earlier Rs. 2.1 trillion to Rs. 320 billion (as revised estimate).

Other key measures and figures announced in budget:

• Gross tax revenue for FY22 budgeted to grow at 16.7%YoY vs -5.5%YoY in FY21 (RE). Tax revenue contraction for FY21 has been stemmed by strong excise duty collection (50% YoY growth, driven by higher excise on fuel). FY22 is expected to see tax buoyancy with both direct and indirect taxes growing at a healthy pace, despite the contraction in excise duty collection.

• Nominal GDP to grow by a strong 14.4%YoY in FY22 compared to a contraction of 4.4%YoY in FY21.

• For FY22 PSU bank recapitalization plan of Rs. 200 billion announced.

• NCLT & Bad Bank/ Asset Reconstruction Vehicles: System will be strengthened– marginal positive for system, but actual impact depends on quality of action.

• Housing impetus to continue: Affordable housing benefits for both buyers and sellers extended by another year; tax exemption for notified rental housing projects (usually low ticket).

• The government has also announced an increase in FDI for insurance sector from 49% to 74%, which is a positive move and will help attract foreign capital flows into the sector.

• Custom duty on gold and silver cut to 7.5% from 12.5%. Custom duty on steel down from 12.5% to 7.5%.

Source: Budget Documents. A= Actual, BE=Budgeted Estimate, RE = Revised Estimate

Outlook:

The equity markets have cheered the budget with it being growth oriented, and no major tax changes or levy (expect the introduction of agri & infra cess). However, the bond markets have seen some hardening in yields due to the higher than expected fiscal slippage and government borrowing. The market will soon digest the budget and move on to fundamental factors and global cues. Corporate earnings in Q3 FY21 have been above expectations and is expected to see robust growth of around 30% (for the Nifty index) in FY22. Even though market valuations are elevated, the recovery in corporate earnings and the easy liquidity scenario globally may help to support valuations for some time. Overall, FY22 will be the year of normalization (from the Covid-19 pandemic) and will set the stage for acceleration in future growth.

– Sampath Reddy, Chief Investment Officer

Disclaimer: “The opinion expressed by the Author in this article/note is his personal opinion and readers are advised to seek independent financial advice before taking any investment decisions. For any tax specific queries/clarifications, please contact your tax advisor. For more details please refer to the budget document and Finance Bill.”

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More